Strong Stocks Befuddle Bearish Investors

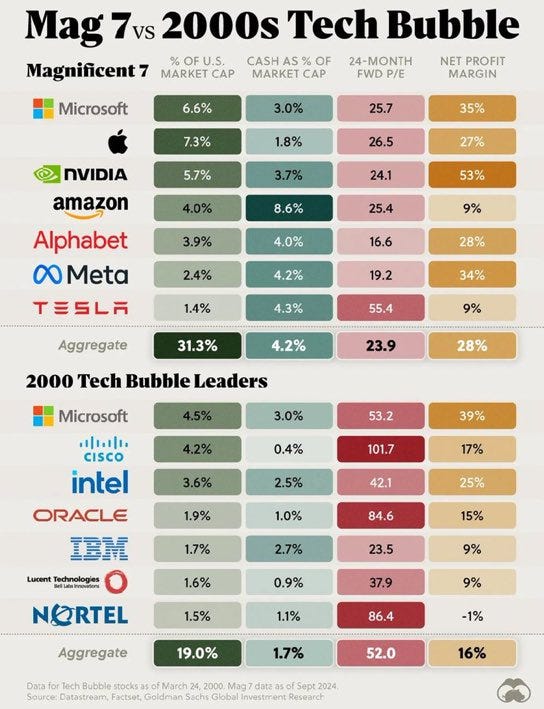

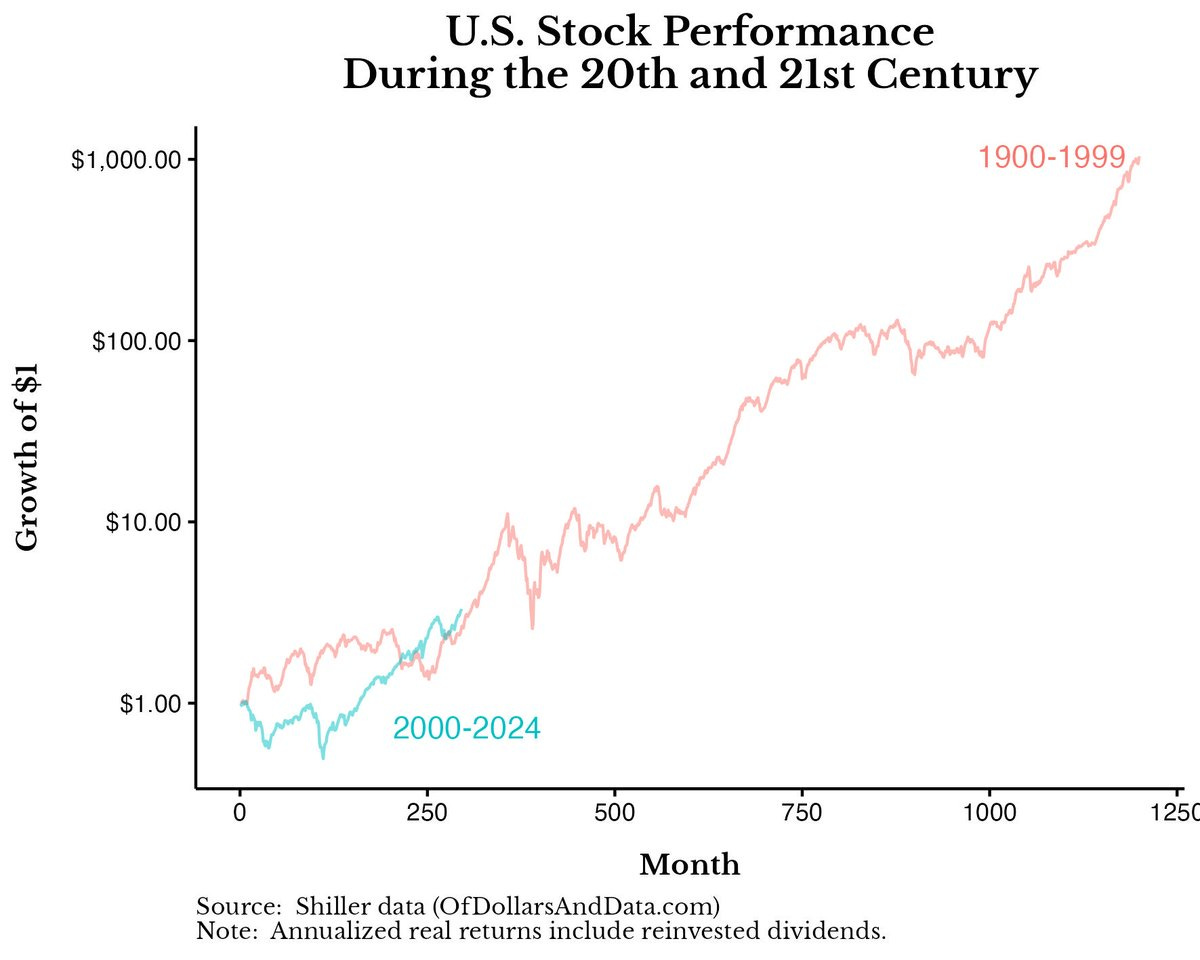

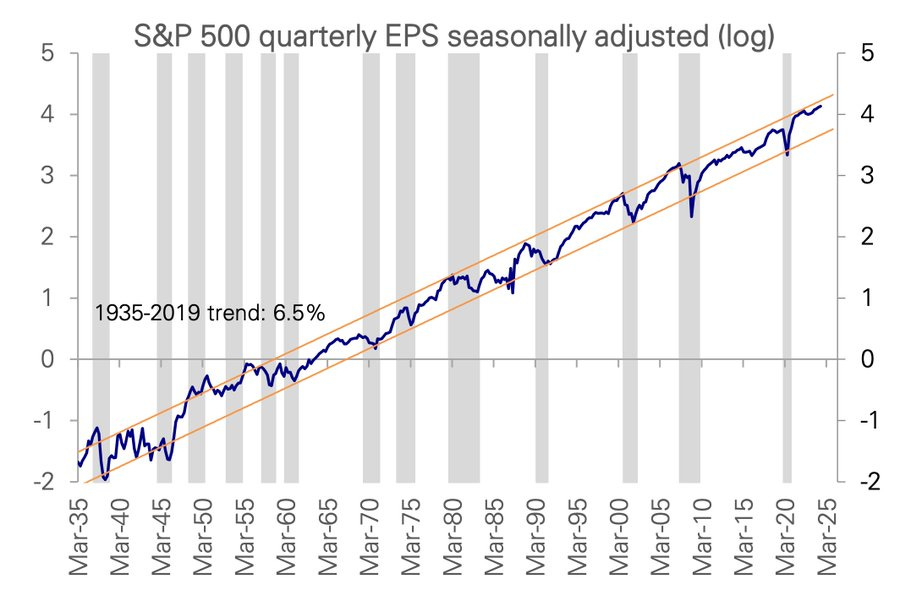

READER NOTE: I am hosting the first book signing for my new book, How To Live An Extraordinary Life, in New York City on Monday September 30th at 7pm. There will be a short discussion about the book and then I will sign copies for anyone who attends. You can RSVP to come to the event by clicking here. RSVP for Book Signing on Monday To investors, The debate around a potential recession continues to rage on. Bearish capital allocators are yelling and screaming about sky-high valuations in the largest tech companies. But Michael Antonelli shared a great graphic that argues the opposite — current valuations are nowhere near the peak dot com valuations. The rebuttal to the bears doesn’t stop there. Nick Maggiulli explains that US stock performance during the 21st century is just now catching up to the performance of the 20th century. Who would have thought the 10+ year bull market of 2010s would have left the 21st century performance so far behind the prior century. This is what happens when stocks go sideways for a decade following a big bust like the dot com insanity. So why do stocks continue to go up and to the right? Brent Donnelly shared a simple, yet important, insight:

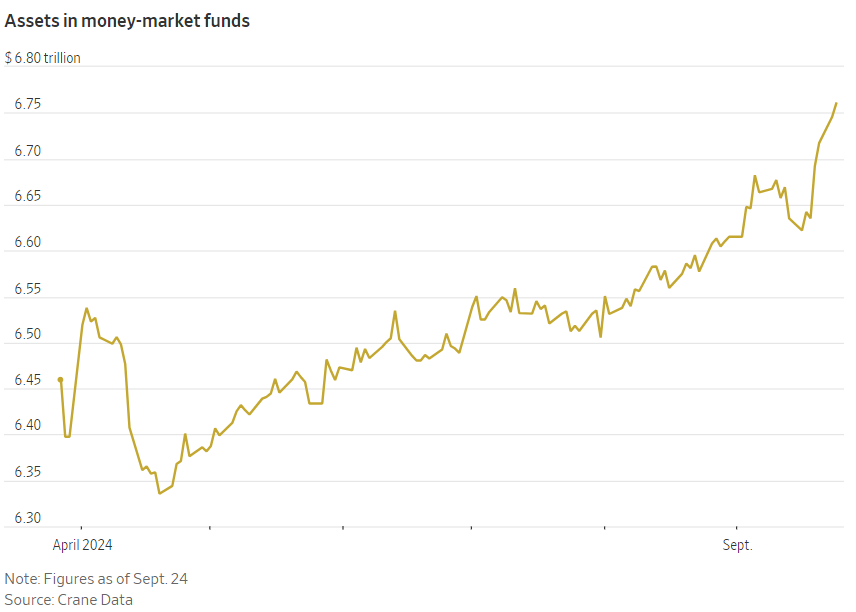

Occam’s Razor — the simplest explanation is the most likely. But there is something else happening in markets that may surprise you. Wall Street Journal’s Gunjan Banerji highlights the Federal Reserve cut interest rates, yet money-market funds are still seeing strong inflows. This is allowing money-market funds to collectively reach new all-time high records for AUM. Major narrative violation. These narrative violations are going to continue to happen because there is more money in the system. People have to put the capital somewhere. Overall, those who are bearish will continue to be bearish. No amount of data or logic is going to convince them otherwise. But that doesn’t change the truth. It is hard to see a bearish argument over a 5+ year outlook when cheap capital is coming into the market. It is called stimulus for a reason. Hope you all have a great weekend. I’ll talk to everyone Monday. -Anthony Pompliano Founder & CEO, Professional Capital Management James Lavish is the Co-Managing Partner of the Bitcoin Opportunity Fund, and is the author of the ‘The Informationist’ a weekly newsletter that simplifies financial concepts. In this conversation, we break down the macro environment, how inflation has been ravaging America, national debt & the future impact on the economy, bitcoin, potential solutions, risk of CBDCs, and where the world is going. Listen on iTunes: Click here Listen on Spotify: Click here James Lavish Explains The Risks For National Debt & Bitcoin As Potential SolutionPodcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2024 |