This Stock Will Start Trading On Nasdaq Today

To investors, There has been a wave of publicly-listed crypto companies in Canada trying to crossover into the United States. The idea is that America has the strongest, most liquid capital markets in the world. If you can get listed on the Nasdaq or the New York Stock Exchange then you appeal to a wider investor base. The problem for the last few years was the prior administration’s SEC was not willing to approve these companies to cross into the US market. That is all about to change though. Galaxy Digital has previously announced they will start trading on the Nasdaq on May 16th, so everyone has been excited about the inflow of these crypto companies to America. But Galaxy is not going to be the first to crossover. DeFi Technologies, a company that I wrote to this group about in April 2024 and has since increased in share price by almost 800%, has been approved by the SEC and is going to start trading on the Nasdaq today. DeFi Technologies ($DEFT) is a crypto holding company that owns Valour (ETP asset manager with ~ 60 ETPs) and a number of other interesting assets, along with a balance sheet that was valued at $44.7M across cash, stablecoins, and digital assets as of April 30th. This is a VERY BIG milestone for a company that was trading at $0.02 per share in January 2020 and saw its stock decline from $3.17 back down to $0.06 in 2022 and 2023. The only way to survive those types of drawdowns, and be fortunate enough to come roaring back, is to execute relentlessly and build an attractive business. That is exactly what the DeFi Technologies team has done over the last few years. Here are the 2024 full year financials published by the company (link to announcement):

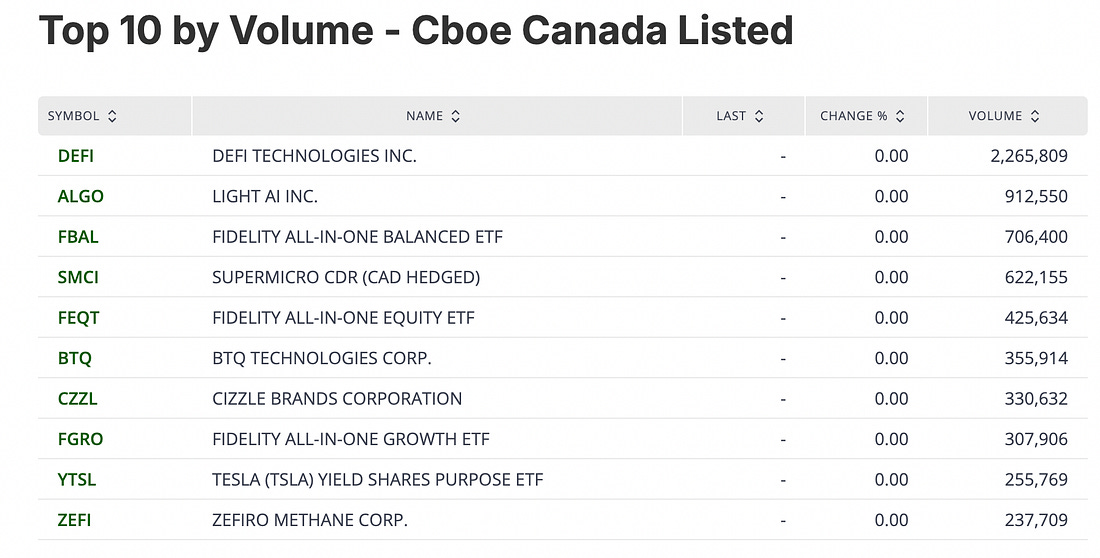

Based on Friday’s closing share price, DeFi is now valued at just over $1.3 billion. This means the business is trading at less than 10x their 2024 adjusted revenues. Given the growth they have experienced, there is a strong argument the company is still undervalued. It seems like many other investors agree. According to the CBOE Canada website, DeFi Technologies was the most popular stock on the entire exchange by volume as of Friday. Now, to be clear, I am biased here — I have been an advisor to the company for awhile and I sold a company I started (Reflexivity Research) to DeFi Technologies in January 2024. As part of that deal, my partners and I took 100% of the purchase price in stock because we believed the company was significantly mispriced in the market. Zero cash, all stock. You only do that as an entrepreneur if you have strong conviction on something. I love seeing this progress for the company as a shareholder. So today should be an interesting development in the lifecycle of this business. DeFi Technologies ($DEFT) is graduating from the Canadian exchange into the US capital markets. The US-China trade deal progress has markets exuberant. There seems to be a persistent tailwind to bitcoin and crypto right now. And DeFi is going to break the seal on Canadian companies crossing over. There will be many more, but DeFi being the first to my knowledge under this administration signals a sea change underway. US capital markets are now open to crypto companies from around the world. That incentive will be too strong for companies to resist, so expect these crossovers to be a recurring theme in the coming months. Good luck to the DeFi Technologies ($DEFT) team today. Hope you all have a great start to your week. I’ll talk to you tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management Note: I have been fairly public about my lessons learned during the 2021 bull market and the subsequent 2022 bear market. No one likes to hold assets through a big drawdown, so I am planning to sell many of my liquid investments outside of bitcoin at some point in 2025 (first rule of bitcoin: never sell your bitcoin!). I don’t know when, how, or why at the moment, but I want to give everyone fair warning about my current thought process. Jordi Visser Says Bitcoin’s Price May Be Setting Up For A Short SqueezeJordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation we discuss a potential bitcoin short squeeze, current macro environment, public vs private markets, trade deals, inflation, AI, and where he sees opportunity. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. DISCLAIMER: The author of this letter is not a securities dealer or broker, investment adviser or financial adviser, and you should not rely on the information herein as investment advice. The author is a paid advisor to DeFi Technologies. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on this communication. Examples that the author provides of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Stock profiles contained herein are intended to highlight certain companies for your further investigation; they are not stock recommendations or constitute an offer or sale of the referenced securities. The securities issued by the companies profiled should be considered high risk; if you do invest despite these warnings, you may lose your entire investment. Please do your own research before investing, including reading the available public filings, press releases, and risk disclosures. It is our policy that information contained in this profile was provided by the company, extracted from regulatory filings, company websites, and other publicly available sources. The author believes the sources and information are accurate and reliable but cannot guarantee it.You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |