What Will Cause The Next Bull Run?

Born in 2011, Kraken is the industry-leading crypto exchange in security and transparency. Verify the backing of Kraken’s reserve assets thanks to regular Proof of Reserves audits. Dear Bankless Nation, 2022 is going down in crypto’s history books as a series of clusterf*cks. That’s how industry outsiders will paint it. But the truth is that many applications and tools have held up just fine in 2022’s tornado storm. Keep your eye on them because these will be the key players leading the next bull run. Today, we dig into who some of them might be. – Bankless team What Will Cause The Next Bull Run?

Things feel bleak. We’ve seen stablecoins collapse, hedge funds and lenders go under, and supposed tier-1 exchanges explode. There’s no sugarcoating it: 2022 has been awful for crypto. However, amid the chaos, the industry continues to build. And, believe it or not, there are plenty of reasons to be optimistic about its future. It may sound like hopium today… yet with innovation continuing unabated, another bull-run is (eventually) coming. Okay, that is hopium. But there are tons of cool things being built. Furthermore, with all of the year’s largest blow-ups being those of centralized entities, the value proposition of decentralized technologies has never been more clear. I still think it will take a long time for crypto to recover , but here are my early thoughts on what I think could catalyze a new crypto-bull run. 🐐 The Majors Strike BackBTC as a Fiat HedgeFor crypto to experience another bull-run on the scale of 2017 and 2021, Bitcoin and Ethereum will once again need to lead the way. The majors account for ~55% of the total crypto-market cap and there’s plenty of reasons as to why investors may have renewed interest in them. In the case of Bitcoin, excitement around the asset still stems from its use as a hedge against geopolitical risk and central banks with diminishing credibility. The world has mourning geopolitical risks, such as the continued war in Ukraine, tensions between China and the United States, and political polarization and instability in a host of nations across the world. The credibility of central banks like the Federal Reserve is as low as it’s ever been, as these institutions compounded their mistake of wanton money printing with a failure to react to the rampant inflation it caused in a timely manner. This uncertainty sets the stage for renaissance in assets like BTC, as investors may seek non-sovereign assets to store their wealth in these tumultuous times. ETH as an Internet BondEther is the other asset poised to benefit from the renewed interest in crypto as a fiat-alternative. Not only does ETH have store-of-value properties, with an issuance rate that is projected to go deflationary upon the slightest uptick in blockspace demand, but it now provides investors with a yield following its transition to Proof-Of-Stake.

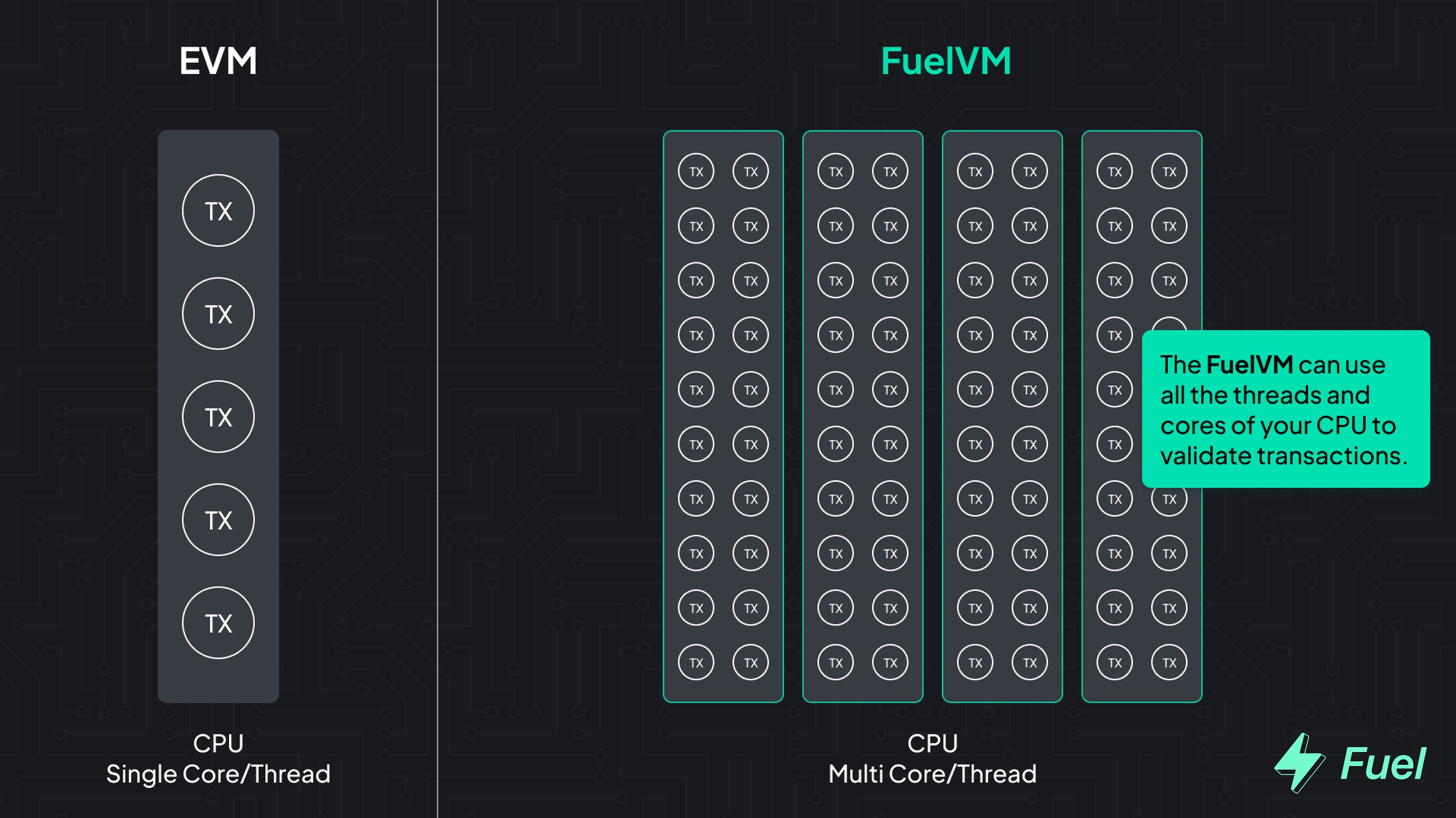

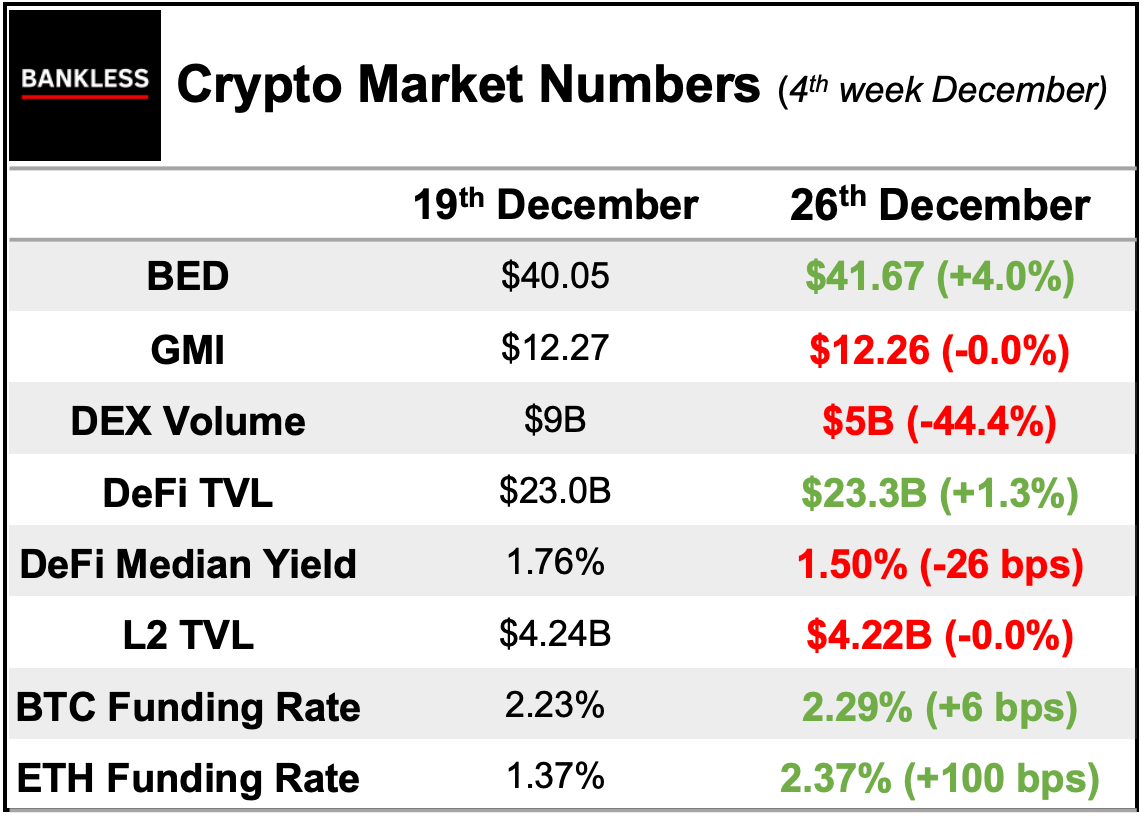

This staking yield will help ETH become increasingly attractive to the large cohort of investors who prefer to invest in productive assets. Of course, its role as trustless collateral and an index of the on-chain economy remains unchanged, and if anything, has been further reinforced by the litany of crypto calamities in 2022. 🚀 DeFi’s Resurgence2022 exposed CeFi as opaque and fragile – setting the stage for a major DeFi comeback in 2023 and beyond. Although centralized exchanges, lenders, and hedge funds went belly up, DeFi protocols didn’t skip a beat, continuing to execute as programmed with zero downtime. These non-custodial, transparent, decentralized financial rails proved themselves a sturdy foundation on which we can rebuild. While CeFi combusted, numerous exciting sectors of DeFi continued to ship and develop innovative products. One is liquid staking, with demand to stake set to soar after the Shanghai upgrade and many up-and coming, new protocols like Rocket Pool, StakeWise, Frax ETH, Swell, and Diva set others poised to compete with incumbents like Lido and Coinbase. Decentralized perpetuals are another exciting area, with protocols like GMX, dYdX, Perpetual Protocol, Gains Network, Rage Trade, Cap Finance, battling to continue their growth trajectories in 2023 as more trading activity comes on-chain in the wake of the FTX collapse. Bankless recently covered both these sectors. See my article here on liquid staking and here on perps. 🛠️ Non-Financial (Sort Of) ApplicationsTrading and speculation may currently be crypto’s largest use case, but there are numerous categories of non-financial applications which are poised to continue growing such as decentralized social media, Music NFTs and crypto gaming. Decentralized social media platforms have been one of the pockets of growth during these bear markets. The expansion of the user-bases of platforms like Lens and Farcaster have been up-only, while the recent Twitter chaos has only demonstrated the merits of censorship-resistant social networks that provide users with ownership and portability of their audience. If you want to read more about the status of Web3 social, I’d highly recommend you check out a recent piece by Donovan. Music NFTsOkay, so Music NFTs are financial applications. But I’ll still include them here because like social media, they represent another pocket of growth. Music NFTs have begun to emerge as a new way for artists to monetize. Artists, particularly smaller ones, are able to earn far more from selling NFTs to a handful of fans than they ever would from streaming on platforms like Spotfiy, where middleman capture the vast majority of the value that’s created. While the community and market remains niche, in recent months music NFT platforms like Sound has seen strong growth in key KPIs like volumes, users, and mints. Interested in “learning through aping?” Another member of the Bankless team, and prolific music NFT collector, Lucas wrote a great piece on how to find the next hit music NFT. Crypto GamingThe incredible rise and subsequent fall of play-to-earn games like Axie Infinity may have tainted the space in the eyes of many, but GameFi remains another incredibly exciting area within crypto. The intersection of blockchain and NFTs with gaming has tantalizing potential, with hundreds of millions in VC funding pouring into the space over the past year. I’ll concede that there have not been many exciting GameFi launches over the past year, with the exception of OP Craft (my personal favorite) and a couple of other on-chain games. But given the intellectual and financial capital flowing into the sector, I’d imagine that a crypto game becoming a major hit is more a matter of when, not if. 🥺 Hopium Abound2022 stunk. But amidst falling prices and failing firms, the seeds of the next bull-run have been planted. It may not seem like it, but there’s plenty of reason to be optimistic and have hope for the future. It may take some time to get there, but between a BTC and ETH comeback, a DeFi resurrection, and the rise of Web3 social, Music NFTs, and crypto gaming, there’s a plethora of reasons as to why a return to valhalla is inevitable. – Ben 🙏 Together with ⚡️FUEL⚡️Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput. 👉 Go beyond the limitations of the EVM: explore the FuelVM 🎙️ NEW PODCAST EPISODE🎙️ Listen to podcast episode | iTunes | Spotify | YouTube | RSS Feed MARKET MONDAY:Scan this section and dig into anything interesting Market numbers 📊Market Opportunities 💰Yield Opportunities 🌾What’s Hot 🔥

Money reads 📚Trending Project: RAGE 📈Governance Alpha 🚨Meme of the Week 😂

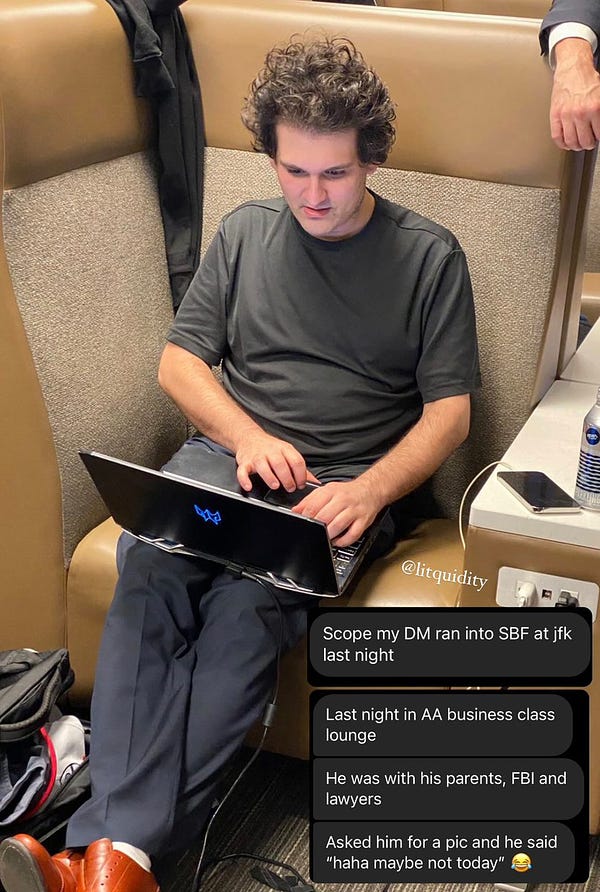

litquidity @litcapital

One of my followers spotted SBF chilling at JFK airport last night and snapped some icon photos

8:07 PM ∙ Dec 23, 2022

15,983Likes1,160Retweets

Job opportunities 🧑💼Browse more roles (or add your own) at the Bankless Jobs Board Action steps

Author BioBen Giove is an analyst for Bankless. He’s the former President of Chapman Crypto and an analyst for the Blockchain Education Network (BEN) Crypto Fund, a student-managed crypto fund built on Set Protocol. He’s also a proud member of the Bankless DAO and methodologist behind the GMI index. Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge. 🙏 Thanks to our sponsor FUEL👉 Explore the FuelVM and discover its superior developer experience! Want to get featured on Bankless? Send your article to submissions@banklesshq.com Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

Read Bankless in the app

Listen to posts, join subscriber chats, and never miss an update from Ben Giove.

© 2022 Bankless, LLC. |