The Future Of Liquid Staking

Born in 2011, Kraken is the industry-leading crypto exchange in security and transparency. Verify the backing of Kraken’s reserve assets thanks to regular Proof of Reserves audits. Dear Bankless nation, If there’s one segment of DeFi that’s grown especially hot amid the cooldown, it’s the liquid staking market. Yields may be down across the board but there are bullish signals on Ethereum’s horizon. Is anybody close to toppling Lido’s dominance? Who are the rising players? What does Lido’s reign mean for Ethereum censorship? Today, we explore all of these questions and more. – Bankless team The Future Of Liquid Staking

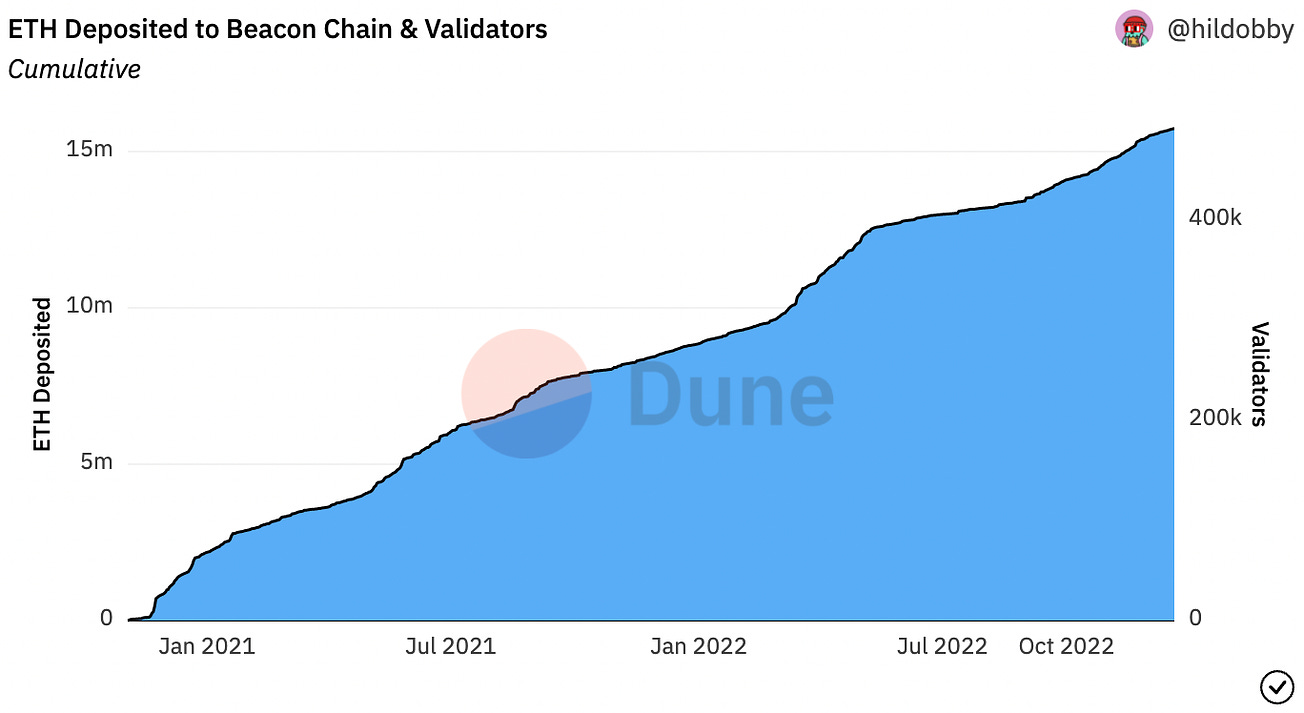

There’s always a bull market somewhere. While crypto may be in the midst of a brutal bear market, Ethereum staking remains an area of secular growth. The amount of ETH staked has soared 77.9% in 2022, including 14.4% since the merge.

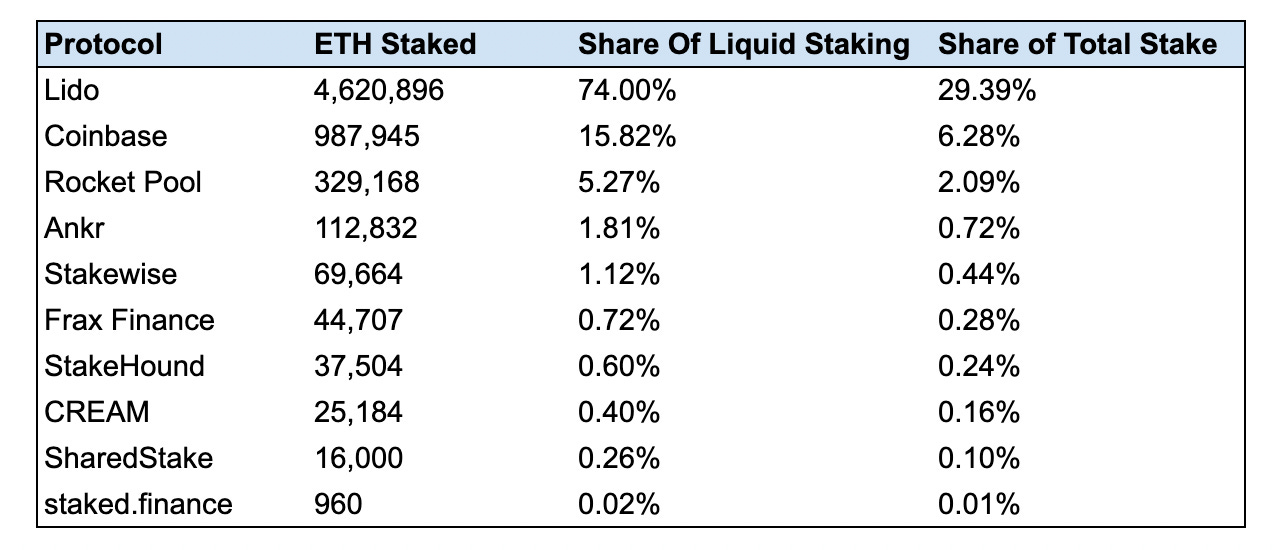

There is currently more than 15.7M ETH staked, and while this may seem like a large number, it accounts for just 13% total supply. This is well below the average stake rate for PoS networks, which is 61%. The ETH stake rate may never reach this average due to the highly distributed nature of its supply, but regardless, the Ethereum staking story is clearly still in its early innings. A major catalyst that is set to accelerate this stake rate is the Shanghai network upgrade, which will de-risk staking by enabling users to withdraw their deposits. This is likely to lead to millions of ETH being staked in the months following its expected implementation date of March-April 2023. The entities that are most poised to benefit from this boom are liquid staking protocols. These services represent the largest cohort of stakers, accounting for 32.8% of Beacon Chain deposits. The sector has found clear product-market fit by removing the opportunity cost of staking through the issuance of a liquid-staking derivative (LSD), an ERC-20 token that represents a claim on staked ETH and allows its holders to earn rewards while still being able to deploy their assets within DeFi. As LSD issuers take a cut of staking rewards as revenue, their business model is levered to the price of ETH and demand for blockspace, meaning that their revenue figures are poised to soar from the onboarding of new stake when markets recover, and on-chain activity returns. This begs the question… who is most poised to capitalize on this staking boom? And how will the competitive dynamics of staking change post-Shanghai? Let’s find these answers below: The State Of Liquid StakingLido Reigns Supreme… But How Long?Before we dive into how staking will change and who will capture market-share post-Shanghai, let’s take a look at the liquid staking landscape today. To date, liquid-staking has largely been dominated by one player: Lido.

The stETH issuer is the largest entity staking on the Beacon Chain, with a 29.4% market share, including a 74.0% share among liquid stakers. There are several factors that have contributed to Lido’s dominance. The protocol has benefited from a first-mover advantage, as it was the first LSD issuer to launch at scale in December 2020. In doing so, they built up a key competitive advantage: deep liquidity. Liquidity has been the top priority for stakers in the pre-Shanghai era, as secondary markets for LSDs are the only way to exit a position. stETH is far and away the most liquid LSD, with hundreds of millions in DEX liquidity across Curve, Balancer and Uniswap. Lido has been able to build up this deep liquidity for stETH through a massive incentive program, as the protocol has spent $208M of token incentives YTD in 2022. This has helped build an incredibly powerful network effect for stETH, as users will want to stake with the most liquid LSD to maximize their ability to exit, thereby begetting even more liquidity, and therefore market share, for Lido. This network effect has led to speculation that the protocol will become a monopoly. Although they are working to enable permissionless validation, many have pointed to Lido as a possible centralization vector for Ethereum, as LDO holders are the only ones able to add/remove node operators. However, it appears increasingly likely that these fears are be misplaced, with signs of chinks emerging in Lido’s armor as competition for stake intensified post-merge.

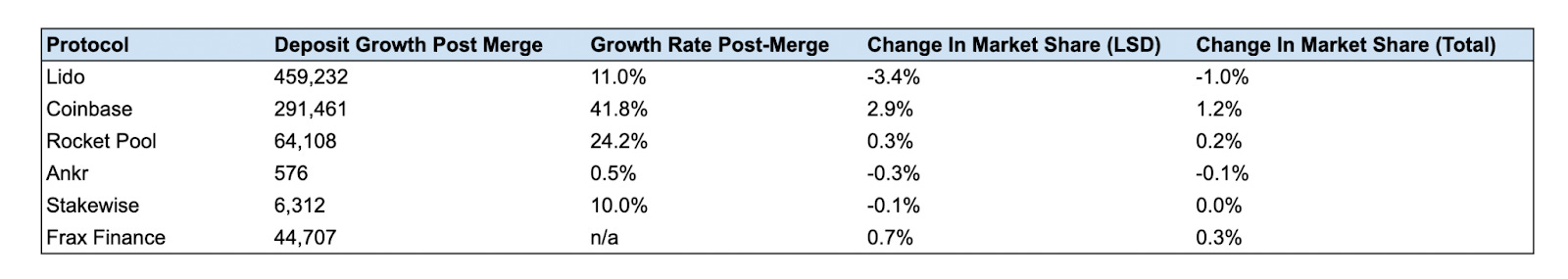

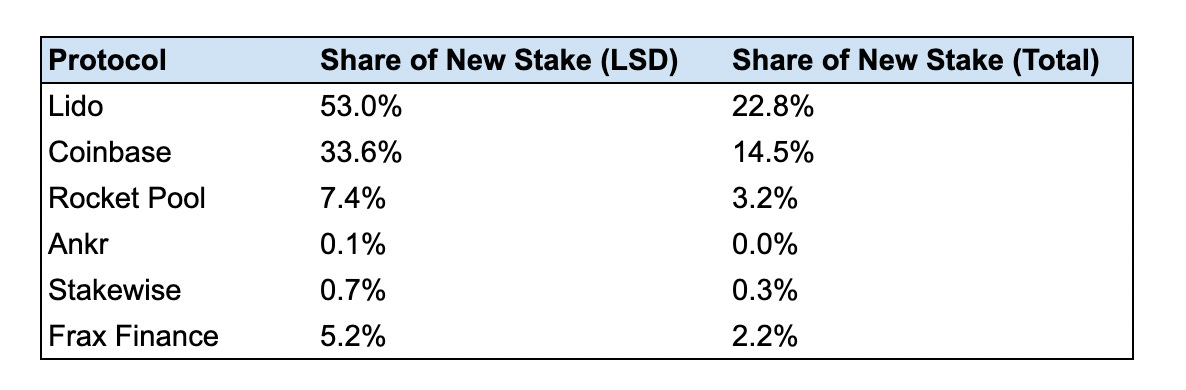

Despite growing the largest in aggregate, Lido has experienced “just” the third fastest growth rate among the major LSD issuers. The stETH issuer has also seen its market share shrink over this period, falling 3.4% in liquid staking and 1.0% overall. Lido’s slower growth rates are to be expected, as it’s far easier for a smaller protocol to grow at a faster clip than a larger one. However, when taking a look at who is attracting deposits of newly staked ETH after the merge, we can see signs that the protocol’s chokehold over liquid staking may be beginning to loosen.

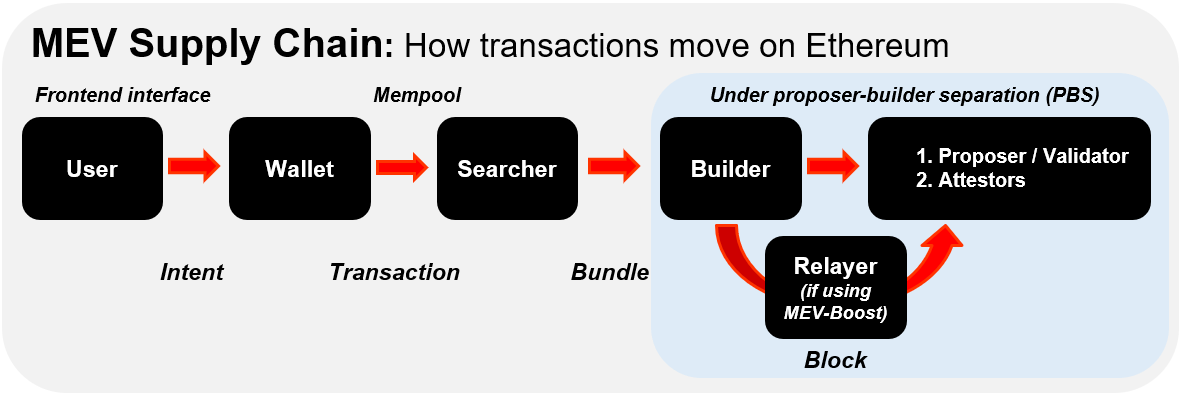

While it has a 29.4% share of all staked ETH, Lido has captured “just” 22.8% of post-merge deposits. Furthermore, although it has 74.0% market share in liquid staking, Lido has attracted 53.0% of deposits into these protocols over this period. As we can see, much of this loss in market-share can be attributed to the growth of Coinbase’s cbETH. The CEX-issued LSD has captured a 33.6% share of the inflows into liquid staking since the merge, likely from being able to convert its existing pool of stake into cbETH. With Coinbase having immense resources at its disposal as the largest CEX in the United States, it is likely to maintain competitiveness for the foreseeable future. All in all, it’s clear that Lido remains in pole position. However, the increased diversification of incremental stake suggests that the market may be trending more towards oligopoly than monopoly. Yield CommoditizationAnother factor that is likely to fuel oligopoly, rather than monopoly, in liquid staking is the commoditization of yields. A common argument as to why stake will consolidate is that big pools of capital and professional validators benefit from economies of scale in that they are able to execute proprietary MEV strategies. In doing so, these entities are able to generate higher yields relative to smaller stakers, driving out competition and leading to cartelization. While it seems likely that this may occur to some extent, there are several developer changes on the Ethereum protocol layer and technologies that in the long-run, will democratize staking yields by allowing solo-stakers and smaller protocols to generate returns that are competitive with their larger counterparts. One of these is proposer-builder separation (PBS). PBS aims to separate block production from block validation, by creating a new stakeholder called the block builder. The block builder is an entity that determines which transactions are included in a block, meaning that rather than order transactions themselves, validators merely need to choose the builder that is proposing the highest value block. This represents a significant tailwind for yield commoditization by democratizing access to sophisticated MEV. While it will eventually be enshrined at the protocol level, PBS is currently implemented via relayers like MEV-Boost. A second factor that will fuel yield commoditization is distributed validator tech (DVT). DVT is like multisig for validators, as it distributes validator keys across several different nodes, rather than just one. In doing so, it improves validator uptime and resilience by democratizing the points of failure and reducing risk of slashing events. DVT is particularly valuable for solo-stakers, who are at greater risk of running into maintenance issues that can eat into long-run returns. The two primary DVT solutions are Obol and SSV, both of which are live on testnet. Both PBS and DVT remain in their early stages, though fully implemented each should help reduce economies of scale for large staking pools and commoditize returns across liquid staking providers. The CompetitionWith liquidity set to become less of a concern post-Shanghai and yields likely to be increasingly commoditized, in the long-run liquid staking protocols will have to compete on product to attract both depositors and validators. In other words – The design of the protocol and the LSD itself will actually begin to matter. There are numerous product features that will contribute to the success of an LSD:

With this in mind, let’s take a look at a few of the non-custodial protocols that are poised to capture the opportunity from this new competitive environment. 🚀 Rocket PoolRocket Pool is the second-largest liquid staking provider, with a 5.2% and 2.1% share of Beacon Chain and liquid staking deposits, respectively. The protocol has the second highest post-merge growth rate of any LSD issuer at 24.2%, capturing 3.2% and 7.4% of total and liquid-staking deposits respectively. Rocket Pool has optimized for being highly decentralized. The protocol was the first to support permissionless validation, as any node operator can validate for the network if they post 16 ETH of collateral (½ of a validator) as well an RPL bond worth at least 1.6 ETH. This overcollateralization creates built-in slashing protection for rETH, as an NO’s bond will be sold to protect users from slashing events, where a validator will lose a portion of their stake as punishment for diverting from the rules of PoS. Rocket Pool also benefits from tax efficiency, as rETH reflects staking rewards by appreciating in value (like Compound’s cTokens), rather than utilizing a rebase model that creates numerous taxable events. Rocket Pool’s primary weakness is that it is capital inefficient. Capital efficiency has been a huge factor in fueling the dominance of stETH and cbETH, as each LSD can be minted 1:1 for each underlying ETH deposit (though these LSDs rely on weaker slashing mitigation measures like insurance). While node operator collateral requirements will soon be lowered to 8 ETH with the LEB8 proposal, this still presents a hefty barrier that could lead the protocol to struggle to attract new validators as it scales. 💠 StakeWiseStakeWise is an incumbent staking protocol that is in the midst of a major transition. Though it currently uses a two-token model, the protocol is soon set to launch StakeWise V3, which will utilize a modular architecture where users can stake into segregated vaults. V3’s design has several distinct advantages over monolithic protocols like Lido, Coinbase, and Rocket Pool, such as allowing stakers to select their validator. The protocol also enables greater isolation of slashing risk, as losses can be more easily contained to a single vault, while providing further slashing protection through overcollateralization, as users can only mint osETH, the protocols LSD against a fraction of their stake. These features allows validators to permissonlessly join the network with low capital requirements, while also providing enhanced customizability over vaults, such as creating whitelisted ones for institutions. While StakeWise V3 appears disruptive to the monolithic world order, it faces significant execution risk, as it is launching what is essentially a brand new protocol. Furthermore, its design creates more complexity for end-users, as users who choose to “liquify” their stake, rather than simply hold the NFT that is minted to represent their deposit, will have to continuously manage their collateralization ratio to avoid liquidation. ¤ Frax FinanceThe issuer of the FRAX stablecoin, Frax has expanded into liquid staking with the launch of Frax ETH. The protocol’s offering has grown like a weed, attracting 44,707 in ETH deposits while grabbing a 0.7% share of the LSD market. Frax ETH utilizes a similar design to StakeWise V2, where stakers are issued two tokens, frxETH which represents their underlying ETH deposit, and sfrxETH which accrues staking rewards. This model provides Frax ETH stakers with greater capital efficiency from the opportunity to deploy multiple assets within DeFi to earn yield. While its growth has been undeniable, and although it has a significant warchest of CVX to attract liquidity on Curve, Frax ETH faces several obstacles that could make it difficult to secure long-term market share. A primary one is the inefficiency of the two-token model as this fragments liquidity and increases incentive costs for LSD issuers. In addition, in its current state, Frax ETH is highly centralized, as validators are run entirely by the Frax team, though this will change in the future. Other Challengers:Rocket Pool, StakeWise, and Frax are not the only ones seeking to challenge Lido and Coinbase’s dominance. There are numerous other protocols that will soon launch with unique product offerings. These include:

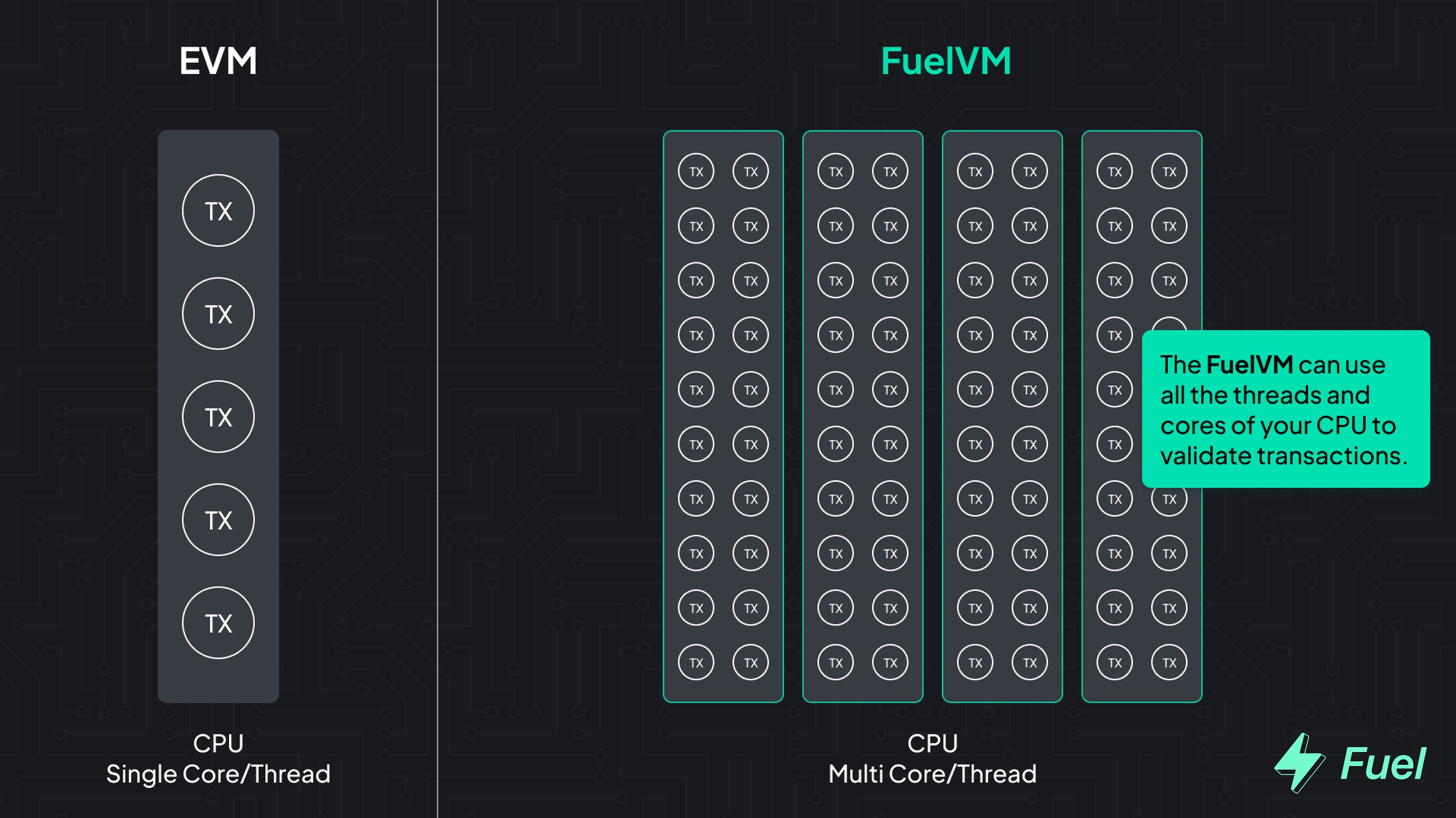

Of course, we’d be remiss not to mention the elephant in the room – Binance. It seems likely that crypto’s largest CEX will launch an LSD in 2023. Given its reach and resources, it’s probable that its LSD would grab significant market-share. A Rising Tide Will Lift (Most) BoatsBy enabling withdrawals, Shanghai is poised to unleash a liquid staking boom and shake up the dynamics of the sector. While Lido reigns supreme, it’s facing increased challenges from CEXs like Coinbase, as well as non-custodial protocols like Rocket Pool, StakeWise and Swell which bring product improvements like increased slashing protection, permissionless validation, modularity, and greater tax efficiency. The disruptive design of these new challengers means that they should be able to grab market share from and grow at faster rates than Lido in a post-Shanghai world. Another factor increasing the odds that these solutions succeed is likely commoditization of yields in the long-run among staking providers as a result of upgrades and technologies like PBS and DVT. This is not to say that Lido won’t remain dominant. The capital efficiency and liquidity based network effects of stETH, coupled with the potential for clogged withdrawal queues, means that it’s unlikely to cede its status as the market leader. Furthermore, it, along with other well capitalized LSD issuers like Frax, Coinbase, and possibly Binance, should be able to use their resources to build a liquidity based network effect even if they are less competitive on product. All in all, it appears that liquid staking is trending towards oligopoly, not monopoly. In that scenario, it is likely that the surge in stake post-Shanghai represents a rising tide that will lift many boats in the short and medium term. How things shake out is unknown. But what’s more clear is that stakers, validators, and investors should prepare for a multi-LSD world. May the best protocols win. 🫡 Action steps🙏 Together with ⚡️FUEL⚡️Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput. 👉 Go beyond the limitations of the EVM: explore the FuelVM Author BioBen Giove is an analyst for Bankless. He’s the former President of Chapman Crypto and an analyst for the Blockchain Education Network (BEN) Crypto Fund, a student-managed crypto fund built on Set Protocol. He’s also a proud member of the Bankless DAO and methodologist behind the GMI index. Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge. 🙏 Thanks to our sponsor FUEL👉 Explore the FuelVM and discover its superior developer experience! Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

Read Bankless in the app

Listen to posts, join subscriber chats, and never miss an update from Ben Giove.

© 2022 Bankless, LLC. |