Why Is Gold Outperforming Bitcoin?

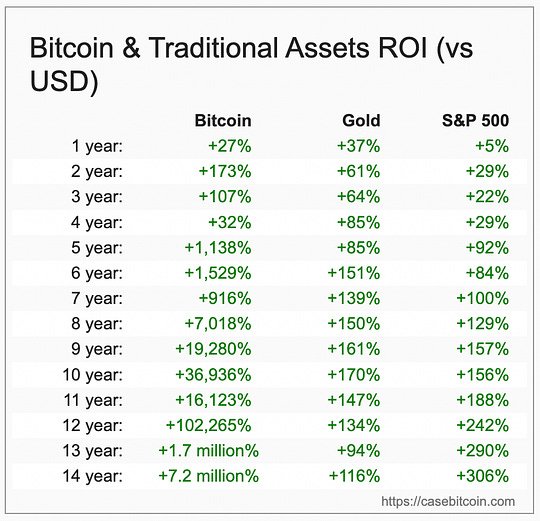

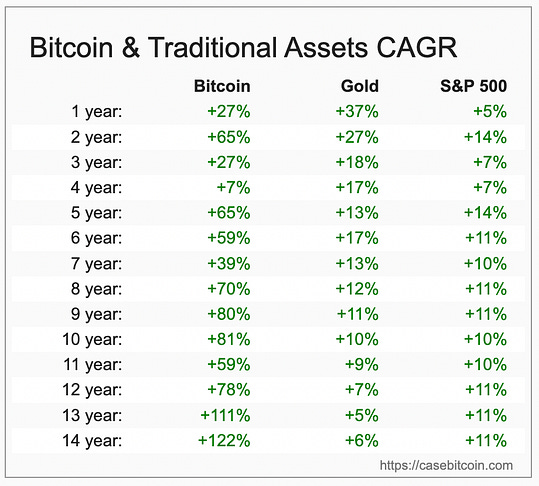

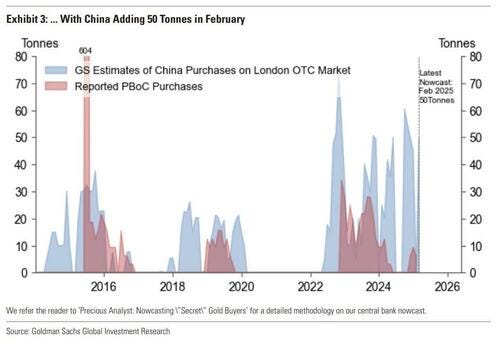

To investors, Bitcoin and gold are brothers from a different mother. They both embody the sound money principles that allow an asset to benefit from the debasement of a currency. Those principles include being outside the traditional financial system and the inability for anyone to create more of the asset. Simply, sound money can’t be messed with. And both assets have had an epic run over the last 15 years, while the US dollar continued to see its purchasing power erased by undisciplined fiscal and monetary policy. But given that bitcoin has significantly outperformed gold over the last 15 years, many people have been wondering why gold is outperforming bitcoin over the last 12 months? If both assets benefit from the same thing, shouldn’t they be moving together? And if bitcoin is the smaller, more volatile asset, then shouldn’t bitcoin be outperforming gold during that timeframe? Bitcoin is down ~ 10% since the start of 2025. Gold is up about 20% in the same period. That isn’t supposed to happen, right?! The reason for this big outperformance is that central banks and large pools of capital are aggressively buying gold right now. There is economic uncertainty, so people want a store of value. These very large pools of capital are not used to buying bitcoin yet. In fact, many of them are not approved to buy digital gold, so they have to stick to analog gold. You can see this chart from Goldman about the PBOC buying way more gold than they have previously been disclosing: If you are a bitcoin investor though, you don’t need to worry. David Foley and Lawrence Lepard published a chart showing gold tends to lead in rallies, but bitcoin follows shortly after.

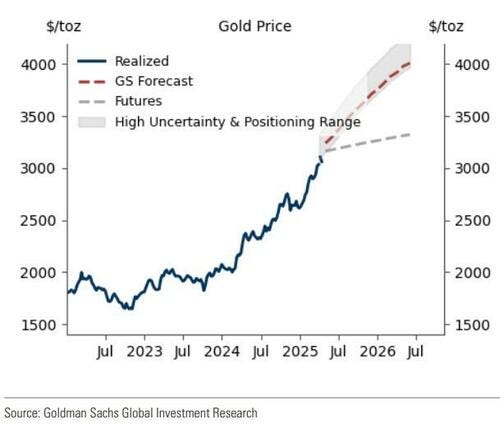

Is David right? I don’t know. We are going to find out. But we know Goldman Sachs recently raised their year-end gold forecast from $3,300 to $3,700 per ounce. So if Goldman is raising their gold forecast and bitcoin historically does a great job of catching up, then it could be an explosive second half of the year for digital gold. It is not fun for bitcoin investors to watch gold gaining, while bitcoin is falling, but just remember that both assets are likely to do well over time. The government can’t stop printing money. And sound money is undefeated, regardless of whether it is analog or digital. Have a great start to your week. I’ll talk to everyone tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management Jordi Visser Explains The Decentralization Of Global Monetary OrderJordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation we discuss how the market broke, what is going to happen, what that means for your portfolio, how US gets out of this situation, how China will react, and how bitcoin plays into all of it. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |