The Multi-Billion-Dollar Problem With Regional Sports Networks

Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not already a subscriber, sign up and join 90,000+ others who receive it directly in their inbox each week. Today’s Newsletter Is Brought To You By Sorare!Sorare is one of the fastest-growing companies in sports. Backed by superstar athletes like Lionel Messi, Kylian Mbappé, Rudy Gobert, Aaron Judge, and Serena Williams, they have built blockchain technology that allows fans to collect officially licensed NFT-backed player cards. Sorare, which started in Europe with fantasy football games, recently launched exclusive licensing deals with the MLB/MLBPA and NBA/NBPA to create a custom fantasy game for each sport. The concept is simple: Sorare lets you buy, sell, trade, and earn digital trading cards of your favorite players. But rather than just looking at them as a digital collectible, you can use these trading cards to enter fantasy sports competitions for prizes & rewards. So use my link below for a free limited card — it’s free to get started! Friends, Earlier this year, I wrote a newsletter explaining why I think the NBA is poised to grow faster than any other major sports league over the next decade. My thesis was simple — media rights are about to triple, expansion teams are on the horizon, the league is investing heavily in Africa and India, and new rules allowing private equity funds, sovereign wealth funds, pension funds, and endowments to buy minority stakes in teams should significantly increase demand for a fixed-supply asset. And the email was well received. So much so that two NBA owners contacted me afterward to continue the discussion. They largely agreed with what I was saying — they own the teams after all! — but they also mentioned two specific risks that keep them up at night:

Now, the first concern — players receiving equity — seems to have been discussed for decades. And the truth is, it will probably happen at some point. The owners will fight it and demand something significant in return, but NBA superstars will want to better monetize their stardom and participate in the upside.

But the threat of players demanding equity is more of a long-term issue (10-20 years), while the second risk — local broadcast rights — is now playing out in real-time. For example, regional sports network (RSN) owner Diamond Sports missed a $140 million interest payment earlier this month and is likely headed for bankruptcy. The company now has a 30-day grace period where its management team will try to restructure its $8 billion debt load with creditors — and if they can’t come to an agreement, they’ll default on their debt and have to file for bankruptcy. This is important because Diamond Sports currently holds the local media rights for 42 teams across the NBA, MLB, and NHL. They televise roughly a third of the games across those leagues and owe teams $2 billion in rights fees this year alone.

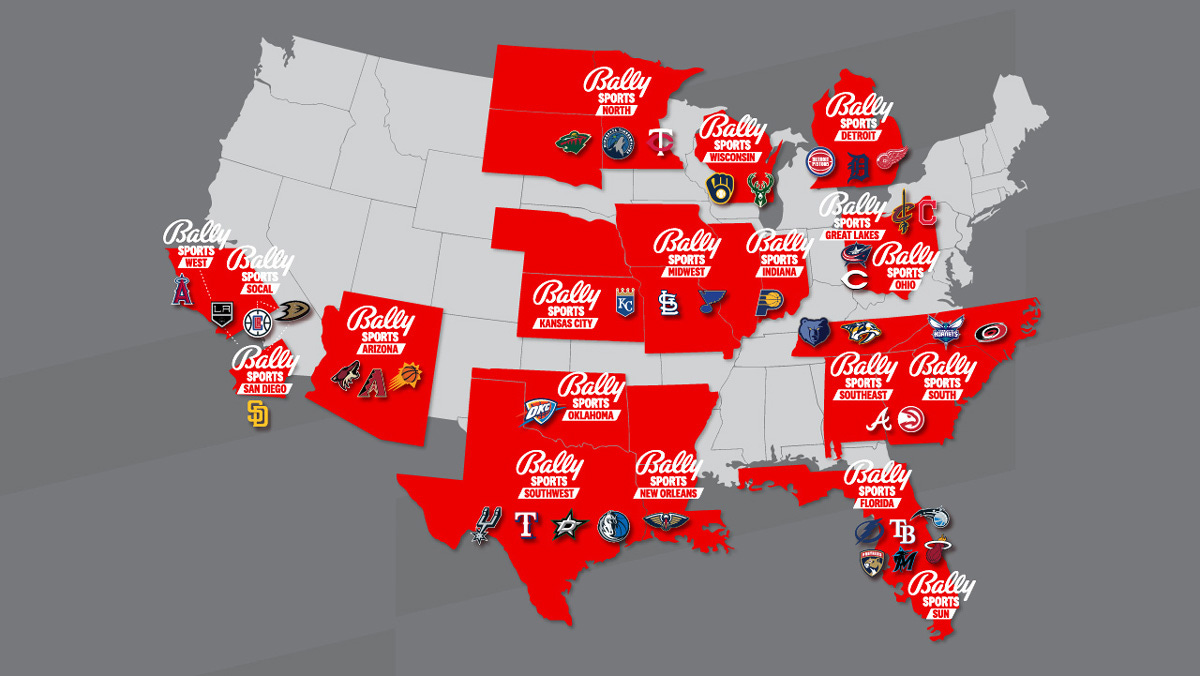

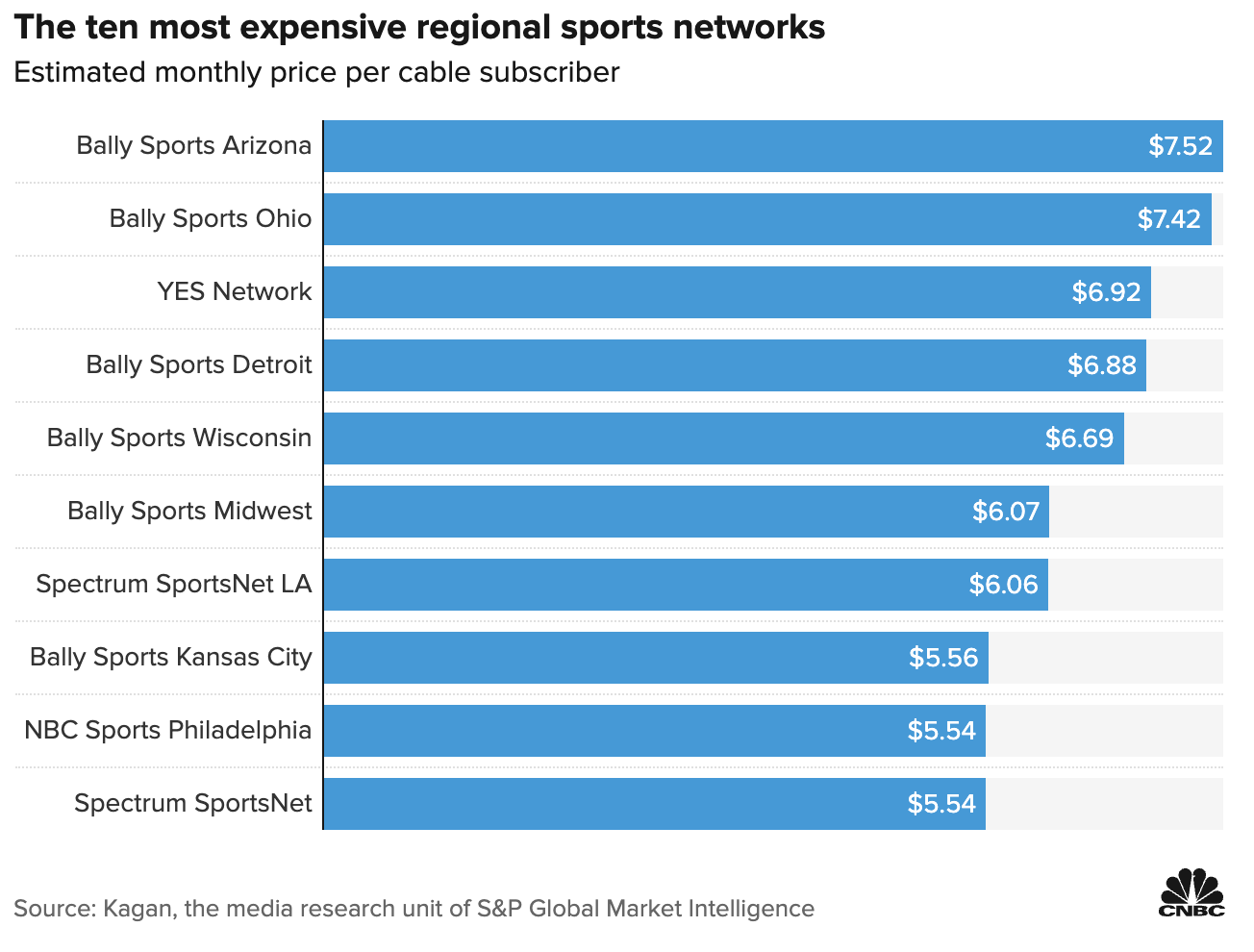

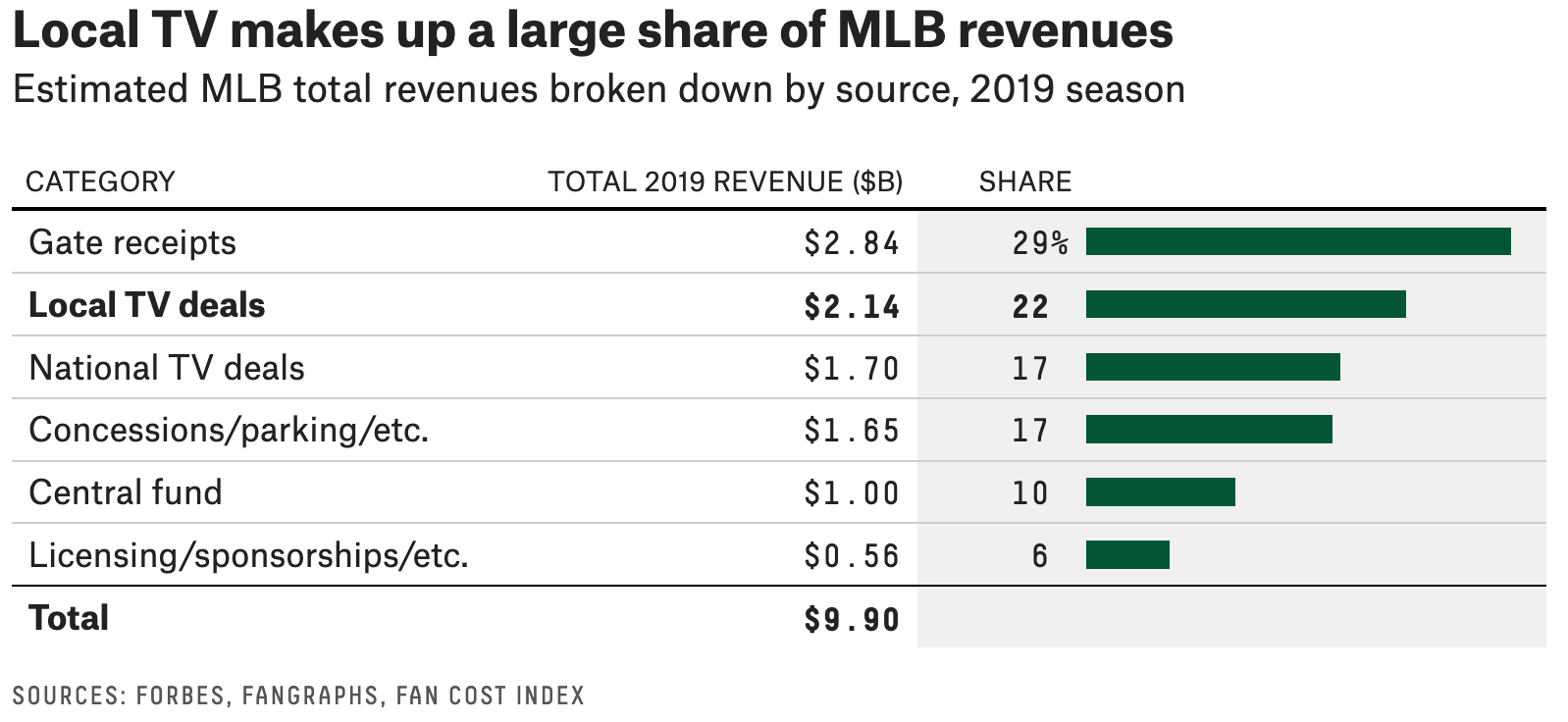

So today’s email will break down what an RSN is, why fans should care about the current situation, what might happen next, and more. Let’s go! The easiest way to explain regional sports networks (RSNs) is that they are local cable channels that broadcast sporting events of local teams in U.S. professional sports leagues (mainly the NBA, MLB, and NHL). Diamond Sports is the biggest regional sports network. Sinclair acquired the assets from 21st Century Fox in 2019 at a $10.6 billion valuation. They also have minority interests in Marquee Sports Network (home of the Chicago Cubs) and YES Network (home of the NY Yankees and Brooklyn Nets), and they pay about $2 billion annually for the broadcasting rights to roughly 50% of teams across the NBA, MLB, and NHL. And for additional context, Sinclair rebranded Diamond Sports’ assets as Bally Sports Network to take advantage of legal sports betting — and here’s a look at the company’s current portfolio of broadcasting rights. This local broadcasting model has been hugely profitable. It enabled teams to extract large fees from the RSNs for a portfolio of games, and cable operators just passed those fees along to customers whether they watch sports or not. For example, RSNs typically cost each customer between $5 to $7 per month as part of the cable bundle, and everyone pays for it (even if you don’t ever watch a game). And this model has produced enormous cash flow for sports teams over the last several decades. For example, it’s estimated that local tv deals represented about 22% of all Major League Baseball revenues in 2019. That was second only to gate receipts, meaning local TV deals produced more revenue than national TV deals, concessions, licensing, and sponsorships. But the RSN model has been cracking for several years, and no one should be surprised. The biggest problem is that consumers continue to migrate away from traditional cable TV to streaming services, with the number of pay TV households in the United States dropping from 100 million in 2014 to roughly 65 million today. Fun fact: It’s estimated that there will officially be more non-pay TV households (68.2 million) in the United States than pay-TV households (63.4 million) by the end of 2023. Number Of Pay TV Households In The United States

Add in the fact that RSNs are the most expensive part of the cable bundle, and the decline of cable TV households has only further accelerated their problems. For example, Xfinity dropped MSG Networks — home to the Knicks, Rangers, Devils, Islanders, and Red Bulls games — in 2021 after it found that 95% of its customers didn’t watch more than 10 of the 240 games on the network. And this creates a vicious cycle. Cable operators that choose to keep these RSNs have to continuously increase the bundle’s price to make the economics work, which only makes more people cut the cord in the long run. And given that RSNs typically earn about 90% of their revenue from carriage fees, networks dropping their channel from the cable bundle can be disastrous for the company’s bottom line. The downstream impact is scary too. TV money is a core part of each league’s revenue stream, so if these RSNs fail or local TV revenue drops dramatically, we could end up seeing a reduction in salary caps (meaning less money for players). And this would be particularly bad for a league like the NHL, which has smaller national TV deals and relies more heavily on local TV rights than others. National TV Broadcasting Rights Annual Value

