Should we be worried about Binance?

Should we be worried about Binance?Binance’s recent audit left traders concerned. We examine why.

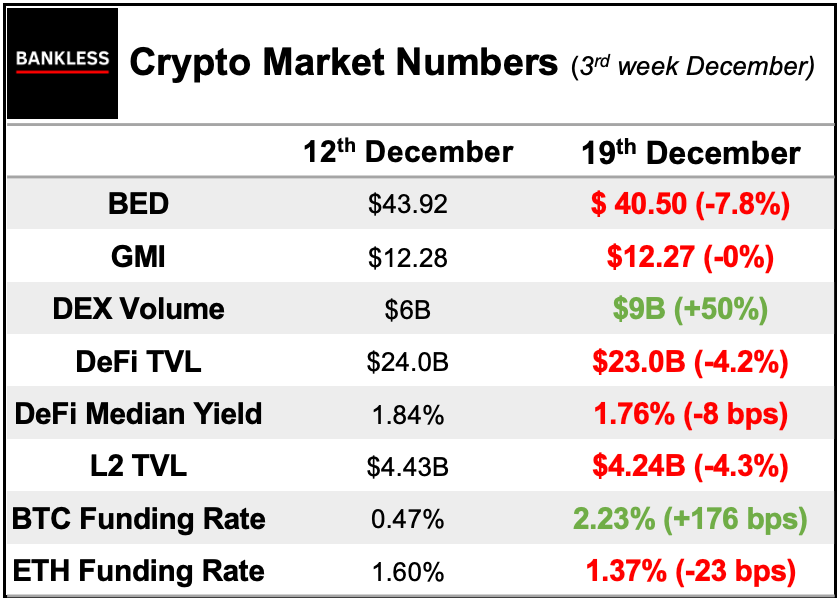

Have you seen the updated Token Ratings we’ve released? As always, the first rating is available for all Bankless readers, but to get access to the rest (and the Bankless Token Bible) you’ll need to upgrade to Premium. Dear Bankless Nation, Merry week-before-Christmas! We’re hoping the crypto markets end the year on a jolly note — we kind of deserve some good news at this point. As the year comes to a close, traders aren’t taking anything for granted. Many spent the week openly wondering whether Binance is headed towards its own implosion. We dig into what sparked those concerns. – Bankless team Should we be worried about Binance?

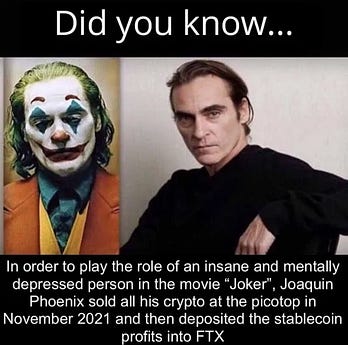

This past week, Binance found itself the focus of many a crypto doomer who fear the massive CEX is following in FTX’s insolvent footsteps. Where is the concern stemming from? Is FTX 2.0 incoming? Should crypto be worried? Let’s take these questions one at a time. FTX blew up in November because it was an exchange that functioned more like a bank — it traded customer deposits when it wasn’t supposed to. In the wake of its shocking bankruptcy, other crypto exchanges have scrambled to signal that they weren’t doing the same shady things. They’ve aimed to do this by committing to showcasing their so-called “proof-of-reserves”. At the center of Binance’s drama this past week is a half-baked attempt to do just that. Binance released a 5-page audit of its reserves by the financial auditing firm Mazars — in accordance with a few “agreed-upon procedures”. Audit shortcomingsFor one, the report audits only Binance’s Bitcoin on selected chains:

On top of only looking at Bitcoin, the report also looks at a select range of public addresses that were chosen by Binance:

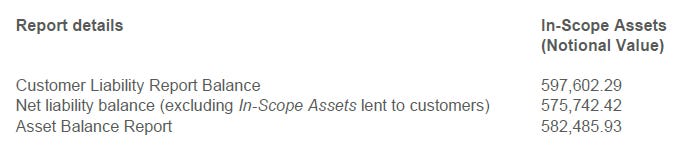

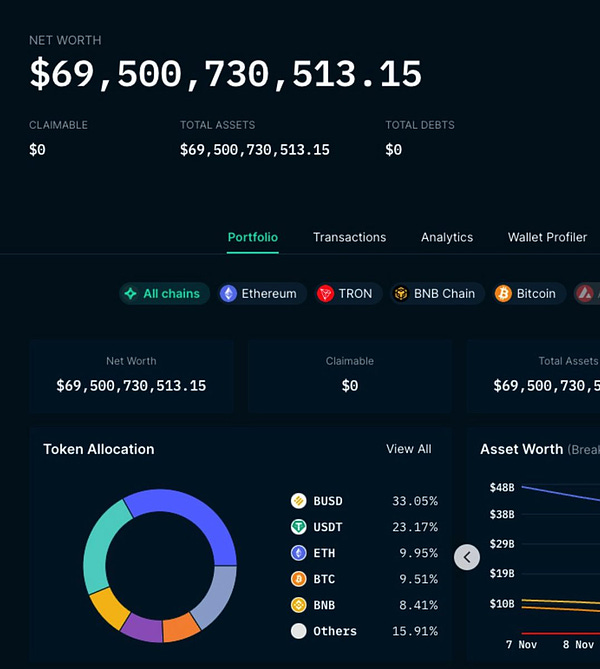

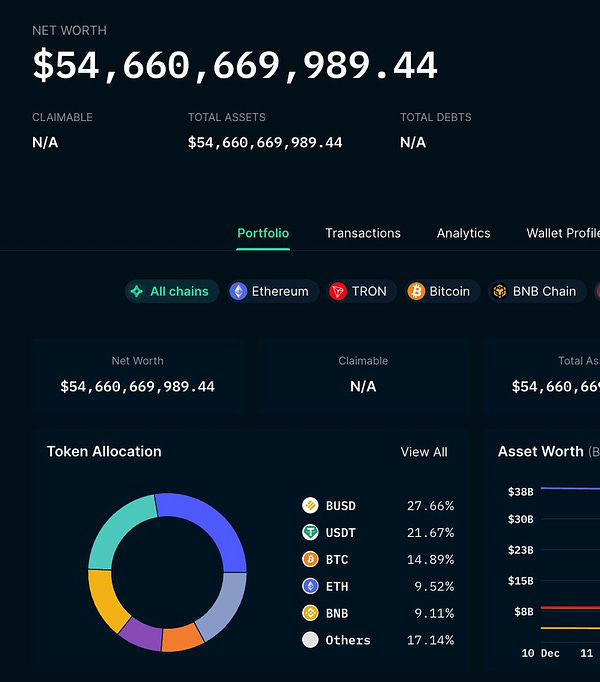

Within these narrowly-defined parameters, the Mazars report concluded with three pertinent numbers: The first and third numbers claim that at the time of the audit (November 22), Binance holds a total of 582,486 BTC assets and customers liabilities of 597,602 BTC. This means Binance’s Bitcoin reserves are short by the 1:1 ratio mark of 15,116 BTC (2.5%). However, Binance’s users can also borrow BTC from the exchange as part of its loan program. When we factor in these loans of 21,860 BTC (597,602 minus 575,742) into Binance’s assets, its liabilities shrink to 575,742 BTC, indicating that Binance is overcollaterized by 15,117 BTC. So the audit concludes that Binance’s BTC funds are safu. But people are (rightfully) upset at the Mazars audit as produced as this is hardly an audit in the traditional sense. Why only Bitcoin? What about any loans that Binance may have taken in ETH, USDT, or BNB? Those funds are omitted from the “liability” side of Binance’s balance sheet. What about Bitcoin assets that are not on the aforementioned three chains? Any loans in wrapped Bitcoin that Binance may have borrowed on the Solana or Avalanche chain are also missing. The whole process is a little bit like asking an auditing firm to audit a bank but by looking only at certain currencies in certain bank accounts. Finally, there is also the problem of treating wrapped Bitcoin and Bitcoin interchangeably. This obscures the security risks involved with wrapped assets, since they are supposed to be backed by an equal underlying value in the wrapped token. Presumably, Binance would hold 1:1 for every BTCB and BBTC that it issues, but that is not known. The Mazars audit treats wrapped BTC as fundamentally secure, but Binance could be issuing more than its underlying collateral for all we know. The Mazars report at least does one thing well: it is transparent around some of Binance’s liabilities. Most proof-of-reserves do not reveal any data on the liability side of the balance sheet. But because it neglects all non-BTC assets, it comes up woefully short on proving a complete picture of Binance’s financial health. Binance has said that it would reveal more information on its other assets in the near future. But for now, the audit only proves a slice of Binance’s reserves, rather than a comprehensive view. All the ruckus led to Mazars announcing December 16 that it was halting audit work for Binance and its other crypto clients including Kucoin and Crypto.com. How is Binance actually doing?There are rampant rumors and people are panicking, but things still appear pretty business-as-usual at Binance, which announced Monday that its US arm had reached a $1B deal to acquire Voyager’s assets. So, really, what’s the situation looking like at Binance? Binance saw massive outflows in the past week worth billions, with $4.27B withdrawn on December 14 alone. This was partially sparked by on-chain data of prominent TradFi players like Jump and Wintermute pulling out their funds from Binance on the 12th. While those are some eye popping numbers, let’s take it in context. Binance’s total proof-of-reserves reported elsewhere – not to be confused with the Mazars report that audited only Bitcoin – show a quantity of ~$55B as of December 19, down from ~$70B before the current PR crisis commenced.

Nansen 🧭 @nansen_ai

Binance held $69.5B* in crypto over a month ago, and it’s at $54.7B now, due to large withdrawals and price fluctuation. *Based on their publicly disclosed wallets, incl. Bitcoin, Ethereum, BNB Chain, and Tron assets.

3:06 AM ∙ Dec 17, 2022

624Likes147Retweets

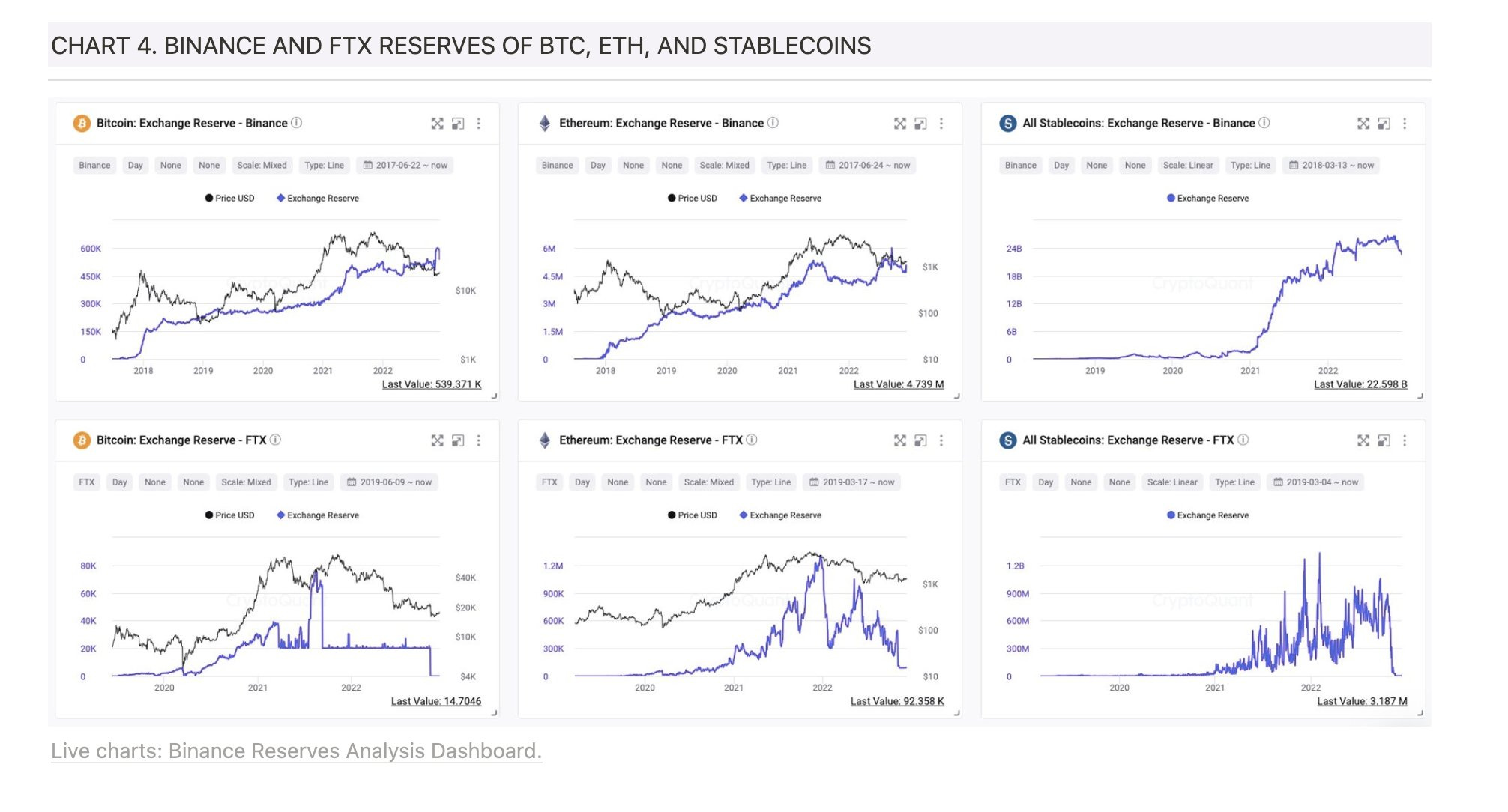

If Binance was nearing the end, it would show on its ETH and stablecoin asset outflows depleting to near-zero, as was the case with FTX. While sizeable outflows are occurring as users look to avoid any chances of an FTX 2.0, on-chain data is telling a different story. Binance’s stablecoin and ETH reserves are still sitting at ~22B and ~5M respectively.

