The NBA’s Bright And Lucrative Future

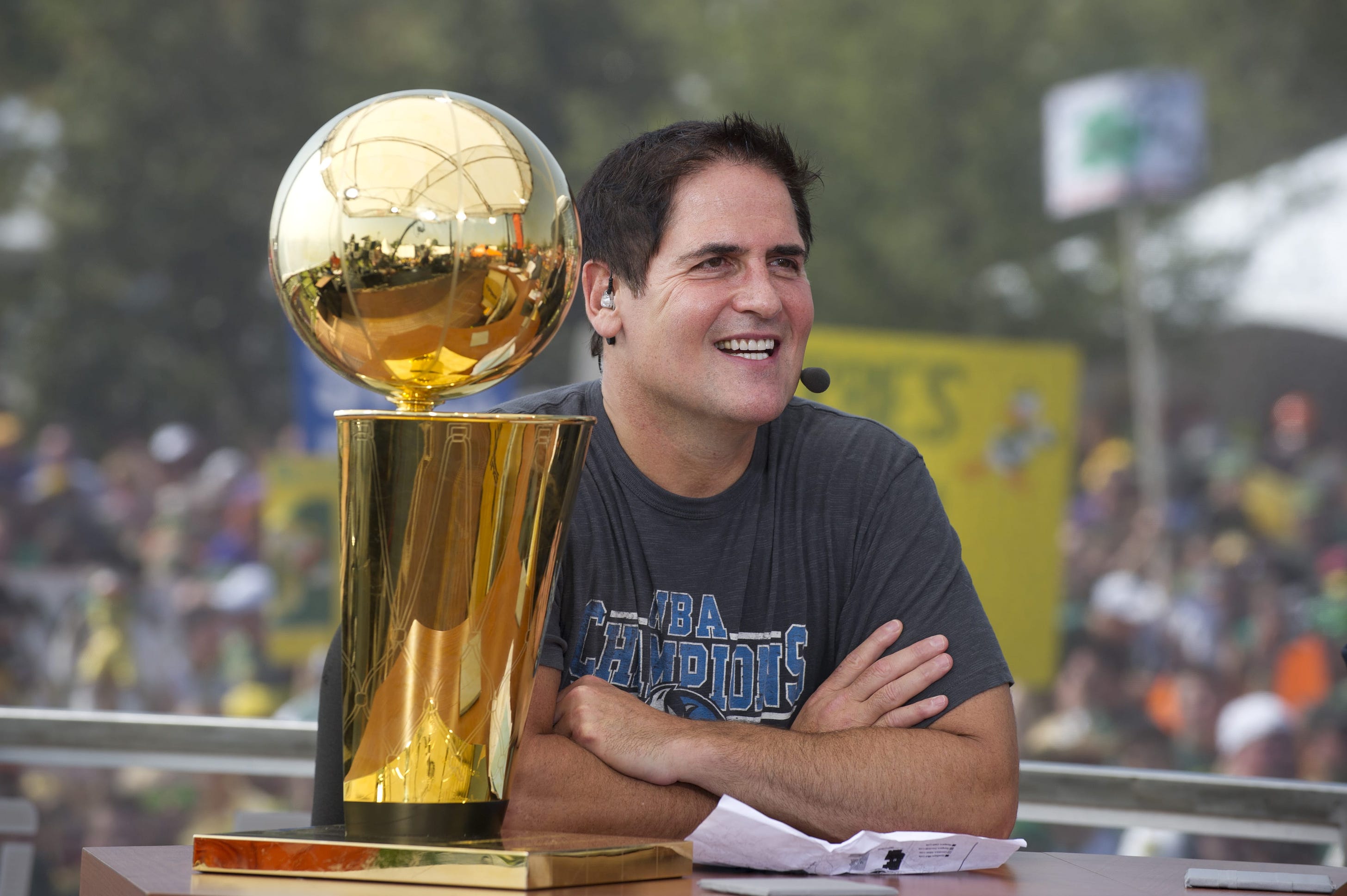

Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. Subscribers include investors, professional athletes, team owners, and casual fans. So if you are not already a subscriber, sign up and join 80,000+ others who receive it directly in their inbox each week — it’s free. Today At A Glance:NBA franchise valuations have tripled over the last decade. This has caused many people to say that we have hit a peak and this trend can’t last forever, but I think the NBA will be the fastest-growing major US professional sports league over the next decade. So today’s newsletter breaks down my reasoning. Enjoy! This newsletter is also available in audio format via Apple and Spotify. Today’s Newsletter Is Brought To You By Goldin!The world’s top 500 sports cards have an ROI of 855% over the last 15 years, compared to just 175% for the S&P 500 — and there is no better place to start or build your collectible portfolio than Goldin. Goldin is the leading and most trusted destination for some of the most significant pieces of sports and pop culture collectibles. Their marketplace is open 24/7, they have weekly auctions starting at just $5, and there is something for every collector. And here’s the best part: Goldin is currently offering all sellers 50% off marketplace fees when you list your items before February 17th. So use the link below to check ’em out — I’m a big fan of the product, and I think you will be too. Friends, Dallas Mavericks owner and tech billionaire Mark Cuban famously claimed in 2014 that the National Football League (NFL) was “ten years away from an implosion.”

Many people ran wild with these comments, and Cuban later posted a lengthy Facebook message to expand on his reasoning. But still, he was wrong, of course. The NFL has grown its annual revenue base from $11 billion in 2014 to nearly $20 billion today. The average franchise valuation has increased from $1.43 billion to $4.5 billion, and the NFL is still the world’s most profitable sports league (by a mile). For example, out of the 200 most-watched TV programs in the United States over the last two years, the NFL was responsible for 157 of those spots — compared to 0 for the NBA, MLB, NHL, and MLS…combined. So the idea that the NFL is king in the United States is not even up for debate; it’s a fact. But I would also argue that Mark Cuban wasn’t that far off. As someone who talks about the business and money behind sports for a living, I frequently get asked all sorts of questions. Some of these questions are specific — media rights negotiations, salary cap increases, etc. — while others are pretty broad — global growth trends, fan engagement, and more. But one of the most popular questions I get undoubtedly surrounds which US-based professional sports league I think has the brightest future. For example, if you could buy a professional sports team in any league in the world, with the sole goal of capital appreciation over the next decade, which league would you pick and why? The answers to this question typically range from the NFL and MLS to Formula 1 and the Premier League, but my answer might surprise some people. I think it’s the National Basketball Association (NBA), and I’ll explain why. My thesis around why the NBA will be the fastest-growing major sports league over the next decade revolves around three main pillars:

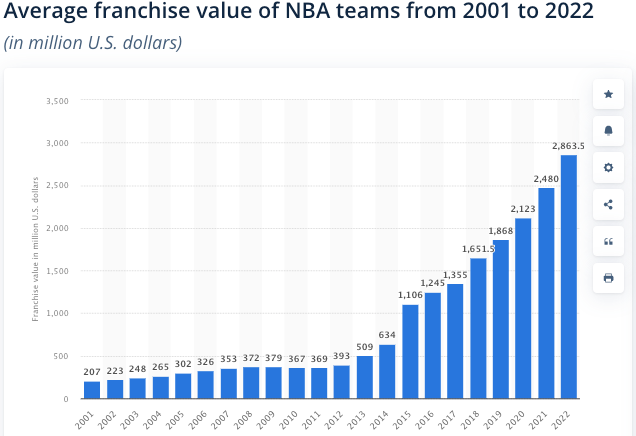

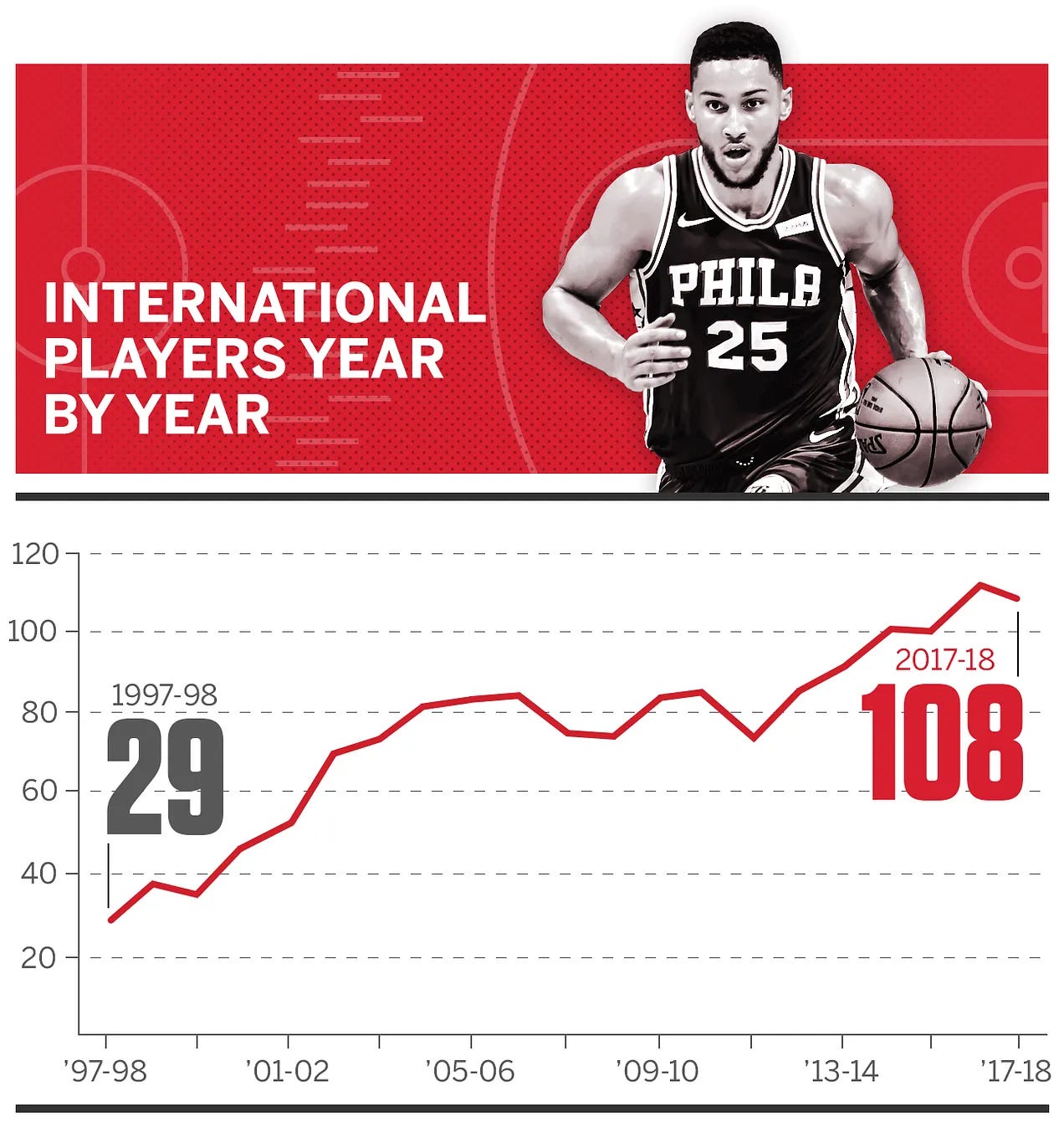

Let’s break each of these down. Increasing Media RightsThe NBA currently has two primary TV contracts with ESPN and Turner Sports that are worth a combined $24 billion. These agreements are up for renewal after the 2024-25 season, and rumors have been floating around that Commissioner Adam Silver is requesting a $75 billion package — 3x more than the NBA’s current TV deal. This is the single most important issue for NBA owners over the next decade. A $75 billion TV deal ($8 billion annually) would guarantee each NBA team between $275 million to $300 million in annual payments from the league, and it would put the NBA’s media rights package second only to the NFL’s $10 billion annual deal. But more importantly, look at what happened to team valuations across the NBA after the last media rights deal in 2014. Spoiler alert: They doubled virtually overnight and increased by more than 350% over the next eight years alone. And we are already seeing this being priced into the market. For example, Mat Ishbia recently purchased the Phoenix Suns for $4 billion. That’s $1 billion higher than the team’s current $3 billion valuation, and it signifies a 13x multiple on the Suns’ projected revenue of $300 million this year (compared to the normal 6-8x multiple). A Global And Growing GameOne of the biggest bull cases for the NBA over the next decade is that it’s truly a global sport. Tackle football is rarely played outside of the United States. Baseball is still predominantly played within the Western Hemisphere, and while soccer is the world’s most popular sport overall, it’ll take (at least) a decade for Major League Soccer to convince the world’s best players to cross the Atlantic and come to America. This is where the NBA has a distinct advantage. You don’t need super expensive equipment to play; just a ball and a basket. The league’s best players are extremely recognizable; they don’t wear helmets. And the NBA actually has a solid plan. For example, the NBA has spent the last few decades focused on growing its business in China — the world’s most populated country. This multi-decade-long effort has produced incredible results, with more than $500 million in annual revenue coming from the region and more than 400 million people in China playing basketball today. For context, that means there are more basketball fans in China than the entire population of the United States and Canada…combined. And China was just the first step in this plan. The NBA is deploying the same playbook in other countries, like India, and continents, like Africa. And team owners have said, both publicly and privately, that they expect similar results. World’s Most Populated Countries

So the bottom line is clear: This geographic expansion plan is something a league like the NFL can’t replicate, no matter how hard they try. A Larger & Diversified Investor BaseAnother main reason why I think the NBA will be the fastest-growing major sports property over the next decade revolves around a larger and diversified investor base. You see, franchise valuations have increased across professional sports. The average NFL team is now worth $4.14 billion. The average NBA team is worth nearly $3 billion. The average MLB team is worth $2.3 billion. The average NHL team is worth $1 billion, and the average MLS team is now worth $582 million. This increase in valuations has drastically reduced the number of people who can (and actually want) to buy a professional sports team. For example, the NFL requires the principal owner of a franchise to have at least a 30% stake in the team — that’s a $1.24 billion check at the current average league-wide valuation of $4.14 billion. And minority investors have also been impacted. The NFL doesn’t allow more than 24 people on each team’s cap table, and minority ownership checks have quickly headed north, from 6-7 figures a few years ago to 8-9 figures today. But the NBA has been the most aggressive league when it comes to expanding its investor base. For example, at the start of 2021, the NBA became the first of the US major leagues to allow private equity firms to take minority stakes in clubs. There were rules, of course. Private equity firms couldn’t own more than 30% of a team, and one single private equity firm couldn’t own more than 20% of a team. But still, the money came piling in. PE firms like Dyal Capital Partners, Arctos Sports Partners, and Sixth Street have acquired minority positions in nearly ten NBA teams, including the Atlanta Hawks, Golden State Warriors, Sacramento Kings, Utah Jazz, and San Antonio Spurs. So the NBA has decided to double down, recently expanding this rule to cover sovereign wealth funds, pension funds, and endowments. That means everyone from Saudi Arabia to Blackrock to Princeton University to the California State Teachers Retirement System can now own a minority stake in an NBA franchise, although each investor has to be individually approved by the league office. This decision will expand the demand for NBA franchises and should be one of the driving forces behind the continued growth of league-wide valuations. And from an institutional investment perspective, NBA franchises are a no-brainer — they are blue-chip assets with a strong record of valuation appreciation that are relatively illiquid and allow investors to lock up capital and collect management fees. There are plenty of other reasons why NBA team owners will be very happy over the next decade. Sports betting is just getting started in the United States, expansion teams are on the horizon, and revenue should be up across the board. But still, I consider the three reasons listed above to be the primary drivers of increased valuations across the NBA, and I expect those returns to significantly outpace (on a percentage basis) rival leagues like the NFL, MLB, and NHL. If you enjoyed this breakdown, please share it with your friends. Thanks! Have a great day. I’ll talk to everyone on Friday. Enjoy this content? Subscribe to my YouTube channel. Your feedback helps me improve Huddle Up. How did you like today’s post? Loved | Great | Good | Meh | Bad Extra Credit: Rafael Nadal Shows Off His Champion MindsetI recently started watching “Break Point” on Netflix, a behind-the-scenes tennis documentary that is produced by the same company that made F1: Drive to Survive. The series is pretty good — players like Nick Kyrgios, Taylor Fritz, Matteo Berrettini, and Ons Jabeur take center stage — but my favorite part is a scene where Rafael Nadal (mentally) defeats Casper Ruud at the French Open before even taking the court. Check it out — it’s rare we get a look inside the mind of a champion.

Joe Pompliano @JoePompliano

My favorite scene from Netflix’s new series “Break Point” has to be Rafael Nadal winning the French Open before they even take the court.

7:13 PM ∙ Jan 15, 2023

36,212Likes2,812Retweets

Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. Subscribers include investors, professional athletes, team owners, and casual fans. So if you are not already a subscriber, sign up and join 80,000+ others who receive it directly in their inbox each week — it’s free.

Read Huddle Up in the app

Listen to posts, join subscriber chats, and never miss an update from Joseph Pompliano.

© 2023 |