Silvergate Crashes the Party

Silvergate Crashes the PartyRegulators are making life hell for crypto-friendly finance — leaving the space more vulnerable.

Dear Bankless Nation, After a couple of months of crypto peace and prosperity, there’s trouble brewing with a good old-fashioned bank run facing crypto-friendly Silvergate. Things aren’t looking great with a mass exodus of depositors and the bank staring down the barrel of insolvency. A TradFi blowup ought to push regulators to establish clearer guidelines and protections for good faith actors aiming to innovate, but in all likelihood the federal government will just use this as another excuse to put up roadblocks for institutional players that embrace crypto. – Bankless team 🙏 Thanks to our sponsor KRAKEN👉 Kraken has been on the forefront of the blockchain revolution since 2011 ✨ A Good Old-Fashioned Bank Run

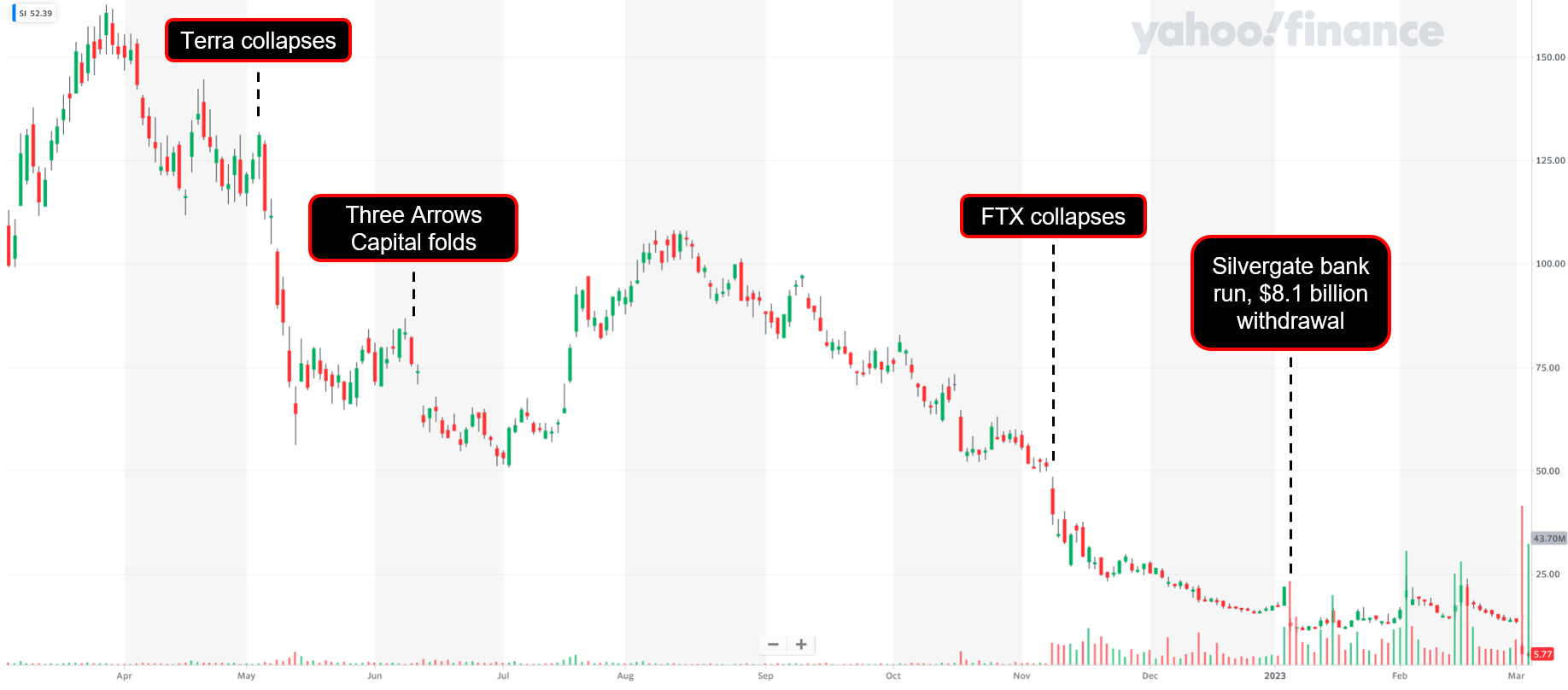

If you’ve ever onramped into crypto through a centralized exchange, you have likely indirectly used Silvergate bank. Silvergate is the biggest crypto-friendly bank, with 90%+ of its deposits from the crypto sector. The bank pivoted from a small regional presence in the past decade into a major bank with $12B in deposits by Q3 2022, servicing major crypto institutions like Coinbase, Gemini, FTX and BlockFi. After months of turmoil, Silvergate is seemingly capitulating under a mix of regulatory and market pressure this past week — undergoing something of a bank run. The straw that broke the camel’s back was Silvergate’s two-week delay of its annual 10-K SEC filing last Thursday, citing the need for more time to assess its finances. Silvergate’s stock immediately spiraled on the news, dropping 55% to around $6.50 per share. JPMorgan analysts downgraded Silvergate’s already-beaten down stock from “neutral” to “underweight” rating. In response, Silvergate’s clients began severing ties with the bank’s services. Coinbase quickly distanced itself when it announced a switch to Silvergate’s main competitor Signature, another crypto-friendly bank.

Coinbase @coinbase

At Coinbase all client funds continue to be safe, accessible & available. In light of recent developments & out of an abundance of caution, Coinbase is no longer accepting or initiating payments to or from Silvergate.

1:23 PM ∙ Mar 2, 2023

1,436Likes296Retweets

Other clients that have left Silvergate for greener pastures include Paxos, Crypto.com, Bitstamp, Cboe Digital Markets, Galaxy Digital, Gemini and LedgerX. On Friday, Silvergate was forced to suspend its Silvergate Exchange Network (SEN), its zero-interest payment platform that crypto companies use to make fiat transactions with one another. Silvergate’s insolvency concerns have been brewing for months. When crypto suffered a credit crisis in 2022, Silvergate saw an $8B drawdown. To maintain a liquid balance sheet, the bank was forced to off $5.2B worth of bonds in its portfolio amid a high interest rate environment where the Fed was hiking rates to stave off inflation, incurring losses of $751.4M. Silvergate also borrowed a whopping $4.3B in short-term loans from the Federal Home Loan Bank (FHLB) system, a government-backed shadow bank that supports domestic commercial banks in poor market conditions by borrowing from institutional investors at generally below market interest rates and lending to member banks. Silvergate survived the FTX collapse but it did not come out unscathed. The bank reported a ~$1B loss for Q4 2022 and was forced to cut its staff by 40% (200 employees). Unfortunately, the bank’s close association with FTX attracted the attention of regulatory hawks, increasing reputational risk and investor uncertainty. U.S. Senators Elizabeth Warren, John Kennedy and Roger Marshall began probing Silvergate on December 6 for its role in facilitating fraudulent transfers between FTX and Alameda, alleging an “egregious failure of Silvergate’s responsibility to monitor for and report suspicious financial activity carried out by its clients”. Silvergate’s press release then claimed that total deposits from FTX were less than 10% of all its $11.9B deposits. On February 2, U.S. prosecutors in the DoJ were reportedly investigating Silvergate’s for its relationship with FTX and Alameda. In short, Silvergate is buckling under the combination of a massive capital withdrawal plus unwanted regulatory scrutiny. Bad liabilities, not bad assets, are the root of the problem. Unlike Three Arrows Capital or FTX, the ongoing bank run on Silvergate is not due to the implosion of risky overleveraged loans against volatile crypto collateral. As Bloomberg’s Matt Levine writes on Money Stuff:

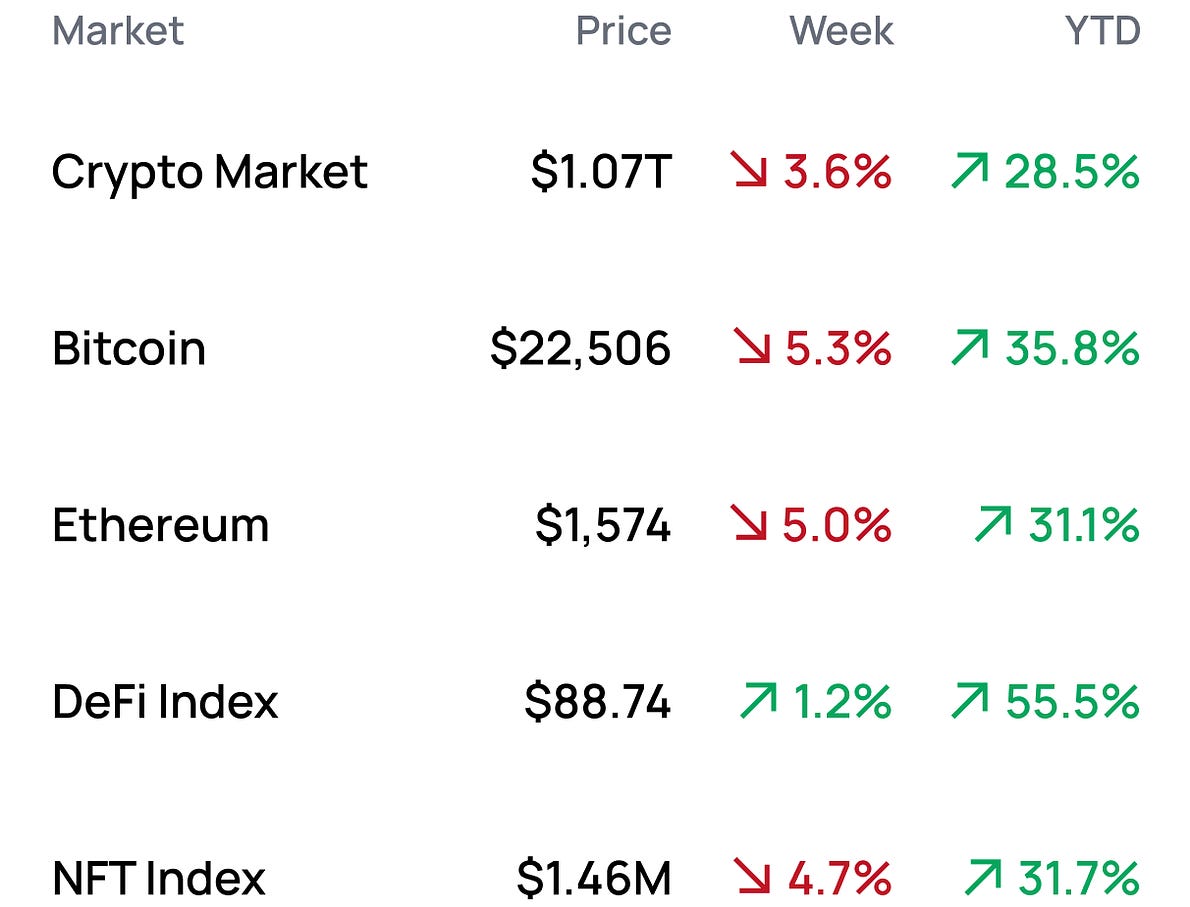

Ultimately, the knock-on effects of FTX contagion is starting to catch up with Silvergate. As the main channel for market makers in crypto to move capital quickly, Silvergate’s demise does not bode well for the industry. The Silvergate panic led to a total crypto market cap dip of 4.8% during ETH Denver week. This fiasco also poses an important existential question for crypto: how can crypto survive without relying on centralized, TradFi rails? The easy answer is “just don’t use TradFi”. But that is perhaps too naive in the short-term, and the reality is there will be some dependency on financially regulated institutions to facilitate capital flows in and out of the sector. If so, crypto must avoid putting all its eggs in one basket and not build into a centralized pothole as it seems to have done with Silvergate. As it stands, the small handful of crypto banks — in particular Silvergate and Signature — represent convenient chokepoints and easy targets for anti-crypto regulators to undermine the industry. Diversification of crypto banks is key, but unfriendly actions and a general lack of support from financial regulators have made it extremely difficult for banks to embrace new financial technologies and serve crypto clients. This has hamstrung the sector and may leave America’s dinosaur financial institutions less willing to take risks to innovate. 🙏 Together with ⚡️KRAKEN⚡️Kraken, the secure, transparent, reliable digital asset exchange, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. Your account is covered with industry-leading security and award-winning Client Engagement, available 24/7. 👉 Visit Kraken.com to learn more and start your experience today. MARKET MONDAY:Scan this section and dig into anything interesting Market Numbers 📊*Data from 3/6 2:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10) Market Opportunities 💰Yield Opportunities 🌾What’s Hot 🔥Money reads 📚Governance Alpha 🚨Rhino.fi is a one-stop trading experience that abstracts away the complexity of DeFi: no bridges, no wallets, no native gas. Manage your entire yield strategy from one command center. Trending Project: PRIME 📈Analyst: Ben Giove

Meme of the Week 😂

Bankless @BanklessHQ

.@EthereumDenver restrooms are quite festive this year. (pic via @PatYiuTazza)

5:10 PM ∙ Mar 4, 2023

343Likes39Retweets

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge. Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

© 2023 Bankless, LLC. |