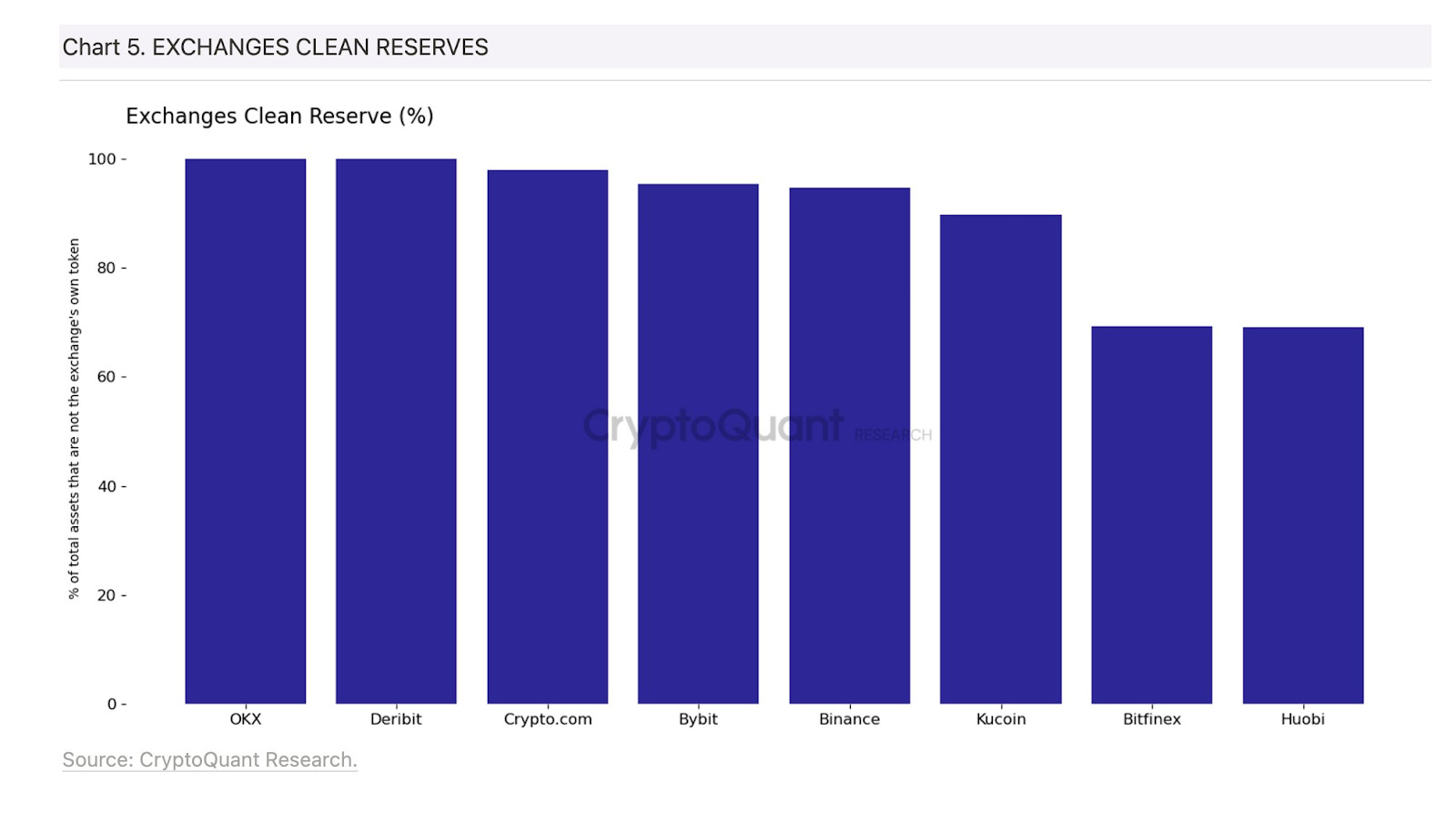

A significant contributor to FTX’s troubles was also in the use of its own FTT token for collateralizing loans. FTX was an exchange that functioned as a bank: it traded customer’s deposits when it wasn’t supposed to. It was a house of cards built on trust and reliance in itself, rather than other more financially robust collateral like U.S. Treasuries, BTC or ETH. If Binance’s business was similarly built on its own BNB token, we may have more cause for concern. Thankfully, only ~10% of Binance’s reserves are made up of BNB, which is about the same as most other crypto exchanges.

