Stocks Have Done Something Crazy Every 20 Year Period…

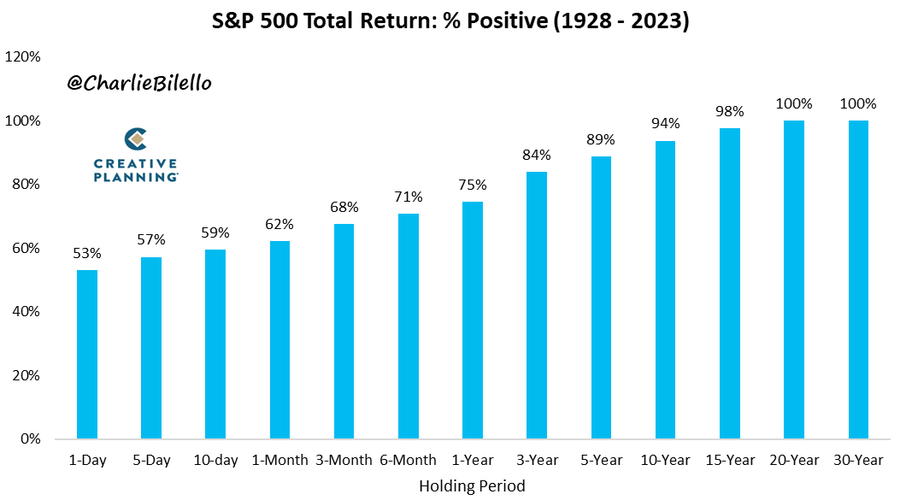

Today’s letter is brought to you by Domain Money!If you’re reading this right now you don’t need financial advice, if you did you would use Domain Money, a company of flat fee financial planners that craft you a personalized, in-depth plan with unbiased, straightforward, and real sound advice based on your values and goals, but you are all better than that. You know about money. That’s why you’re here. If you had questions, you’d use Domain Money. See Disclaimer below¹ Book A Free Strategy Session Today To investors, Everyone knows they should invest for the long-term. They have read the timeless investing books, heard the speakers at conferences, or seen charts showing that stocks go up over the long-run. But I read a statistic over the weekend that blew my mind. Creative Planning’s Charlie Bilello wrote:

