The Money Printer Will Send Bitcoin Higher

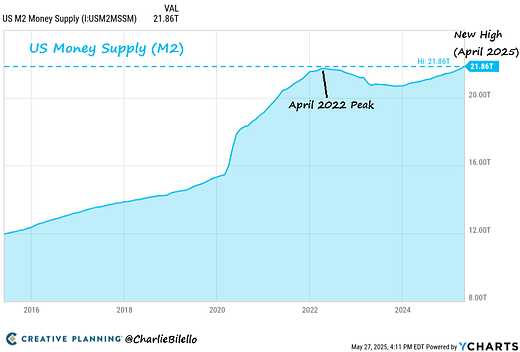

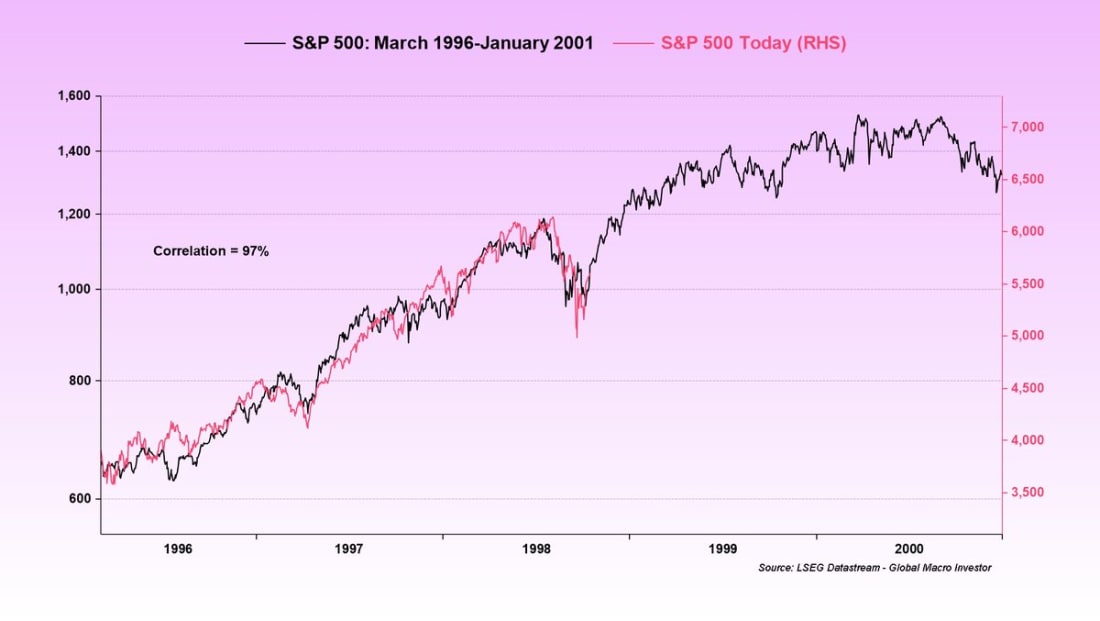

To investors, The administration is making a significant pivot in their economic policy. We just watched them shift from a focus on cutting government spending to an obsession with growth at all costs. This strategic change is coming at an interesting point in time. Creative Planning’s Charlie Bilello highlights “the US Money Supply hit an all-time high in April for the first time in three years. After a brief hiatus, money printing is back.” Put money printing is not the only reason why timing really matters right now. Global Macro Investor’s Julien Bittel explains how there is a very high correlation to the late 1990s:

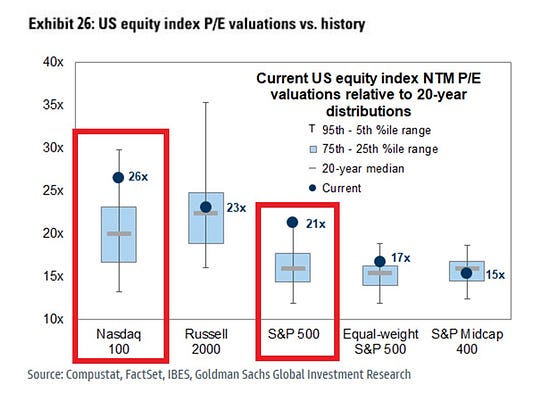

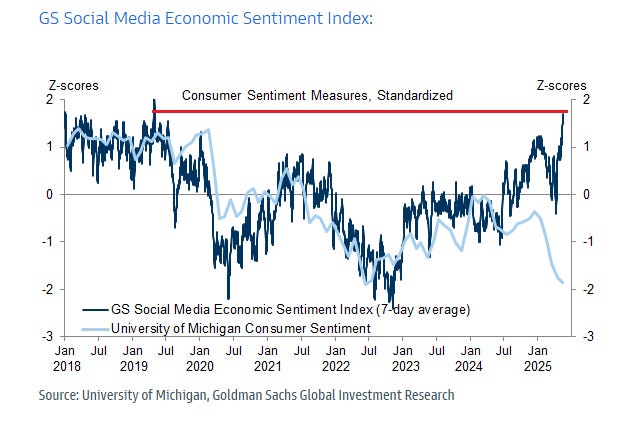

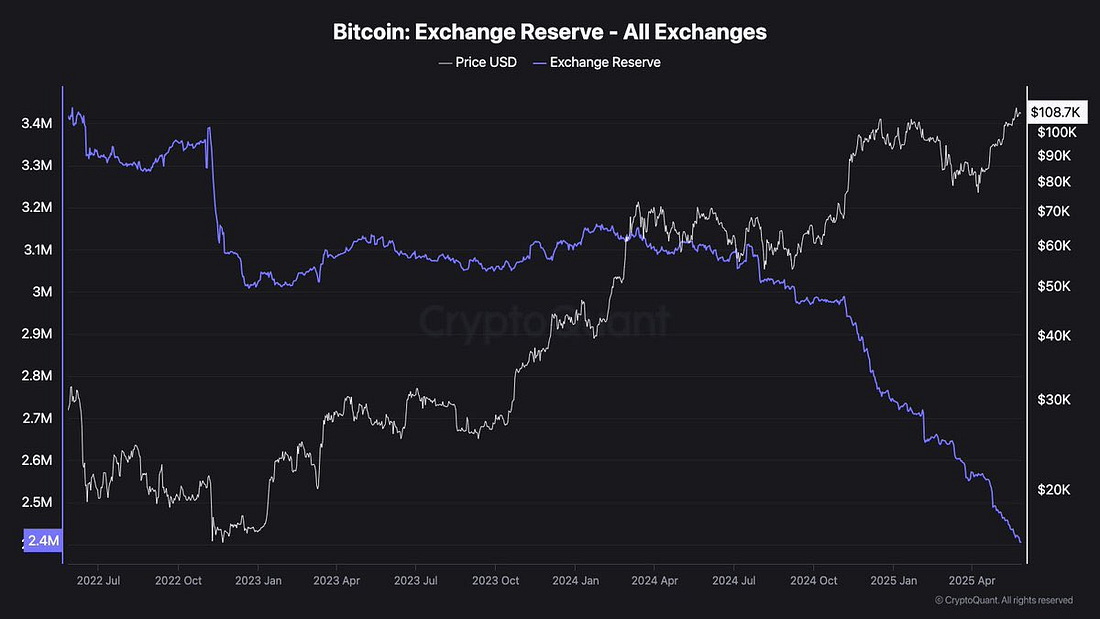

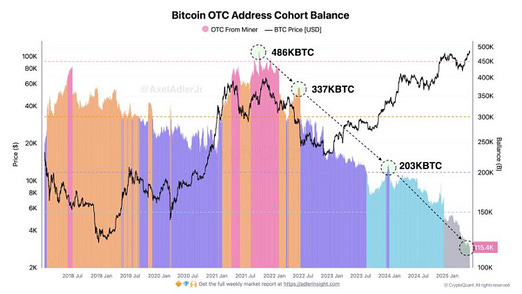

While the market recovery from the late 1990s may give investors peace of mind, it is important to understand “U.S. stocks are now more expensive than nearly any time in modern history. But here’s the real problem: U.S. households are holding more stocks than ever before. This combo is rare and risky.” The Nasdaq is trading at a P/E ratio of 26 and the S&P 500 is trading at a 21x P/E ratio. Not exactly cheap from a historical point of view. And investors are bullish to say the least. Mike Zaccardi shows that the Goldman Sachs Social Media Economic Sentiment Index is nearing the all-time high. So if everyone is bullish and the money printer is getting turned back on, things could get very crazy from here. And that is just normal assets like the S&P or Nasdaq. Certain individual stocks are poised to accelerate higher as retail investors take larger positions, but bitcoin may be the granddaddy of them all. We know bitcoin is the asset most sensitive to global liquidity thanks to the great analysis by Sam Callahan and Lyn Alden. But now Vivek4Real’s data is also showing us that bitcoin balances on exchanges is hitting a new all-time low. But it is not just the exchanges. Quinten Francois sees a rapidly decreasing amount of bitcoin available on OTC desks as well. So fewer and fewer bitcoin are available for sale at the same time that central banks are firing up their money printers. More fiat chasing fewer coins. That means we have to see bitcoin’s price rise to accommodate everyone. We have seen this a few times in bitcoin’s history but it never gets less exciting. The next few months should be fun. Hope you all have a great day. I’ll talk to everyone tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management 🚨 READER NOTE: We launched a new product this weekend to help investors manage their financial lives. The product uses AI models to track your net worth, analyze your portfolio, answer any questions you have about your finances, and make suggestions on how you can improve. You can add public stocks, private investments, crypto assets, cars, houses, investment properties, collectibles, and any other assets you own. You can text, email, or call the CFO too which is really cool. The CFO, called Silvia, now has more than $1.8 billion in assets connected on the platform. You can sign up for the product completely free here: https://www.cfosilvia.com Sign Up For Silvia For Free Here Is The Bitcoin Bull Run Back?John Pompliano and Anthony Pompliano discuss bitcoin, bitcoin conference in Las Vegas, bitcoin treasury companies, macro environment, inflation, timeless investing principles, and how this all impacts your portfolio. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |