The (Big) Business Behind Winning A Championship

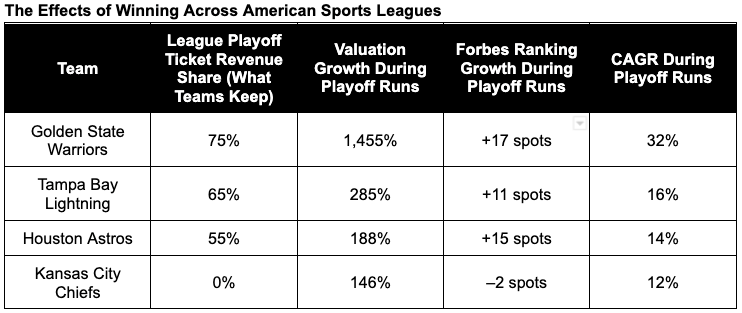

Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not already a subscriber, sign up and join 100,000+ others who receive it directly in their inbox each week. Today’s Newsletter Is Brought To You By Vinovest!The fine wine industry is booming. And with a return of 13.1% in 2022 — compared to -19% for the S&P 500 — wine has emerged as a lucrative addition to any portfolio. And, thanks to Vinovest, it’s never been easier to get started. They currently manage over $100 million in assets for clients from 44 different countries. And they handle everything, from logistics and shipping to storage and insurance. All you have to do is sign up and fund your account with as little as $1,000. A team of experts from Vinovest will then use data-driven algorithms to ensure your investments are always performing their best — so you can sit back, relax, and watch your money grow. Friends, When Joe Lacob, Peter Gruber, and a group of smaller investors paid $450 million for the Golden State Warriors in 2010, most deemed it a massive overpay. Forbes had valued the Warriors at $315 million just seven months earlier, good for 18th in the NBA. They had only made the playoffs once in the previous 15 years. Their home arena was over 45 years old and routinely had poor attendance. And $450 million was the most money ever paid for a professional basketball team at the time. But fast forward a decade, and EVERYTHING has changed. The Warriors are now the NBA’s most valuable team — worth $7 billion. They brought in $206 million in operating income last year — 33% more than anyone else in the NBA — and it’s the first time in 20 years that the NBA’s most valuable franchise doesn’t play in New York City (Knicks) or Los Angeles (Lakers). And the key to this is winning. For example, the Golden State Warriors have been in the NBA Finals for 6 out of the last 8 years. That gives them an additional 10 to 12 home playoff games each year. And based on the NBA’s generous playoff revenue-sharing model, that has resulted in more than $750 million in additional income. But this doesn’t apply to every major professional sports organization. In fact, some leagues are notoriously much stricter with revenue sharing, like the NFL (0%). So today, we’ll run through each of the leagues, and I’ll explain how winning does/doesn’t impact a team’s overall valuation — with plenty of examples to prove my case! The NBA Playoff Revenue Sharing ModelThe NBA is the most generous US professional sports league when it comes to the distribution of playoff revenue. The NBA league office used to keep 45% of all playoff ticket revenue but cut their share in 2016 to 25%, and individual NBA teams now get to keep 75% of all ticket revenue generated from playoff games. NBA Playoff Ticket Revenue Share

Remember, playoff tickets are typically priced at a 200% markup from regular season games, resulting in an additional $300 million in revenue for 16 playoff teams last year. And this team-friendly revenue-sharing agreement can make a difference. For instance, we all know big market teams like the Los Angeles Lakers, New York Knicks, Chicago Bulls, and Boston Celtics don’t necessarily need to win to increase their valuation — real estate, total market size, and local media rights play a huge role. But still, winning can (and does) play an important role. Take the Golden State Warriors and Milwaukee Bucks, for example. They make nearly $100 million in additional income when they make the NBA Finals and host 10+ playoff games, and their team valuations have collectively increased nearly $10 billion over the 10+ years. Golden State Warriors Valuation

Milwaukee Bucks Valuation

This valuation growth outpaces the league average, too, with the Warriors (+1,455%) and Bucks (+1,021%) growing substantially more than the average NBA team (+462%). The NHL Playoff Revenue Sharing ModelThe NHL is the second-most generous US professional sports league when it comes to the distribution of playoff revenue. The NHL League office keeps just 35% of all playoff ticket revenue and allows individual teams to keep 65%. This generosity is especially big for NHL teams because ticket revenue accounts for 44% of the NHL’s annual revenue (from 2021-22 figures), and teams typically markup ticket prices anywhere between 20% to 100% during the Stanley Cup Playoffs. The result is $200 million in revenue for 16 NHL playoff teams in 2022. And while we don’t have a Warriors-esque dynasty to compare, the Tampa Bay Lightning have been in the playoffs 8 of the past 9 seasons and even won back-to-back Stanley Cups in 2021 and 2022. Their 11 home playoff games in 2021-22 brought in an estimated $25 million to $40 million in additional revenue. The league kept 35% of that, of course. But the Lightning still took home $16 million to $26 million over that one year alone. That can be the difference between posting an operating profit versus a loss (for a small market team). And it compounds over time into meaningful valuation growth. Tampa Bay Lightning Valuation Growth

Tampa Bay Lightning Valuation Rank

And Tampa Bay’s valuation growth (+285%) outpaces the NHL average (+103%). The MLB Playoff Revenue Sharing ModelMajor League Baseball has the most complex playoff revenue-sharing model. Teams get to keep 40% of revenue from the first two Wild Card games, first three games of the Division Series, first four games of the Championship Series, and first four games of the World Series — and 100% of the revenue for any games beyond that. So, in other words, MLB takes 60% of all ticket sales for the minimum number of games each series, and teams keep 100% of the revenue if the series goes longer. MLB’s Playoff Revenue Sharing Take

But the league doesn’t keep this money — it goes to the players. Major League Baseball has a postseason player pool, which takes the league’s cut of the revenue and splits it up among the players of all 12 playoff teams. The 2022 postseason pool, for example, totaled $107.5 million (+19% from the 2021 pool). The World Series Champion Houston Astros took home $38.7 million, and the losing Philadelphia Phillies received $25.8 million of the pool. Teams then get to vote on who receives full and partial shares of the bonus pool — clubhouse workers can also receive cash payouts! And last year, this resulted in the Astros handing out $516,347 for full shares and $940,000 in cash awards. But don’t feel bad for the owner; their playoff revenue still makes a huge difference. Houston Astros Valuation Growth

Houston Astros Valuation Rank

Again, the Astros growth (+188%) is significantly better than the MLB average (+72%). The NFL Playoff Revenue Sharing ModelThe National Football League has (by far) the most strict playoff revenue-sharing model. The league office keeps ALL ticket revenue from playoff games and provides teams (home & away) with a stipend for travel and stadium operation costs. Now, teams do get to keep their concession and parking revenue. But that typically only accounts for $1 million to $2 million per game, and teams have to send more than $10 million back to the league office in ticket revenue for each home playoff game. But still, no one is complaining. The NFL’s huge media deals provide team owners with the best profit margins in sports — the average NFL team brings in $600 million in annual revenue — and ticket sales account for just 19% of the NFL’s business. And that means the financial impact of winning is much smaller in the NFL. Take the Kansas City Chiefs, for example. They have become a dynasty of sorts, making Super Bowl appearances 3 out of the last 4 seasons. But this hasn’t translated to financial success, with the Chiefs overall valuation growing roughly in line with the average NFL team (+146% vs. +126%) and their overall rank dropping two spots. Kansas City Chiefs Valuation Growth

Kansas City Chiefs Valuation Rank

Of course, Kansas City can make up some of the difference in merchandise, sponsorships, and season ticket sales. But they still don’t realize the same value from winning championships as their NBA, MLB, and NHL counterparts. So the bottom line is clear: Winning championships can be worth billions, depending on the league. The NBA, NHL, and MLB all have revenue-sharing agreements to reward consistently good teams financially. But the NFL is making so much money that owners don’t care enough to fight for additional money each year. If you enjoyed this breakdown, please consider sharing it with your friends. My team and I work hard to consistently create quality content, and every new subscriber helps. I hope everyone has a great day. We’ll talk on Wednesday. Interested in advertising with Huddle Up? Email me. Your feedback helps me improve Huddle Up. How did you like today’s post? Loved | Great | Good | Meh | Bad Extra Credit: Why The Oakland A’s Are Moving to Las VegasHuddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not already a subscriber, sign up and join 100,000+ others who receive it directly in their inbox each week.

© 2023 |