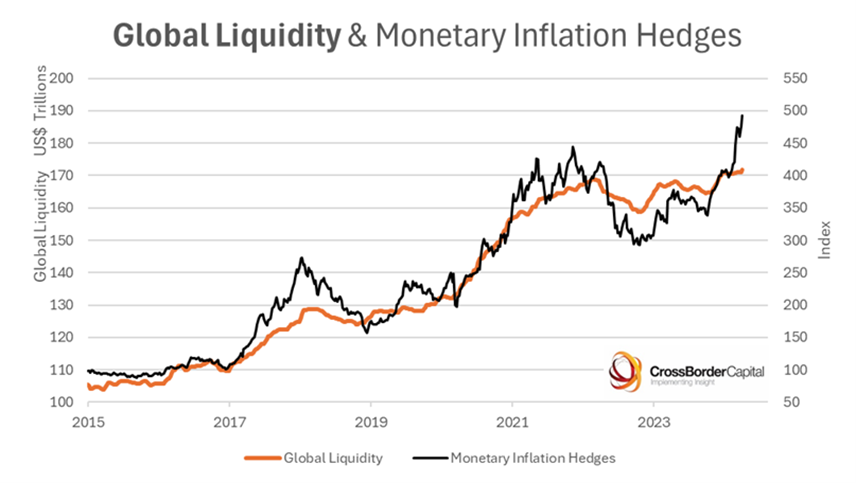

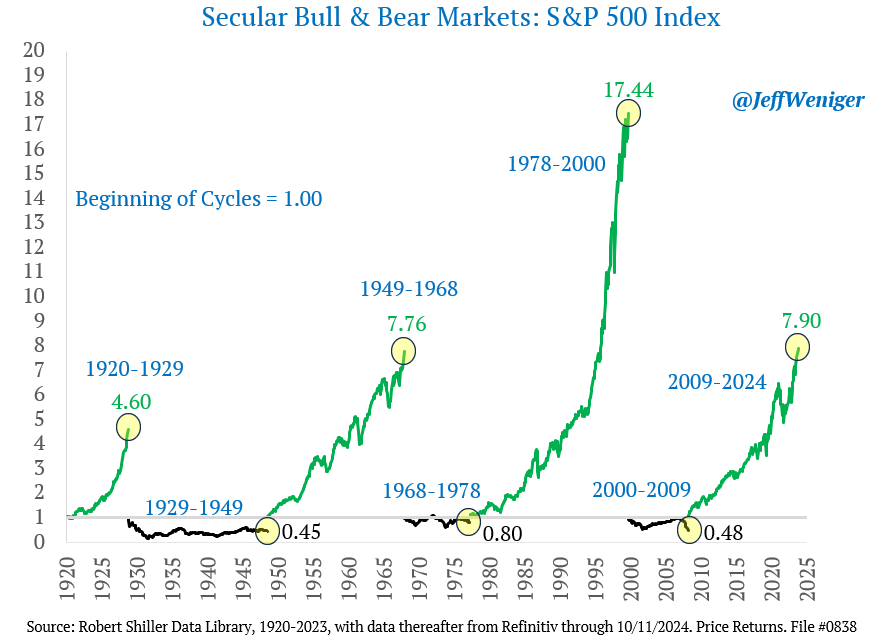

Read that again — “there has never been a negative return for US equity investors” if they held for 20 years. That is an insane data point. Analysis like this makes it hard to ignore the benefits of long-term investing. I would make a comparison of the stock market to an asset like bitcoin, but the decentralized currency hasn’t been around long enough to have a single 20-year hold period. If stocks are doing well over the long run, which can be attributed to inflation and earnings growth, then monetary hedge assets (bitcoin and gold) should do very well also. Earlier this year Crossborder Capital published this chart showing how bitcoin and gold move hand-in-hand with global liquidity. Why do I say that monetary hedges will do well over the long run? Because global liquidity has to continue expanding if we want to avoid catastrophe in major economies. We are addicted to cheap capital that has no end. Here is what I find interesting though — the case for long-term investing is stronger than it has ever been, but Wall Street loves to gamble on the short-term. Take zero-day options as one example. More than 50% of all options trading in the US is now zero-day options. This is literally a bet on what the price of an asset is going to be at the end of the day. Hard to make an argument that people are “investing” when they are betting on outcomes over a few short hours. We shouldn’t mock these people though. Given the rise of data and algorithms, some capital allocators will have a significant advantage in these short-term oriented markets. Just don’t confuse yourself for a machine. Each of you reading this letter has to resist the urge to act based on price movements in a day or week. Let the long-term trend drive your returns. Urgency for the days, patience for the decades. As WisdomTree’s Jeff Weniger highlights, bull markets can go higher and longer than any of us expect. The good times are rolling. Careful you don’t get sucked into chasing the latest trend. The stock indexes have a structural advantage. Bitcoin does too. People holding those for the long-run will probably be very happy in the end. Hope you all have a great start to your week. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management 🚨 Talk or Hang Out With Anthony Pompliano 🚨I want to meet you. In order to get the meeting scheduled, you have to purchase a certain amount of my new book, How To Live An Extraordinary Life. You can do one of the following:

You can use this link to purchase up to 100 books and then use this link for a discount on bulk buys over 100 books. Here is how it works:

I have already done a few calls with people and spoken at different events. It is just as fun for me as for you, so I look forward to meeting many of you as well. Phil Rosen, the Co-Founder of Opening Bell Daily, and Anthony Pompliano, Author of ‘How To Live An Extraordinary Life’ and CEO of Professional Capital Management, discuss everything about bitcoin, why it’s the best performing asset so far in 2024, volatility, bitcoin as a savings account, the global impact of bitcoin being successful, and the recent documentary about Satoshi. Listen on iTunes: Click here Listen on Spotify: Click here Anthony Pompliano Explains The Bitcoin Investment Thesis To Opening Bell Daily’s Phil RosenPodcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. 1 While I am not a financial advisor and can’t give financial advice, Domain Money has board-certified CPAs who can give you financial advice and keep you on track to reach your goals. As always, doing your own research before purchasing any product/service is important. View this important disclaimer so you know exactly what to expect. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2024 |