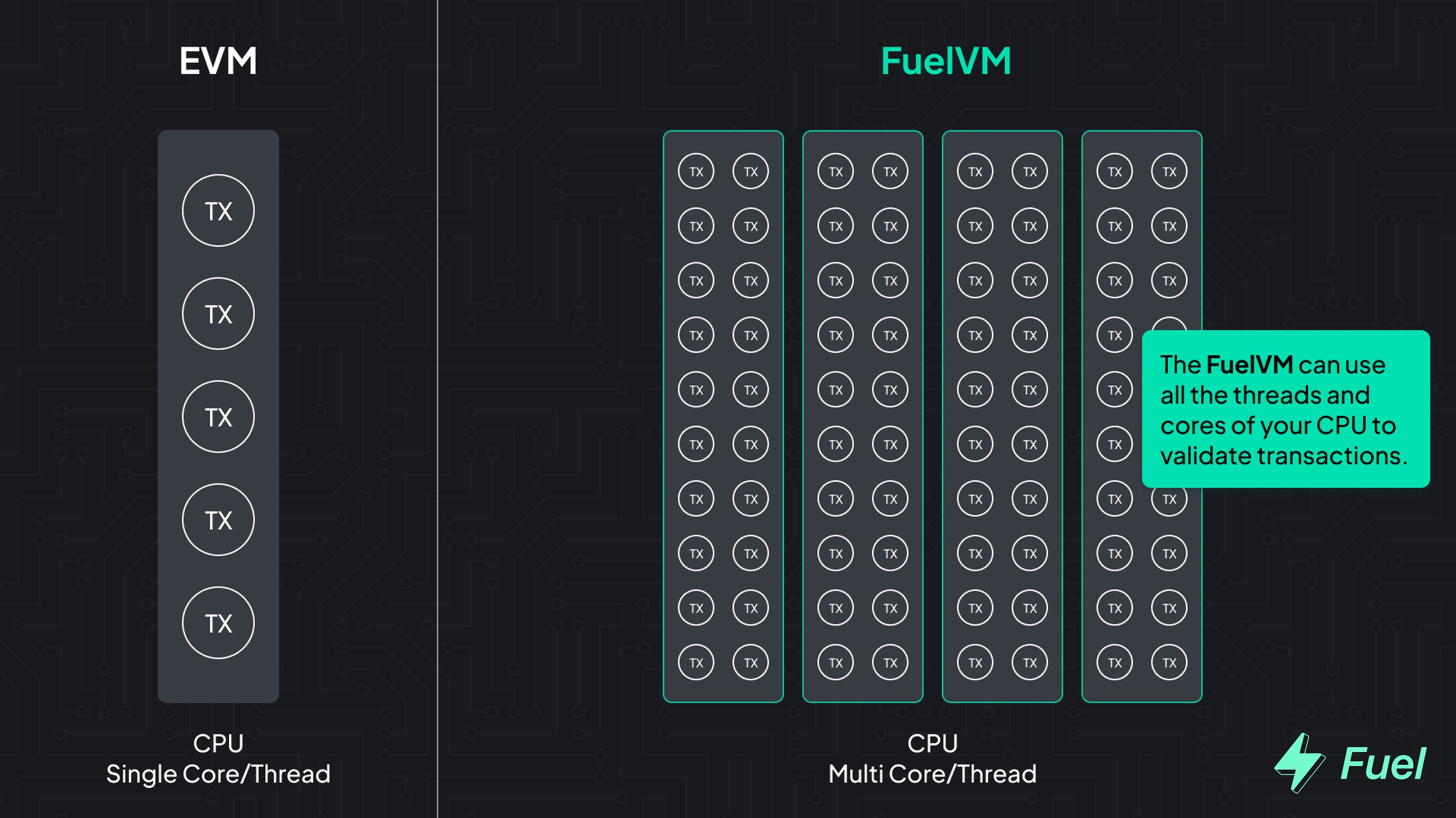

BNB also differs from FTT in one important respect: its utility. FTT was used for trading discounts on FTX, but if the public believes your exchange is impending insolvency, FTT is not going to help. BNB on the other hand, is also an asset that is used for validating and paying transaction fees on the second largest L1 chain today by TVL: BNB Chain. BNB saw a price plummet to $221 on December 17, but has since recovered 11% to $241 today. In closing…All of these indicators show that while Binance is experiencing something of a bank run, the situation is certainly not as precarious as Twitter chatter is playing it up to be. “Bank run” may not even be the appropriate term here because Binance is an exchange, not a bank, and as long as it holds all customer’s deposits 1:1 in accordance to their terms of service (unlike FTX), no one would lose a cent even if every user wanted to take their money out. The problem is that we don’t know that definitively, and that really gets at the heart of why holding your crypto on a centralized exchange will never be as secure as holding it on your own non-custodial wallet. 🙏 Together with ⚡️FUEL⚡️Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput. 👉 Go beyond the limitations of the EVM: explore the FuelVM 🎙️ NEW PODCAST EPISODE🎙️ Listen to podcast episode | iTunes | Spotify | YouTube | RSS Feed MARKET MONDAY:Scan this section and dig into anything interesting Market numbers 📊Market Opportunities 💰Unlock this section, become a Premium Subscriber! Yield Opportunities 🌾Unlock this section, become a Premium Subscriber! What’s Hot 🔥Money reads 📚

Trending Project 📈Unlock this section, become a Premium Subscriber! Governance Alpha 🚨Unlock this section, become a Premium Subscriber! Meme of the Week 😂Job opportunities 🧑💼Browse more roles (or add your own) at the Bankless Jobs Board Action steps

Author BioDonovan Choy is a Bankless editor, and co-author of Liberalism Unveiled. You can follow him on Twitter at @donovanchoy. Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge. 🙏 Thanks to our sponsor FUEL👉 Explore the FuelVM and discover its superior developer experience! Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

Read Bankless in the app

Listen to posts, join subscriber chats, and never miss an update from Donovan Choy.

© 2022 Bankless, LLC. |