So it’ll be interesting to see what happens next. The most obvious (near-term) solution is for Diamond Sports to reach a deal with creditors, file for Chapter 11 bankruptcy, and restructure its debt. This would kick the can down the road, especially since most RSNs still aren’t profitable without interest payments. But it would also keep money flowing from RSNs to teams and give each league more time to develop a long-term solution. Remember, the NBA and NHL playoffs are about to start, and these leagues have already received payment from Sinclair for this season. And when you look at the long-term impact, it gets even more interesting. Major League Soccer was criticized a fair amount for signing a long-term, exclusive deal with Apple TV. For example, why would a league that is trying to grow and acquire new customers close its distribution model and go 100% exclusive to streaming? Well, maybe that wasn’t so bad after all — because while MLS limited its growth and discoverability by removing itself from cable TV, at least its cash flow will be stable over the next decade, and fans know exactly where to watch games (without blackouts). So when/if the RSN model fails, don’t be surprised when these leagues go back to airing games on free local TV stations and allow everyone else to pay a monthly subscription fee to stream anything they want. I hope everyone has a great weekend. We’ll talk on Monday. Interested in advertising with Huddle Up? Email me. Your feedback helps me improve Huddle Up. How did you like today’s post? Loved | Great | Good | Meh | Bad Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not already a subscriber, sign up and join 90,000+ others who receive it directly in their inbox each week. Huddle Up is free today. But if you enjoyed this post, you can tell Huddle Up that their writing is valuable by pledging a future subscription. You won’t be charged unless they enable payments.

Read Huddle Up in the app

Listen to posts, join subscriber chats, and never miss an update from Joseph Pompliano.

© 2023 |