The Biggest Crypto Moments of 2022

The Biggest Crypto Moments of 2022It was a wild year. We break down the heroes, villains and wins.

Have you heard about the Bankless Token Bible? It’s a living document that we update every month with up-to-date analysis on dozens of tokens and protocols. The whole point is to make it as easy as possible for our Premium members to stay on top of the Bankless takes on what tokens to buy, hold, or sell (for entertainment purposes only). Not already a Bankless Premium member? Upgrade now to get immediate access. Dear Bankless nation, Damn. What a year. As we inch closer to 2023, we’re feeling nostalgic and reflecting on what went right (and very, very wrong) in 2022. This week, Ryan and David delivered some livestreamed perspectives on the biggest moments of the year, which we’ve captured for you below. They divided up their highlights into four categories:

Read along and then check out the recording to see who made an impact this year — for better or worse. – Bankless team P.S. Tomorrow we’re minting Ultra Sound Money as a Bankless Collectible. All Bankless DAO Members and 2022 Badge holders have pre-sale access. Mint goes live at 12pm EST 🫡 2022’s Biggest Moments

2022 has certainly been one of the most… eventful… years in crypto’s history. The industry has dramatically changed over the course of the year as prices tumbled and the excesses of 2021 washed away. There’s so much to cover when trying to take inventory of 2022. But thankfully, Ryan and David decided to do it for us with their “2022’s Biggest Crypto Moments” livestream. In addition to the big moments, they touched on a few bonus categories, such as crowning “gm” the meme of the year and awarding Gary Gensler the prestigious honor of “best supporting actor in a comedy” due to his laughable attempts at regulation, including his failure to identify and prevent the massive fraud at FTX, in 2022. As with all Bankless content, the stream is a must-watch. But for the old souls like myself who still prefer the written word, here’s the tl;dr of 2022’s biggest crypto moments. ⬇️ 🦸♂️ Top 5 Heroes5. Michael SaylorEveryone’s favorite Bitcoin permabull takes the fifth spot on the list. Saylor has taken a $3.4B loss on the chin in 2022 as BTC has fallen more than 63% YTD. It’s fair to question Saylor’s strategy in light of his performance, but his conviction is admirable. Saylor has continued to buy throughout the downturn while shunning every other asset in existence. There is no second-best TradFi ape. 4. Anthony SassanoWhile not as high-profile as Saylor, Anthony Sassano is certainly deserving of inclusion on this list. Sassano, runs The Daily Gwei newsletter and YouTube channel, where he provides free, educational content on all things Ethereum. Anthony is as consistent as the block production on the chain he covers, shipping highly informative content day in and day out. 3. CobieCobie is known for being one of the most legendary traders in crypto, but in 2022 has shown himself to have quite the charitable side. Cobie made waves this year through his donations to Twitch streamers and for providing $100K in funding for the defense of atozy against a frivolous BitBoy lawsuit. In a true demonstration of his generosity, Cobie even let atozy keep the money after BitBoy dropped the suit. 2. ZachXBTZachXBT has done god’s work in 2022 as one of crypto’s best self-regulators. The anonymous on-chain sleuth has exposed a plethora of scams, rugs, and unethical business practices across the industry. ZachXBT’s actions are incredibly courageous, as he is taking considerable personal risk in publishing his exposés and doing his part to make crypto a safer and more ethical space. 1. The Merge DevsThe Merge devs take the top spot on our heroes list. The devs, which include, Hsiao-Wei Wang, Parithosh Jayanthi, Marius Van Der Wijden, Ben Edgington, Tim Beiko and Danny Ryan managed to pull off one of the most monumental technical achievements in crypto history in transitioning Ethereum from Proof-Of-Work to Proof-Of-Stake. What makes this accomplishment even more impressive is that the merge went off without a hitch despite the complexity of the task, perpetual distractions with the insanity of 2022, and the high-stakes of handling a $200B+ network. 🦹♂️ Top 5 Villains5. Richard HeartRichard Heart takes the fifth spot on our list. Heart not only is the man behind the highly controversial token HEX, but has also drawn the ire of many through his ostentatious and obnoxious displays of wealth. 4. Alex MashinskyThe Celsius CEO ran his business into the ground due to incredibly poor risk management and excessive risk-taking. That wouldn’t necessarily land him on this list, but Mashinsky and Celsius executives withdrew millions in funds in the weeks leading up to the platform pausing withdrawals and declaring bankruptcy. Mashinsky famously wore a shirt which said “bankers aren’t your friend.” That may be true, but Mashinsky certainly isn’t one either. 3. Su Zhu and Kyle DaviesAs we’ve previously discussed, 3AC’s collapse wreaked havoc on the industry. So it’s fitting that its outspoken co-founders and super-cycle proponents Su Zhu and Kyle Davies make our list, especially after allegations that they double pledged collateral and misrepresented their financial position to lenders. Su Zhu infamously tweeted that Ethereum abandoned its users…but it appears that 3AC abandoned its own creditors and morals in their thirst for leverage. 2. Do KwonDo Kwon takes the second spot on our list. The algorithmic stablecoin founder compounded poor protocol design and reckless risk-management decisions like choosing to back UST with Bitcoin. Kwon didn’t help matters through his tweets, infamously stating that by his hand “DAI would DAI” while directing an army of Lunatics towards any who dared to criticize him or his behavior. 1. Sam Bankman-FriedThis should come as a surprise to no one, but SBF takes the cake for 2022’s worst villain. He stole $8B dollars and committed one of the worst financial crimes in human history. The recently arrested SBF has wreaked an incalculable amount of damage on the space. He is likely going to prison for a long, long time. Good riddance. 🤮 Top 5 Worst Moments5. Tornado Cash SanctionsThere’s a reason why many in crypto feel the justice system is anything but just towards the industry. While many of crypto’s most egregious scammers and grifters walk free today, Tornado Cash developer Alexey Pertsev was arrested in July following OFAC sanctions on the protocol. Imprisoned for simply creating code to protect privacy, a human right, Alexey’s arrest is one the most unjust events of 2022. 4. The Collapse of TerraThe collapse of Terra was one of the largest capital destruction events in human history, with LUNA and UST losing more than ~$60B in combined value in a hyperinflationary death spiral. The algorithmic stablecoin’s implosion is terrible enough in its own right, but is even worse with hindsight as it catalyzed the credit crisis and ensuing contagion that wreaked havoc across CeFi. 3. The Collapse of 3ACOnce a titan of industry, the fall of Three Arrows Capital had a devastating impact on the space. The hedge fund took out numerous undercollateralized loans in order to buy assets and employ unprofitable strategies like the GBTC discount trade. The 3AC meltdown led to a massive sell-off as their positions were liquidated, wiping out more than $1T in crypto market-cap and left a trail of CeFi bodies like Celsisus, BlockFi, and Voyager in its wake. 2. The Ronin and Wormhole Cross-Chain HacksCross-chain bridges are insecure! It’s a lesson that we have learned time and time again as billions have been stolen in bridge hacks. Two of the largest casualties in 2022 were Wormhole, a cross-chain messaging protocol, and the bridge for Ronin, an L1 that hosts the P2E game Axie Infinity. More than $1B was stolen from these two protocols, with the Ronin hack being particularly egregious as it occurred due to improper private key management and helped spur the OFAC sanctions against Tornado Cash. 1. The Collapse of FTXCould it be anything else? The FTX collapse revealed a massive fraud, as CEO Sam Bankman-Fried used customer deposits as his own personal slush fund to purchase real estate, invest in venture deals, make political donations and issue loans to his hedge-fund, Alameda Research. FTX will represent a stain on the industry over the coming months and years. But if there’s any silver lining from this situation, it’s that it has once again reminded us of the importance of decentralization and self-custody. NOT YOUR KEYS, NOT YOUR COINS. 🏆 Top 5 Best Moments5. Crypto Supports UkraineCrypto demonstrated it can be a highly effective tool for facilitating political donations in a fast, efficient, and permissionless manner. Tens of millions were donated to support the defense of Ukraine, including a $6.5M sale of an NFT of the nation’s flag. 4. L2s Flip L1s in Transaction ActivityWe may have been a year late, but we finally had an L2 summer (sort of). According to L2 Beat, in October the average transaction per second (TPS) on Layer 2’s surpassed that of Layer 1. Although we still have a ways to go when it comes to having enough blockspace to onboarding millions and billions, slowly but surely Etheruem is beginning to scale. 3. Web2 Adopts NFTsA host of different Web2 businesses began to adopt NFTs in 2022, such as Reddit, Instagram, TikTok, and Twitter. Your normie friends may still hate them, but it’s undeniable that the stage is being set for NFTs to be integrated into everyday life. 2. The MergeAs previously mentioned the merge was a monumental technical achievement. Its impact on Ethereum cannot be overstated as it reduced energy consumption and ETH inflation by orders of magnitude while paving the way for future scalability upgrades. Watching the flawless execution of the merge live was surreal, and is certainly a moment that the community will never forget. 1. Ryan and David Meet

Lucas 🔥_🔥 @0x_Lucas

Ladies & Gents… It happened. @BanklessHQ history has been made.

4:27 PM ∙ May 16, 2022

2,757Likes132Retweets

While it may not have the same impact on the broader industry as the merge, Ryan and David meeting during Permissionless was undoubtedly the biggest moment of 2022. Despite spending hundreds of hours together on-screen, the two Bankless founding fathers had never met before that date. As someone who witnessed their first face-to-face interactions firsthand, I can truly say that it was a sight to behold. And I’m not just saying all this because they’re my bosses 😉. What A Year…As we can see, 2022 was one hell of a year. With prices in the gutter and Crypto Twitter deep in the throes of Goblin Town, it’s easy to focus on the worst people and events of 2022. And frankly, it’s understandable. The bad this year was really bad. However, it’s also important to remember the good, too. Long-term builders continued to ship, adoption grew, and crypto showed flashes of its incredible potential to serve as a tool for good. As Ryan said on the stream, 2022 needed to happen. Bad actors needed to be flushed out, and poorly run businesses washed away. We can now rebuild from first principles. Crypto can and will re-emerge stronger than ever. Here’s to a better ’23. Action steps

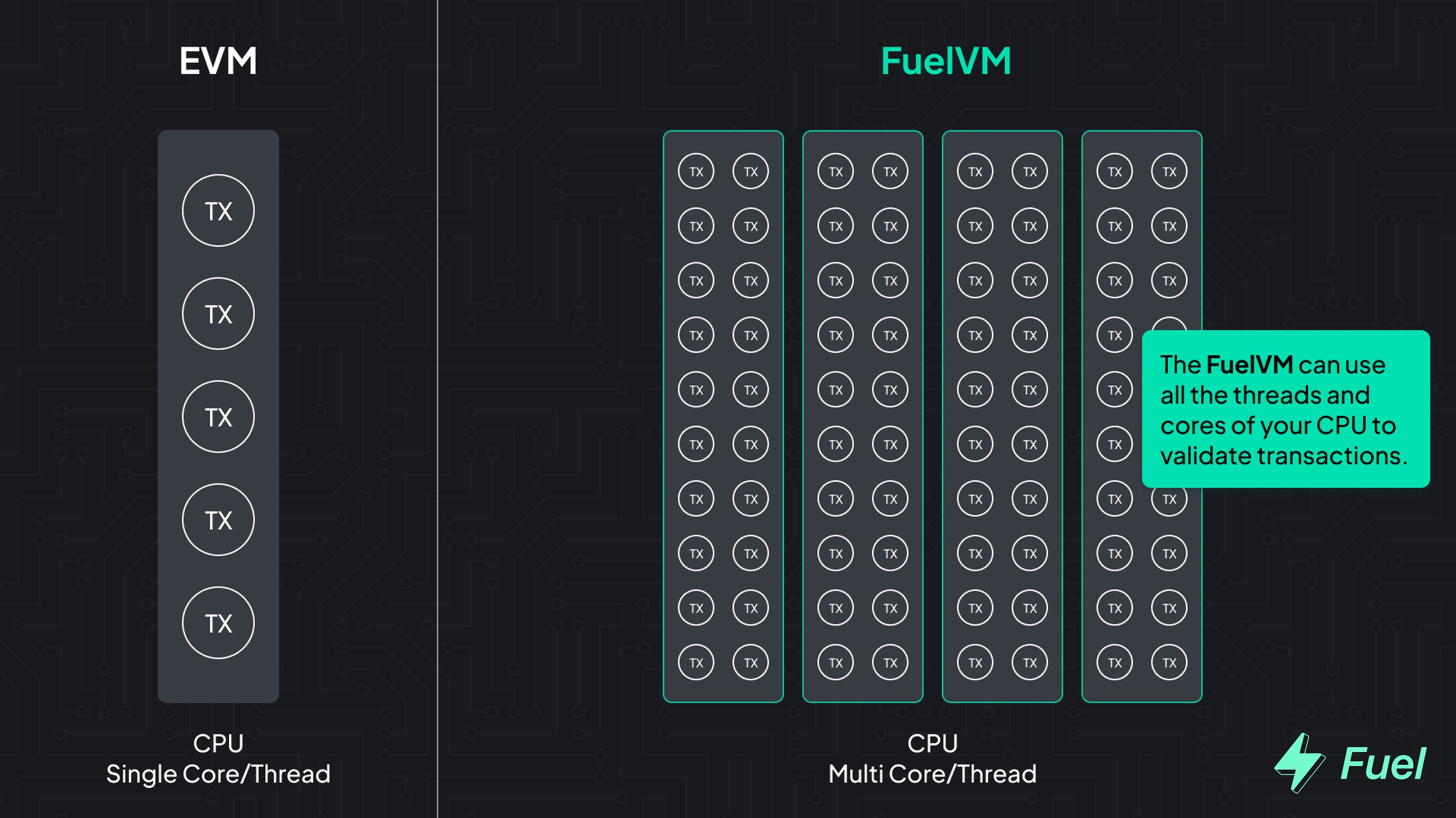

🙏 Together with ⚡️FUEL⚡️Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput. 👉 Go beyond the limitations of the EVM: explore the FuelVM Author BioBen Giove is an analyst for Bankless. He’s the former President of Chapman Crypto and an analyst for the Blockchain Education Network (BEN) Crypto Fund, a student-managed crypto fund built on Set Protocol. He’s also a proud member of the Bankless DAO and methodologist behind the GMI index. Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge. 🙏 Thanks to our sponsor FUEL👉 Explore the FuelVM and discover its superior developer experience! Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

© 2022 Bankless, LLC. |