Why Penn Bought Barstool For $551 Million

Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not already a subscriber, sign up and join 90,000+ others who receive it directly in their inbox each week. Today’s Newsletter Is Brought To You By Goldin!The world’s top 500 sports cards have an ROI of 855% over the last 15 years, compared to just 175% for the S&P 500 — and there is no better place to start or build your collectible portfolio than Goldin. Goldin is the leading and most trusted destination for some of the most significant pieces of sports and pop culture collectibles. Their marketplace is open 24/7, they have weekly auctions starting at just $5, and there is something for every collector. And here’s the best part: Goldin is offering No Marketplace Fees for items sold under $10k. So vault and list your items on Goldin’s Marketplace now to enjoy this limited-time offer. I’m a big fan, and I think you will be too. Friends, Penn Entertainment has officially completed its acquisition of Barstool Sports and now owns 100% of the brand. The entertainment and gambling company paid $163 million for a 36% stake in 2020 and recently exercised its option to purchase the remaining 64% of Barstool Sports they didn’t already own for $388 million. That means Penn paid $551 million for complete control of Barstool Sports. Penn-Barstool Deal Recap

Now, this deal has been in the works for several years, and a lot has changed since Penn’s first investment in 2020. For example, Barstool is now generating ~$200 million in annual revenue. And with more than 50 million Americans betting a record $16 billion on this year’s Super Bowl alone (a 110% increase from 2022’s record), Penn believes Barstool’s audience gives them the necessary firepower to compete with FanDuel, DraftKings, and MGM. So today, we’ll explore how Barstool went from a local newspaper to a $550 million media company. We’ll talk about the synergies that Penn Entertainment might realize through the acquisition, and we’ll also take a look at what’s happening in the broader sports media space. Let’s go! Barstool is a large media company today, but the business has humble beginnings. Dave Portnoy was in his mid-20s when he left his consulting job in 2003 to start Barstool Sports out of his Boston home. The initial idea was to create a newspaper that provided news and advice on fantasy sports and gambling. “For the Common Man, by the Common Man,” Portnoy branded as the company’s mission statement. The newspaper started out black and white and eventually upgraded to color. Portnoy purchased 100 news racks (i.e., containers) that he placed in Boston subway stations, and he hand-delivered newspapers from the back of his Chevrolet Astro Van. Portnoy wrote the newspaper himself and often signed off under pseudonyms to make the paper look like a bigger company than it was. He also inserted fake ads of big companies to try and get their competitors to advertise in the paper, and he spent four years building a loyal fanbase in Boston strictly as a print-only publication. But then Barstool shifted to online content in 2007, and everything changed. Barstool launched its website as a blog in 2007 after a man that moved from Boston to New York asked Portnoy if they could build a website for him to read the content. Portnoy then started hiring bloggers outside of Boston to expand. He hired Chicago’s Dan “Big Cat” Katz in 2008 and New York’s Kevin “KFC” Clancy in 2009, who are both still with the company today — and Barstool started to make a little money. Still, the big change came in 2016 when The Chernin Group (TCG) purchased a 51% stake in Barstool Sports. The deal reportedly valued the company at just $10 to $15 million, and two of Chernin’s best investors/operators (Mike Kerns and Jesse Jacobs) joined Barstool’s board of directors. This was invaluable for Dave Portnoy and Barstool. The Chernin Group includes some of the world’s best investors across sports, media, and technology, and they made several changes that helped Barstool become a $550 million company today:

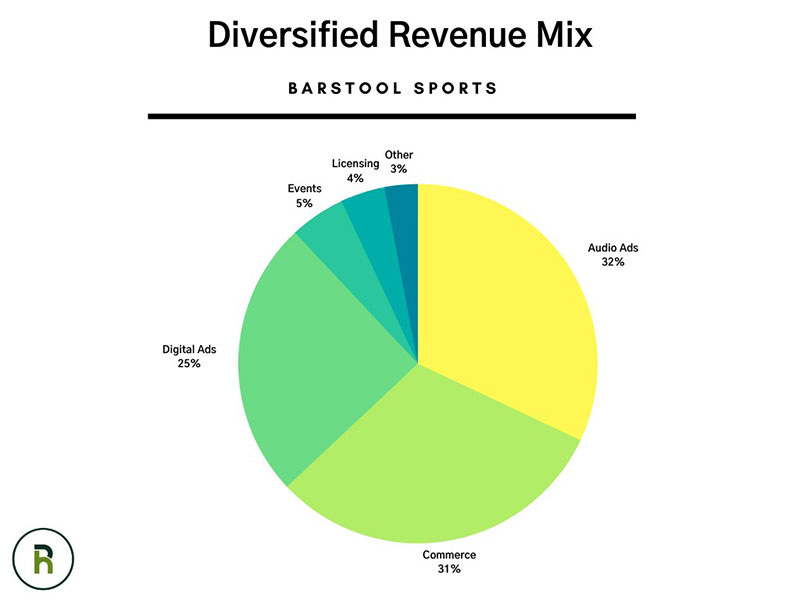

The Chernin Group then doubled down in 2018 and invested another $15 million in Barstool. This valued the company at more than $100 million (up from ~$15 million just two years prior), and it allowed Barstool to double its staff, invest in more pay-per-view events, grow its podcast network, and continue to market alcohol brands. This combination of excess capital and increased operational efficiencies helped Barstool grow exponentially. For example, Barstool was doing just a few million dollars in revenue when TCG acquired a majority stake in 2016, and the vast majority of the company’s income came from advertising. But fast forward to 2019, just three years after TCG’s initial investment, and Barstool was doing ~$100 million in revenue. They were also now profitable, and their revenue mix was significantly more diversified than before. Barstool’s transition from a Boston-based newspaper to an online media company generating $100 million in annual revenue is objectively impressive. And when you combine that with the potential opportunity created through the legalization of sports betting, it’s no surprise that Penn Entertainment came calling in 2020. Barstool Sports Valuation History

And it appears that Penn got a great deal. Of course, we don’t know Barstool’s expenses, margins, or operating profit. But $551 million seems like a pretty good price for a profitable company currently generating ~$200 million in annual revenue. Take FaZe Clan, for example. The esports and entertainment company bragged about its 350 million social media followers and went public at a $1 billion valuation last year. But the company wasn’t profitable, and its stock is down 95% from its IPO price. But when you put price aside, the most critical piece of this acquisition will now be seeing if Penn Entertainment can creatively use Barstool’s audience and reach to meaningfully lower customer acquisition costs for its sports gambling business. This isn’t a new idea, of course. FanDuel is paying Pat McAfee $120 million over four years and recently launched the FanDuel TV cable network with Kay Adams. DraftKings signed a $50 million content and distribution deal with Dan Le Batard’s Meadowlark Media, and Caesars Sportsbook has signed content deals with people like Kenny Mayne, Trey Wingo, and Peyton Manning’s Omaha Productions. But Penn’s big bet is that purchasing Barstool’s audience, rather than renting it through licensed content deals, will provide them with a marketing funnel that allows them to curtail the notoriously high marketing spend for sportsbooks. And the ingredients are all there. Barstool has more than 200 million followers on social media, and 11 million people visit their website each month. Roughly 65% of their audience is aged 21 to 44, and the company has recorded 1.6 billion podcast downloads over the last three years — that’s 533 million podcast downloads annually. Barstool Sports Company Overview

But still, the early results are a mixed bag. Barstool Sportsbook is already live in 16 markets, and Penn has opened several Barstool-branded bars and in-person sportsbooks. But in the second half of 2022, Barstool Sportsbook controlled just 5% of the market in states that report sports betting figures by sportsbook, and the operator is still significantly behind market leaders like FanDuel, DraftKings, and BetMGM. And investors don’t seem to be thrilled either. For example, Penn’s stock is down more than 30% over the last year — compared to a 7% gain for DraftKings. So while the first few years of Barstool and Penn’s relationship have produced up-and-down results, it’s still too early to declare this acquisition a win or loss. Barstool has the audience, which should theoretically give Penn a considerable advantage over its sports gambling competitors. But then the real question becomes — are Barstool’s bettors of the same quality as DraftKings or Fanduel? For example, Barstool caters to a younger audience that likes to frequently bet parlays and disadvantageous odds. This enabled them to hold an absurd 11% in 2021 (that means Barstool won 11 cents on every dollar wagered), which is significantly higher than the standard 5-7% you’ll find at other sportsbooks like FanDuel or DraftKings. But these younger betters also traditionally have smaller wallets, and they could run out of money and churn much faster than the industry standard. So that’s what I’ll be watching over the next few years. If you enjoyed this breakdown, please share it with your friends. My team and I work hard to create high-quality content, and every new subscriber helps. I hope everyone has a great day. We’ll talk on Friday. Interested in advertising with Huddle Up? Email me. Your feedback helps me improve Huddle Up. How did you like today’s post? Loved | Great | Good | Meh | Bad Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not already a subscriber, sign up and join 90,000+ others who receive it directly in their inbox each week. Huddle Up is free today. But if you enjoyed this post, you can tell Huddle Up that their writing is valuable by pledging a future subscription. You won’t be charged unless they enable payments.

Read Huddle Up in the app

Listen to posts, join subscriber chats, and never miss an update from Joseph Pompliano.

© 2023 |