The Fed Will Change Regimes Today And Asset Prices Are Salivating

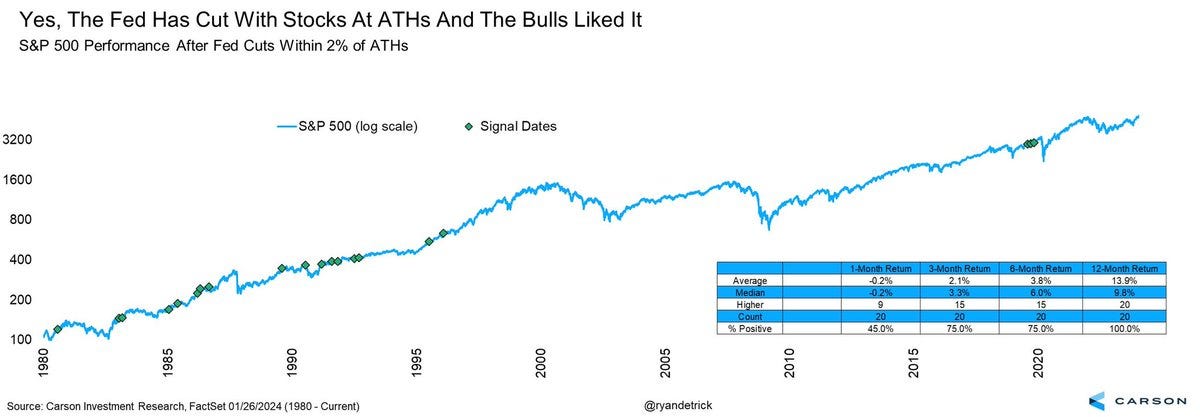

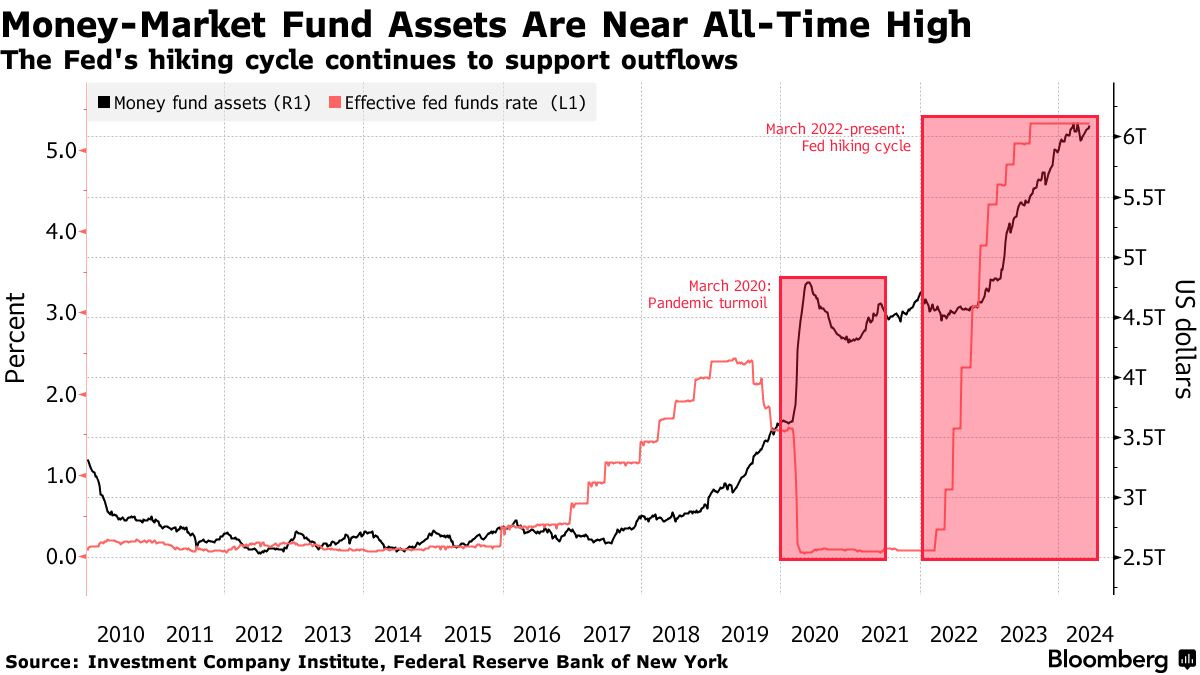

To investors, Jerome Powell is slated to kickoff the highly anticipated regime change this afternoon. The US economy will digress from the financial tightening of the last few years and return to cheap, easy money flowing through the system. One thing to keep an eye on is stocks are already at an all-time high despite the financial tightening that has taken place. The Fed increased interest rates at the fastest pace in history and sold nearly $2 trillion off their balance sheet, yet the S&P 500 and Dow Jones Industrial both hit new record highs yesterday. Carson Group’s Ryan Detrick points out “The Fed has cut rates with stocks near all-time highs 20 times. The S&P 500 was higher a year later 20 times.” Not a bad track record of performance. The anticipation of a drop in the cost of capital is showing up in other places as well — there was a 14% jump in mortgage applications as mortgage rates hit a two-year low, according to CNBC’s Diana Olick. The US economy and financial system is dependent on cheap capital. People have been waiting to borrow money and deploy cash. You can see this clearly in the acceleration of capital sitting in money market funds, which now hold more than $6 trillion. In addition to lower interest rates and money flowing out of the money market funds, I explained in my letter on Monday that M2 money supply is expanding again. This means US dollar liquidity is going to become more attractive for stocks, bitcoin, and other financial assets. Steno Research’s Mads Eberhardt highlights “The only significant divergence [in US dollar liquidity and bitcoin] this year occurred with the U.S. ETF launch in January. Other than that, U.S. liquidity leads Bitcoin.” There are plenty of people predicting a recession, but you may want to ignore the noise. The obsession with “is a recession coming next month?!” is a perfect example of what is wrong with traditional finance. The only investors who care about timing markets are the short-term oriented speculators. Long-term investors continue to dollar cost average into their favorite asset with the intention to hold for a decade or more. Betting on a decade-long recession in the United States would require a lack of understanding on how the system works. Instead, having a long-term view is a competitive advantage in a world dominated by short-term speculators. Interest rates come down today. The money supply will continue expanding. Capital will flow out of the various corners of the market where investors have been hiding it. Financial assets are about to get a tailwind that should push prices higher in the short term, but regardless of what happens in the short-term I still would not bet against the strength of the US economy and our financial markets. Time in the market over timing the market. The old adage has survived decades for a reason. Hope you all have a great start to your day. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management 🚨🚨 Reader Note: BUILD Summit, our annual conference in NYC for founders, is coming up next month on September 26th. The event will provide top tier speakers, networking opportunities, and insightful business discussions on raising capital, scaling businesses, and building products. Current speakers include angel investor Balaji Srinivasan, Khosla Ventures’ Keith Rabois, Perplexity CEO Aravind Srinivas, Eight Sleep Founders Matteo Franceschetti & Alexandra Zatarain, and Passes CEO Lucy Guo. The event is free to attend and will be full of insights on how to operate a company at world-class level. RSVP for Free Attendance to Build Summit Polina Pompliano, Author of ‘Hidden Genius‘ and Founder of The Profile, and Anthony Pompliano, CEO of Professional Capital Management, discuss the economy, upcoming interest rate cuts, what that means for the average American, mortgages, Amazon employees required to be back in office, and recent assassination attempt of President Trump. Listen on iTunes: Click here Listen on Spotify: Click here The Federal Reserve Will Push Asset Prices HigherPodcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2024 |