There Is Misinformation Everywhere In Financial Markets

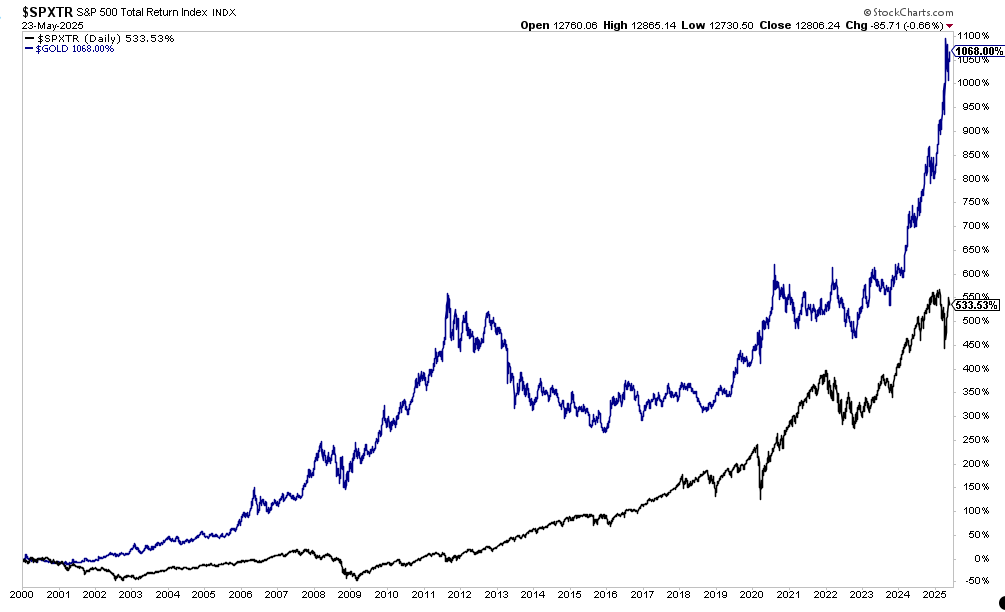

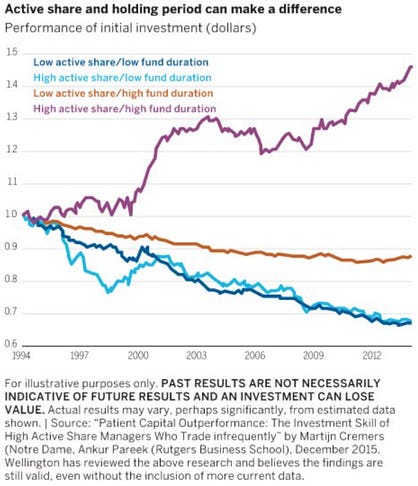

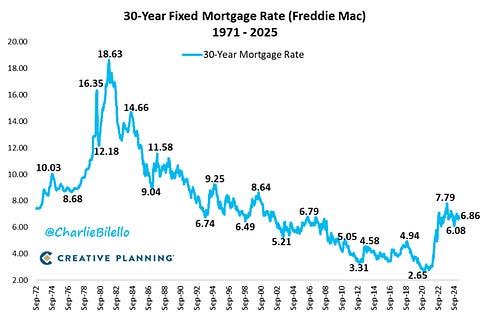

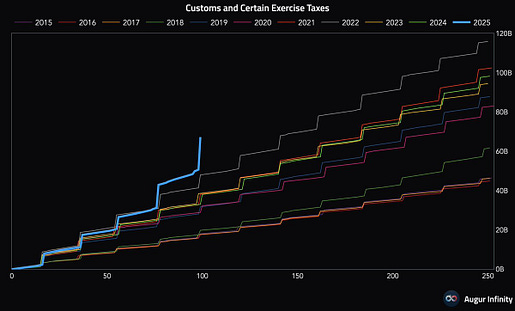

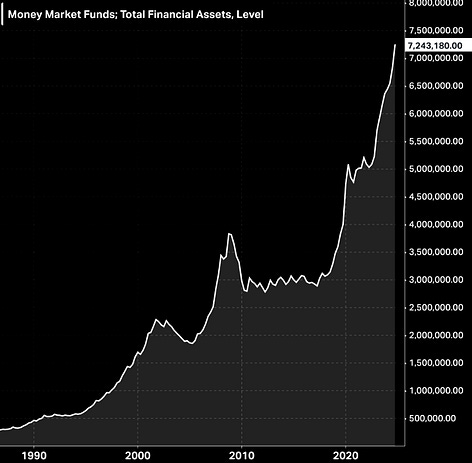

To investors, Traditional markets are full of misinformation right now. You know how stock investors always say they want to hold equities because of the cash-flow? Well Mike Zaccardi shows gold has destroyed the return of the S&P 500 by 2x since the year 2000. Public market investors must be in shambles seeing this. But the misinformation doesn’t stop there. You know how everyone always says to diversify your portfolio across various stocks or assets? Well X account Hidden Monopolies says the data proves that concentrated portfolios with long-time horizons drastically outperform those who choose to diversify. Of course, the misinformation doesn’t end there either. You know how everyone keeps yelling and screaming about the high mortgage rates at the moment? Well Creative Planning’s Peter Mallouk shows “the 30-Year Mortgage Rate today seems really high until you take a bigger picture view.” And then there are the people who keep saying tariffs won’t bring in additional revenue for the United States government. Well Felix Jauvin shows that tariff revenue is starting to accelerate at a pace we have not seen in the last decade. Moving along…maybe you have been told that we are living in a risk-on environment and capital was flying off the sidelines into risk assets? Well Barchart shows that total assets in money market funds has hit $7.2 trillion, which is a new all-time high. Investors are trying to milk the higher interest rates to earn that “risk-free yield.” But bonds are not as safe as everyone thought they were. Take TLT as the prime example — the fund is down almost 50% over the last 5 years. Imagine being long an asset that just goes down and to the right forever, while equity markets are on a historic run. Absolutely brutal. So this brings me to what is actually true right now — global liquidity is continuing to increase at an accelerated rate. Governments around the world are stuffing liquidity into every corner of financial markets. Even the US government is giving up on the idea of cutting government spending to balance the budget. Elon Musk and Scott Bessent are now both talking about growing our way out of the national debt problem, which is a noticeable change in economic policy. We are going to run the economy hot and there is an increased risk of inflation returning because of the new growth mandate. Bitcoin’s price is likely to follow global liquidity, so I would expect the digital currency to do very well through the rest of 2025. The money printer is returning. Digital sound money is going to be a big beneficiary. That is a new law of the universe and no one is going to change it any time soon. Hope you all have a great start to your week. I’ll talk to you tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management Could This Be The Year Bitcoin Goes Parabolic?Jordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation we talk about bitcoin, a potential bitcoin upside collapse, global liquidity, national debt, bonds, AI, Nvidia, and is the US being quiet about bitcoin a strategic move? Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |