Why 8% Is Such An Important Number Right Now

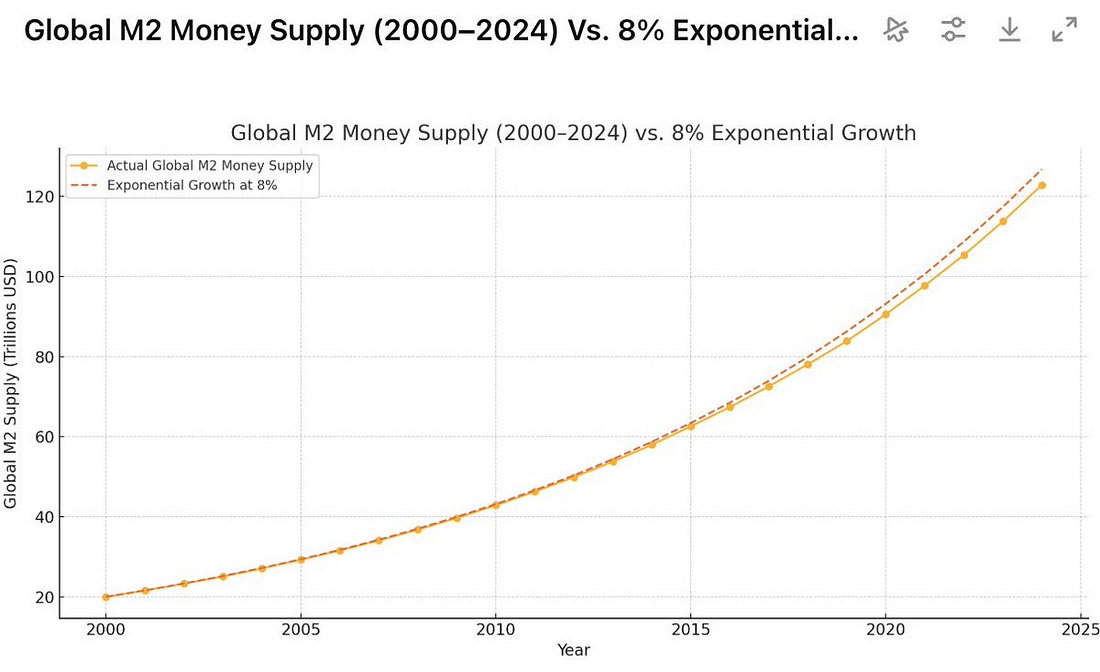

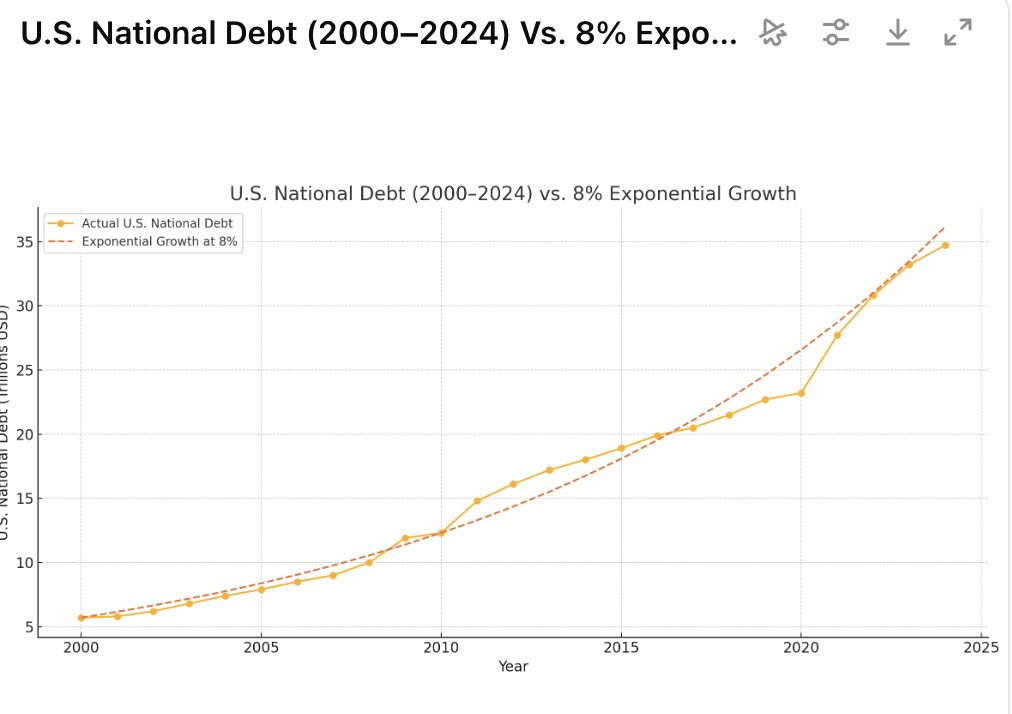

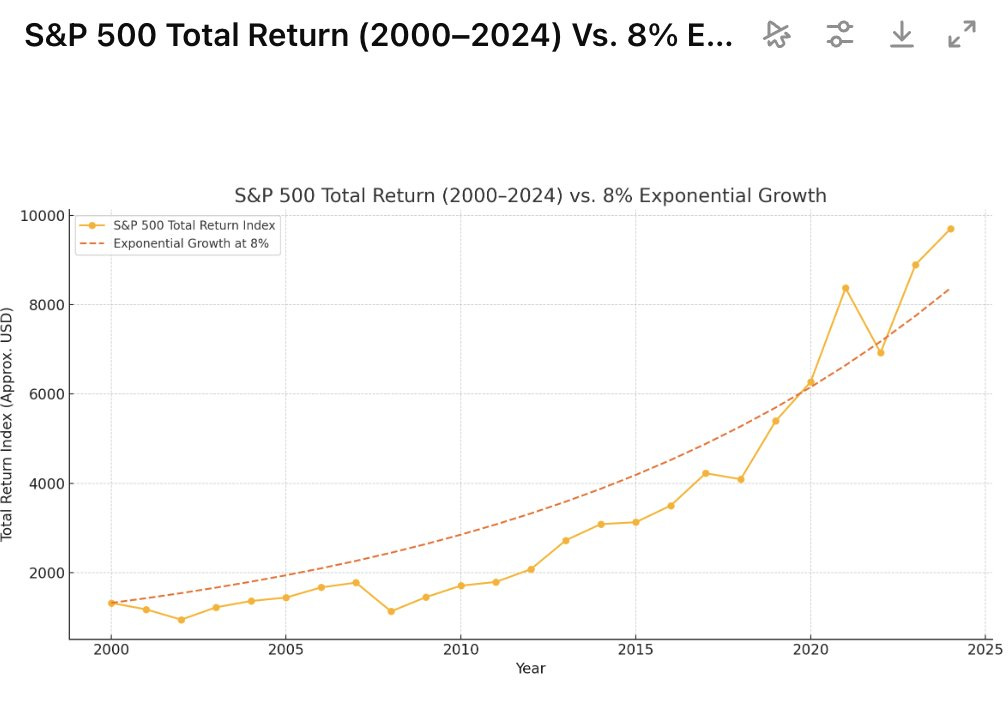

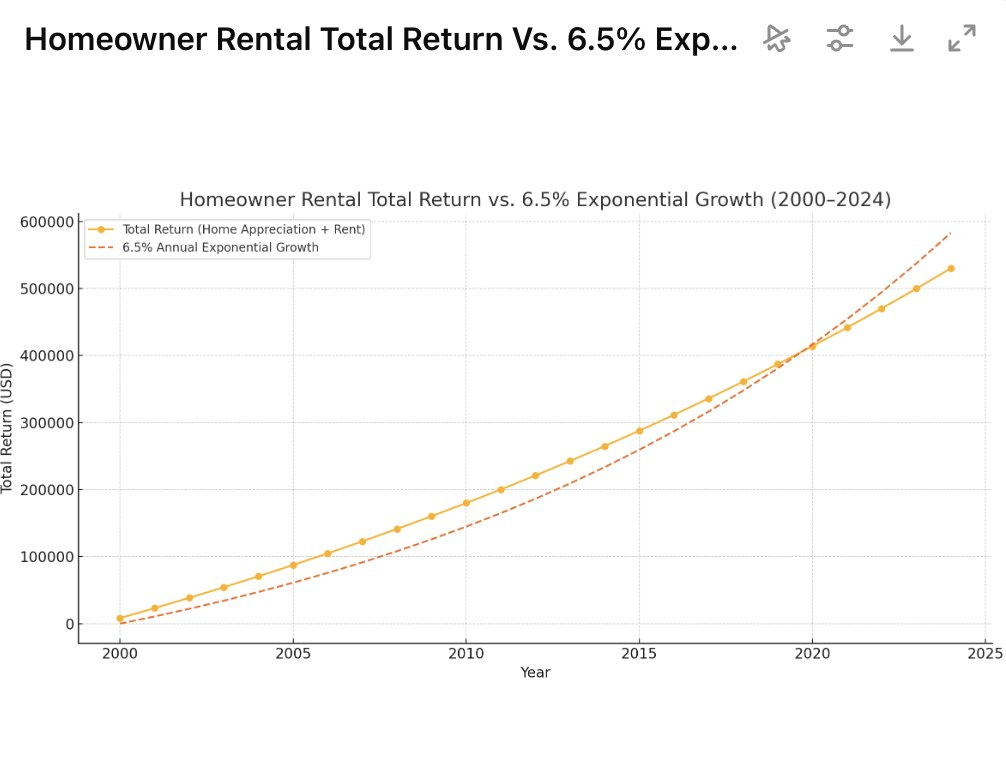

To investors, Fred Krueger had a great write-up yesterday about the importance of “8%” in modern finance. He started by pointing out since 2000, global money supply has been growing exactly at 8%. But then Fred pointed out that US debt has also been growing at 8% — what a coincidence! Next, if you look at the S&P 500 and add in dividends, then you see another result that looks pretty damn close to 8%. If you incorporate taxes, “you lose a minimum of 25%.” Fred shows that housing is in a slightly different situation. He says “houses grow less. Even after rents, and without factoring in property tax and maintenance, the growth is more like 6.5%.” So what does all this mean? Why should you care? Fred explains that “we have a “leaky bucket” that loses 8% of its value a year. Stocks almost make up for it. Not after taxes. Housing does not make up for it. At all.” Which brings us to the big conclusion from Fred’s analysis — “Bitcoin doesn’t leak and is growing 40% per year.” I actually disagree with Fred here. Bitcoin’s compound annual growth rate over the last 10 years is 85% and if you look over the last 5 years, bitcoin’s compound annual growth rate is 62%. These are video game numbers for a financial asset that is just now starting to hit its stride in terms of institutional adoption. Hope you all have a great day. I’ll talk to everyone tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management Darius Dale Explains Why Stocks, Bitcoin & Gold Are Great Assets To Hold During the 4th TurningDarius Dale is the Founder & CEO of 42Macro. In this conversation we talk about why bitcoin, gold, and stocks will continue to win, Elon Musk & DOGE, spending bill, and how markets across the world are reacting. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |