Where Crypto is Still Growing

Have you seen the updated Token Ratings we released on Friday? When you read through, you’ll learn:

As always, the first rating is available for all Bankless readers, but to get access to the rest (and the Bankless Token Bible) you’ll need to upgrade to Premium. Dear Bankless Nation, This bear market has been brutal. We’re ending the year with pervasive uncertainty surrounding some of crypto’s biggest centralized institutions. This week, we’re looking for bright spots in the downturn, pointing out a handful of teams that are experiencing significant growth and showing a lot of promise. Read on to hear what we found. -Bankless Team 5 Projects Thriving in a Bear MarketWriter: Lucas Campbell, Web3 Lead at Bankless & Genesis Member of Bankless DAO

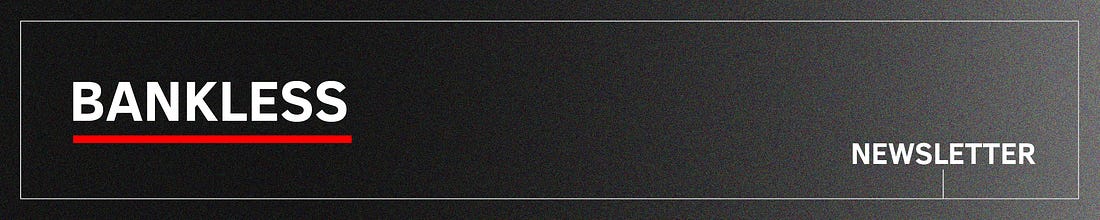

Crypto is in a bear market. There’s no denying that. Despite this, there are still a handful of sectors and projects that are thriving based on key fundamental performance metrics. Here are 5 projects that are defying the odds and experiencing their own bull runs: I’m a big fan of some of these projects and have backed a couple of them, but I think their recent performance metrics really speak for themselves. You can always check out Bankless Disclosures for regularly updated records of where we invest. 1. Lens ProtocolLens Protocol, a web3 social platform, is hitting all-time highs across a variety of metrics. For one, engagement per month has nearly doubled to around 370K engagements per month across posts, comments, and mirrors (the web3 equivalent of a retweet). Despite the bear market, people are interacting with Lens Protocol and its leading app, Lenster, more than ever.

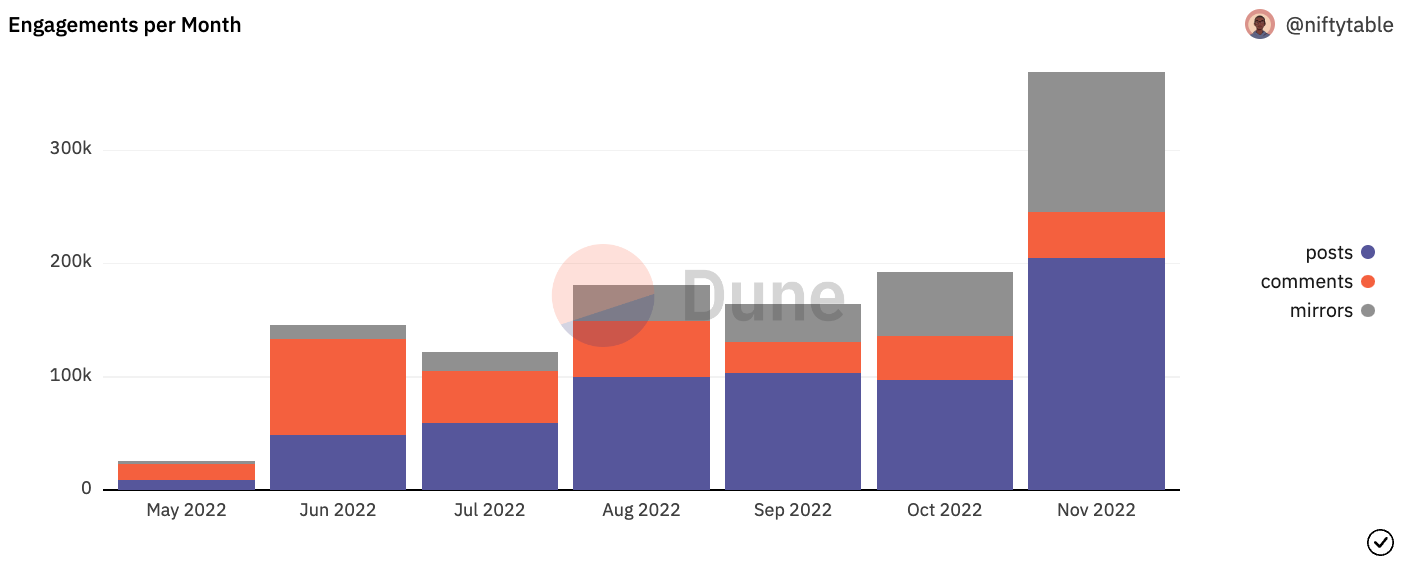

In tandem with engagement from users, the number of monthly active lens profiles is hitting all-time highs, reaching nearly 40,000 unique profiles on the protocol. This is after adding another ~14,800 profiles in the month of November – an increase of 59% from the previous month.

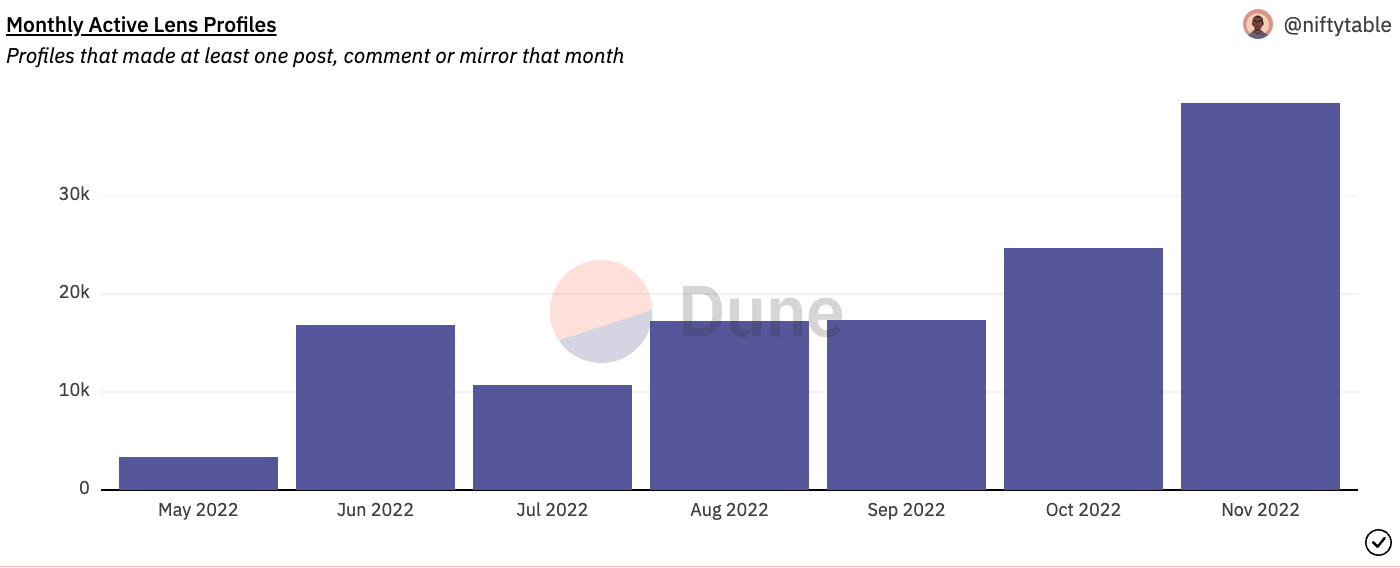

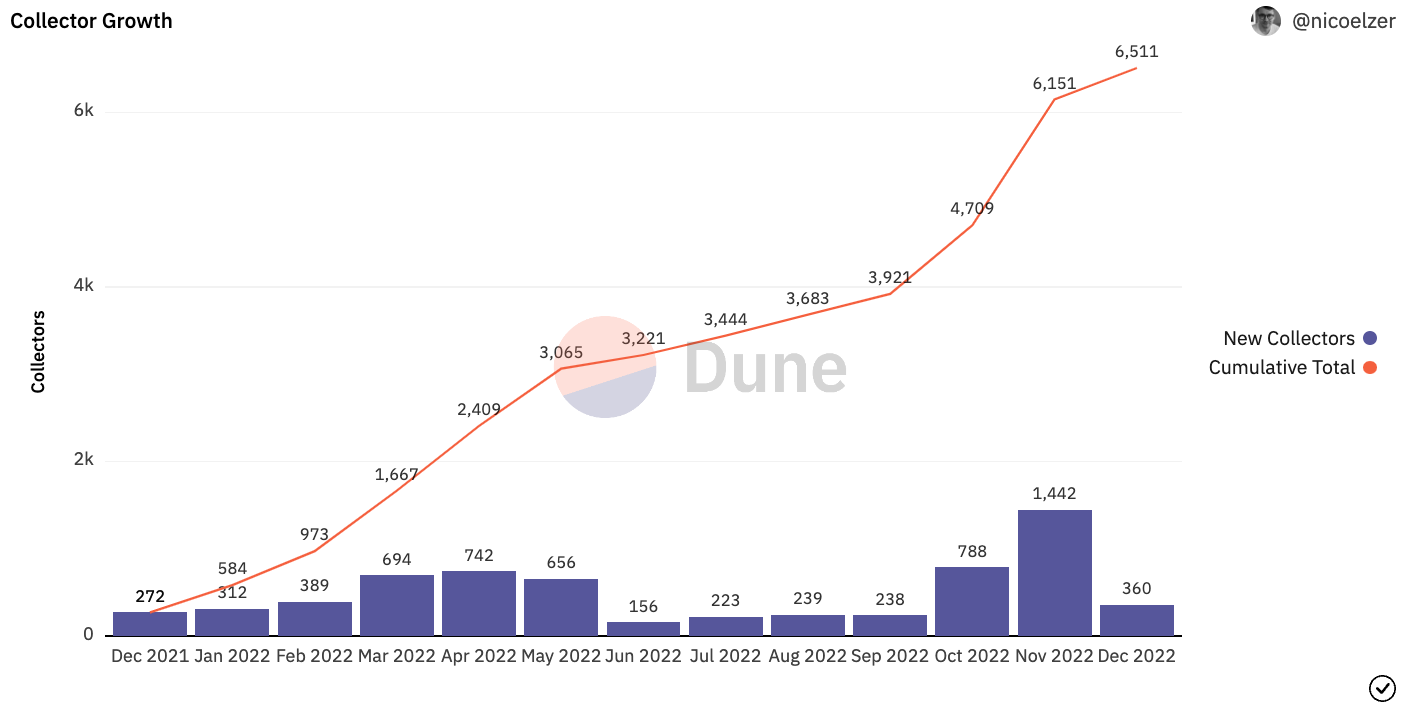

Naturally, with the increase in engagement and number of lens profiles, we can see that the number of wallets that own a Lens Profile are steadily increasing — now over 98,000 wallets. At the current rate, we should expect to see the total number of wallets that own a Lens profile to surpass 100,000 in the coming days. 2. SoundThe leading music NFT platform is seeing a resurgence in activity since reaching its peak back in April. The number of songs minted on the platform reached all time highs back in October, but then more than doubled that metric in November to reach over 12,000 music NFTs minted in a single month. For reference, this is an increase of 242% from its previous record in April 2022 when ETH was over $3,000 (tbt to the good ole days). Songs minted is just the beginning though, collector growth is surging as well with 1442 active collectors in November, bringing the total to 6,500 unique addresses collecting these new type of media NFTs. Even though it hasn’t surpassed its previous records, we’re seeing a material uptrend in secondary market volume from the bottom. Total volume traded on secondary markets reached $271K in November, putting the protocol back on track to levels that it reached back in 2021/2022. That said – Sound Protocol just reached its 1-year anniversary.

sound.xyz (🎧,🎧) @soundxyz_

gm. Sound officially turns one today. Looking back at our first year: ↳ onboarded 240 artists ↳ dropped 709 tracks ↳ reached 6,200 unique collectors ↳ minted 33,771 NFTs ↳ paid $4 million directly to artists We’re just getting started.

4:27 PM ∙ Dec 7, 2022

483Likes142Retweets

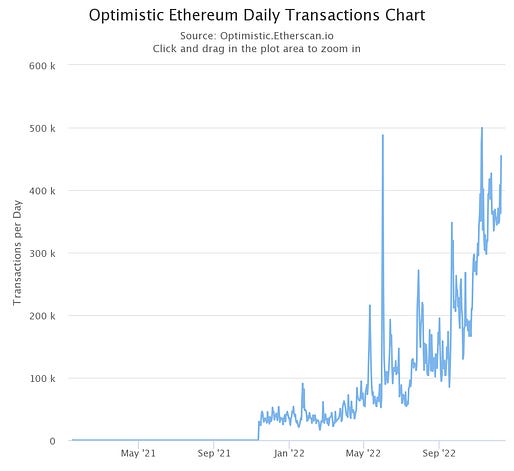

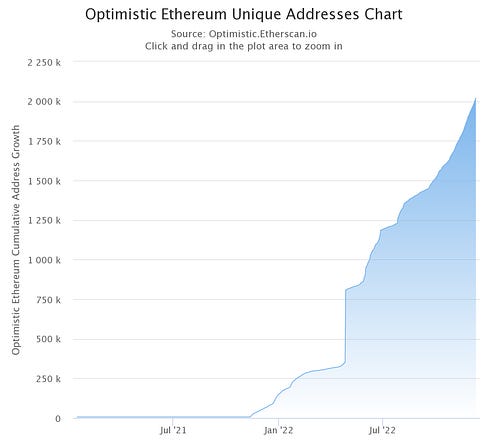

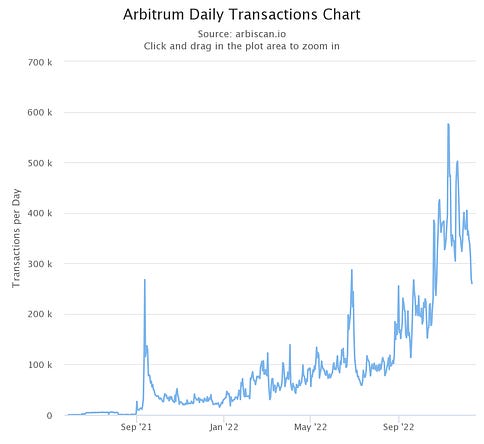

3. OptimismWhile what we’ll call web3 social – Lens and Sound – is hitting its stride, another sector is also garnering a significant amount of adoption: Layer 2s. After launching its token back in May, Optimism has seen a massive surge in usage across multiple key metrics. The first, and arguably one of the most critical, is the number of transactions— blockchains aren’t valuable if there are no transactions! Optimism’s daily transactions are skyrocketing to all-time highs of 500,000 transactions per day. For reference, Ethereum processes just over double that at ~1 million transactions per day (at its current rate). Predictably, the number of unique addresses on the network is also rising exponentially. The network has just crossed 2 million unique addresses – an important milestone for the second-largest Layer 2 by value-locked. The last metric hitting new highs for Optimism is verified contracts deployed. This is a key indicator to gauge developer activity on the network and how much builders are building. The trend is clear: it’s up and to the right after spiking to an all time daily high of 115 contracts deployed just over a month ago. 4. ArbitrumOptimism is not alone. Its toughest competitor, Arbitrum, is also reaching similar heights. We’ll look at the exact same metrics to give you a clear understanding of how these projects stack up. The number of transactions per day on Arbitrum is also hitting an all time high right now, surpassing its competitor to reach 575K daily transactions.

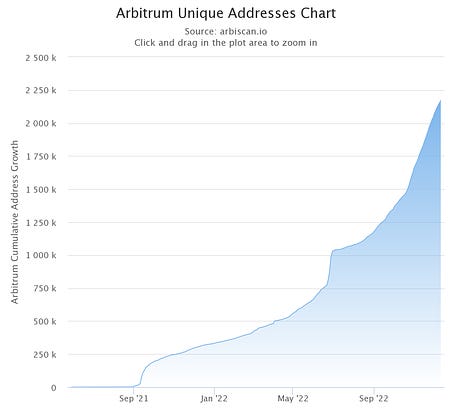

Arbitrum already surpassed 2M unique addresses and is currently closing in on the 2.25M addresses – giving a slight lead over its primary competitor.

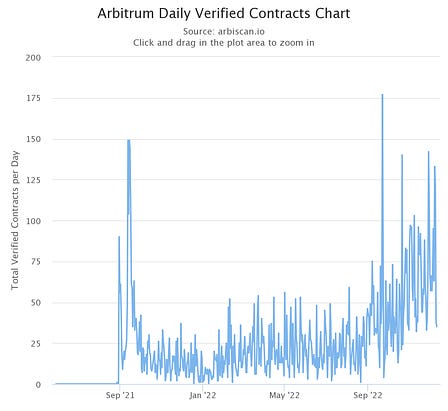

In terms of verified contracts deployed, Arbitrum recently peaked at 176 contracts deployed in a single day, while continuously spiking to over 100 contracts per day in recent months.

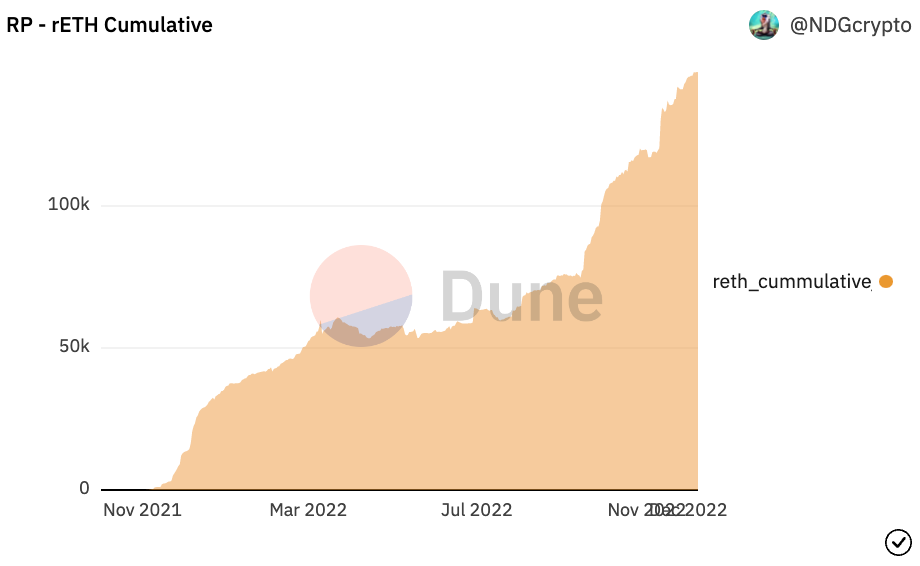

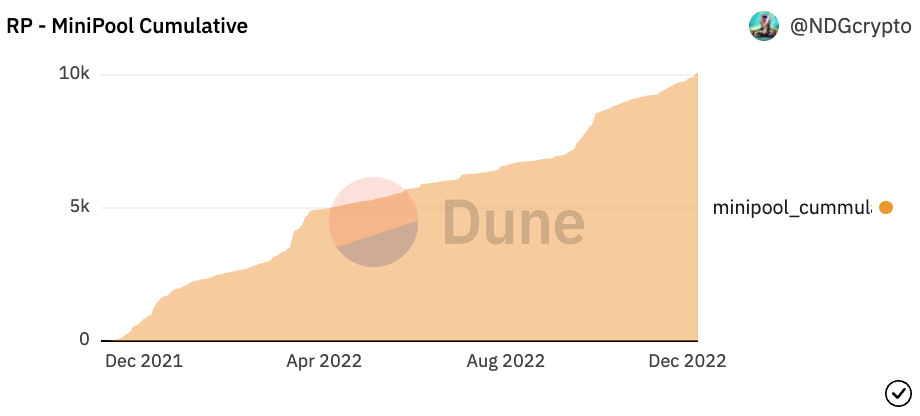

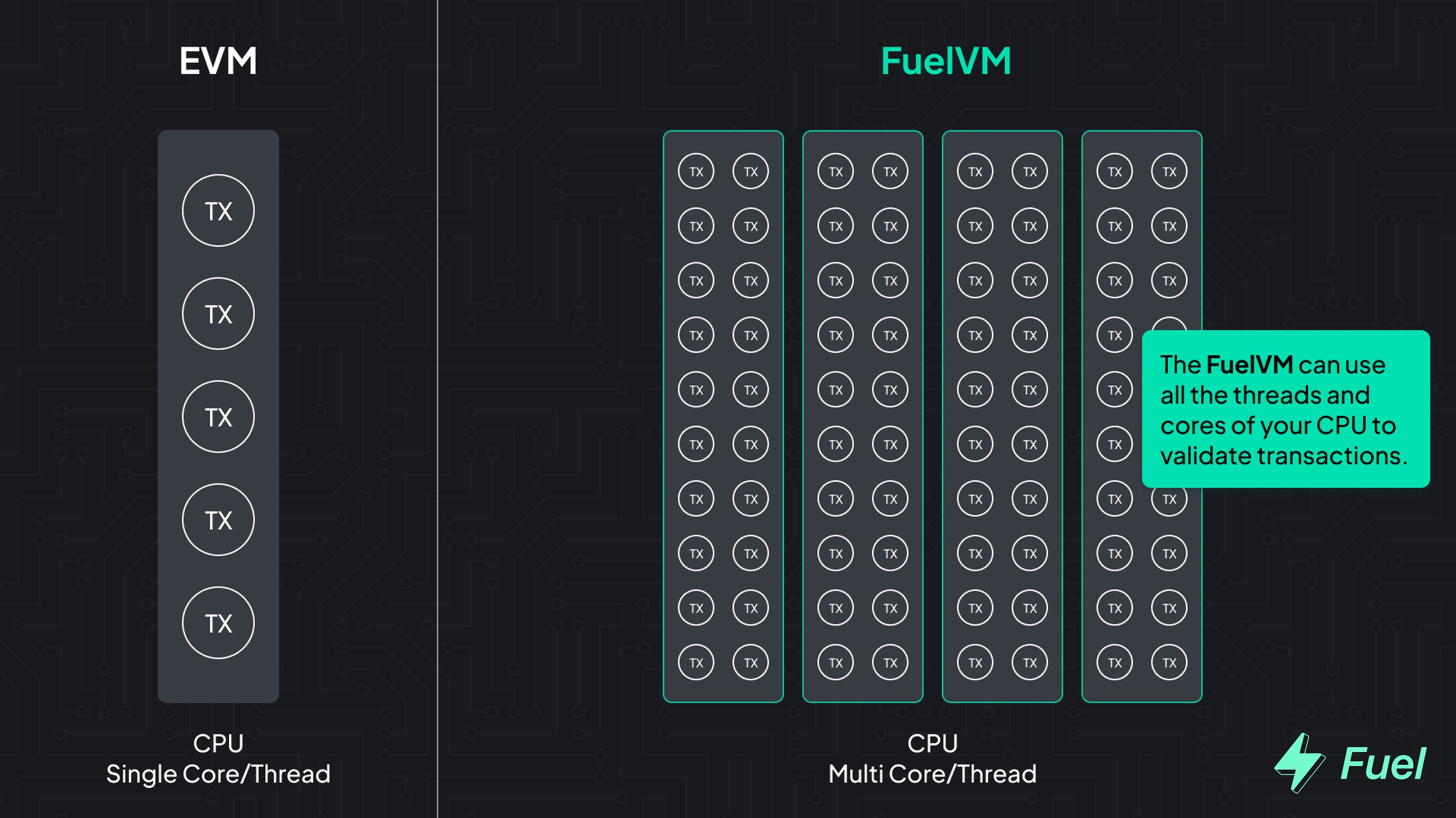

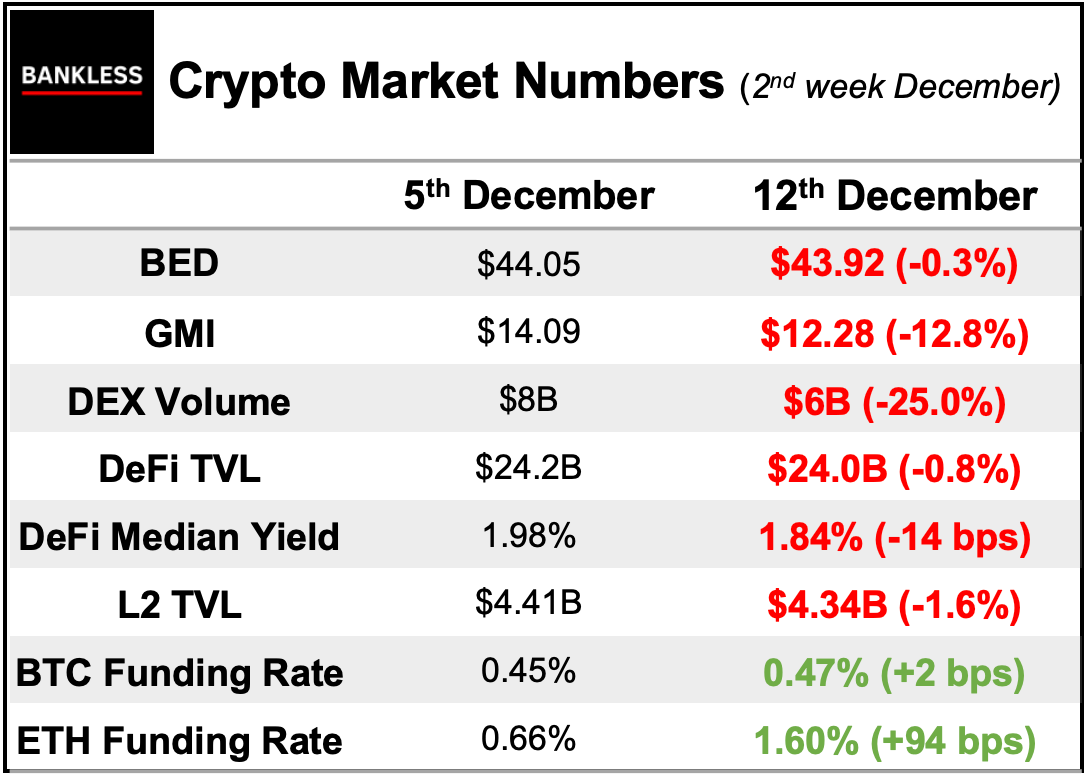

It’s obviously very clear right now that Layer 2s are trending upwards. The key difference between Optimism and Arbitrum right now? Optimism already launched its OP token back in May. Arbitrum has yet to launch its token, keeping a powerful growth steroid in the back pocket. 5. Rocket PoolSo far – we’ve seen the prominence of what is shaping up with Web3 social and Layer 2s. Now, let’s talk about one more upswing trend: liquid staking. More specifically, Rocket Pool, which is seeing an eyebrow-raising level of growth in recent months. Even though it’s cumulative, there’s an accelerating amount of adoption across different key metrics for Rocket Pool. The primary metric is the number of rETH in circulation, which has surged to a new height above 150,000 rETH. For reference, this number was shy of 75,000 back in September, meaning they’ve doubled the total supply in 3 months. While impressive, it’s still significantly behind the leading protocol, Lido, which currently holds 4.5M ETH under its purview. That said, there’s a key difference in design choice between Rocket Pool and Lido. Anyone can run a Rocket Pool validator (known as a minipool), whereas Lido is closed. When looking at the data, this is proving to be a strong growth driver as the number of Minipools just hit 10,000 unique nodes on the network. When users run a Minipool, they are required to stake an additional amount of RPL as “insurance” against the “borrowed” ETH they’re using to run a full validator. As such, with the increase of Minipools on the network, the amount of RPL staked on the network has increased to 7.8M RPL. This is equivalent to 41% of the total supply currently locked away on the network to support validation for liquid stakers. It’s not all doom and gloomWhile prices have tanked over the past year, it’s important to look further than the surface. Why? Because these are generally the opportunities that pay off in a bull market. That’s not to say that these projects are locked in as the next big things. It’s more to highlight that these projects all have charts that are up and to the right while everything seems to be down horrendously. With that, it may be wise to keep tabs on these projects as we search for the end of what’s been a very dark and volatile tunnel. See you on the frontier. – Lucas 🙏 Together with ⚡️FUEL⚡️Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput. 👉 Go beyond the limitations of the EVM: explore the FuelVM MARKET MONDAY:Scan this section and dig into anything interesting Market numbers 📊Market Opportunities 💰Yield Opportunities 🌾What’s Hot 🔥

Money reads 📚

Trending Project: 📈Analyst: Ben Giove Governance Alpha 🚨Meme of the Week 😂Job opportunities 🧑💼Browse more roles (or add your own) at the Bankless Jobs Board Action steps

Author BioLucas Campbell is the Web3 Lead at Bankless & a Genesis Member of Bankless DAO. Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge. 🙏 Thanks to our sponsor FUEL👉 Explore the FuelVM and discover its superior developer experience! Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

© 2022 Bankless, LLC. |