WWE Sale Could Net Vince McMahon $3 Billion

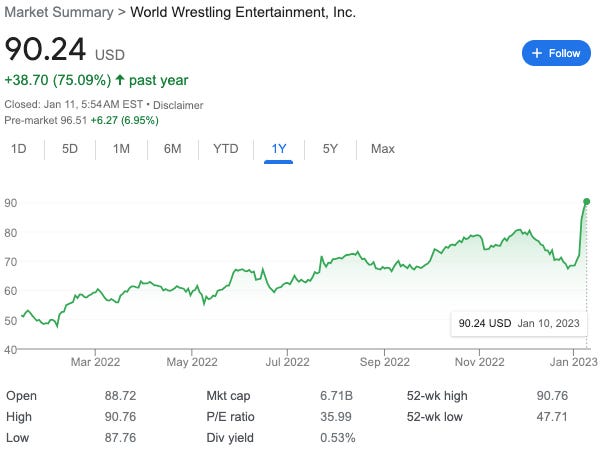

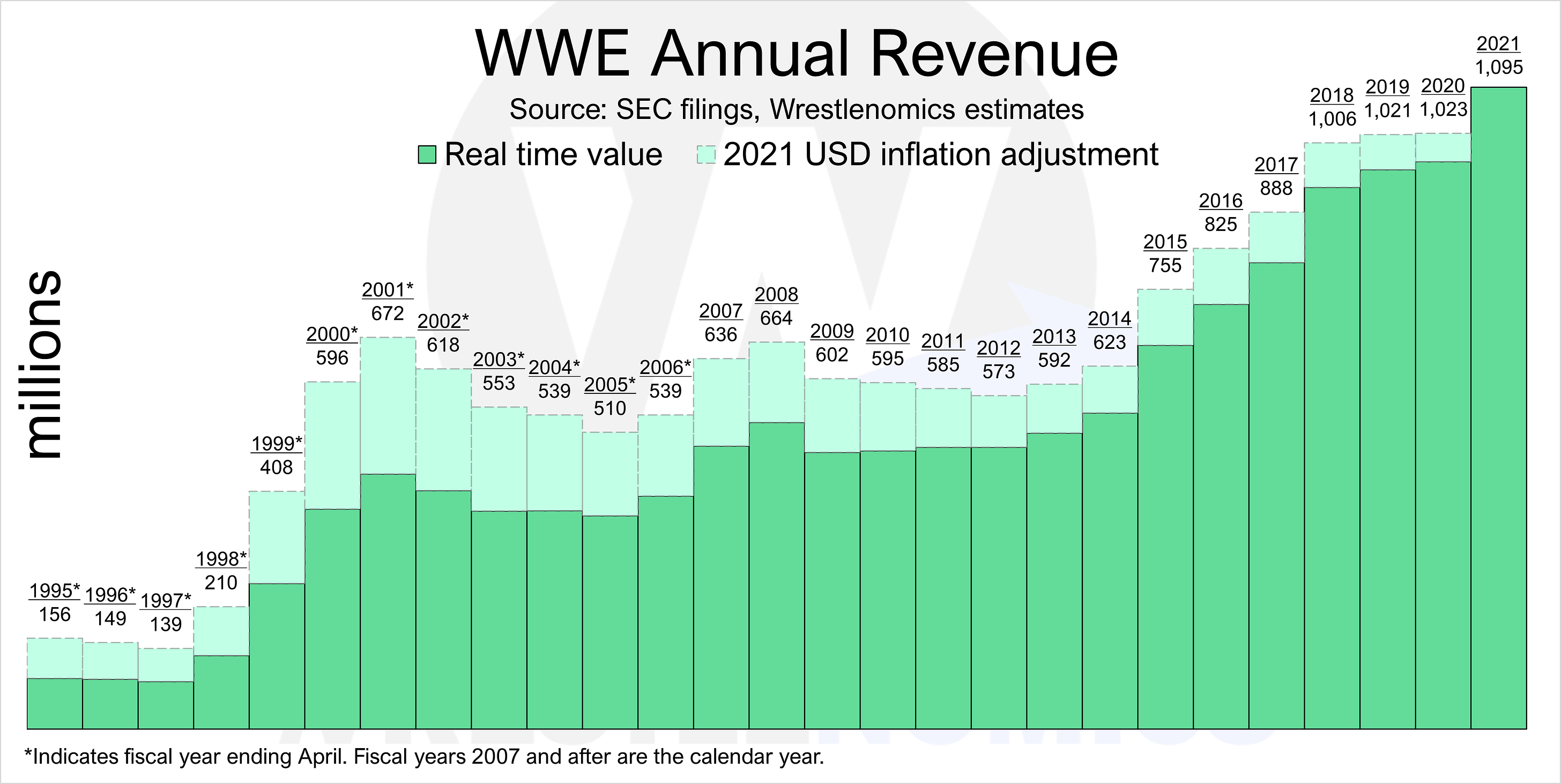

Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. Subscribers include investors, professional athletes, team owners, and casual fans. So if you are not already a subscriber, sign up and join 79,000+ others who receive it directly in their inbox each week — it’s free. Today At A Glance:World Wrestling Entertainment (WWE) has experienced tremendous growth over the last several decades — they did more than $1 billion in annual revenue last year — and the business is now reportedly in line to be acquired by Saudi Arabia’s sovereign wealth fund. So today’s newsletter breaks down everything you need to know, including the past, present, and future of the world’s premier wrestling organization. Today’s Newsletter Is Brought To You By Eight Sleep!I’ve been using an Eight Sleep mattress for several years, and it’s one of the best products I’ve ever purchased. Their thermo-regulation technology — the bed gets colder or warmer throughout the night depending on individualized health metrics — helps me fall asleep faster, get higher-quality sleep, and wake up feeling energized. But don’t trust me: clinical data shows that Eight Sleep users experience up to 34% more deep sleep, and elite athletes like Lewis Hamilton, George Russell, Francis Ngannou, and Justin Medeiros are now using Eight Sleep to gain an edge on the competition. So check them out, and save $250 through my exclusive link below. Friends, The WWE has had a tumultuous few months. There have been hirings and firings, multi-million dollar hush money payments, and the world’s biggest wrestling promotion has even retained J.P. Morgan to advise on a potential sale. Yet the company still appears to be firing on all cylinders, at least financially. For example, WWE posted a record $1.1 billion in revenue last year, and their final 2022 numbers should be even higher. The company’s stock is also defying the rest of the market and soaring, up more than 75% over the last year alone — compared to a 17% drop for the S&P 500, a 40% drop for Netflix, and a 45% drop for Amazon. WWE has built an incredibly valuable catalog of intellectual property over its 70-year history. They had more than 150,000 people show up to WrestleMania 38 in Arlington, Texas, last summer, and the company’s board of directors returned more than $200 million to shareholders through repurchases and dividends last year alone. It has objectively become a great business — revenue and market cap are growing substantially. But WWE has also been chaotic and disorderly at times, and before things get stable, they might get even crazier. For example, news broke last night that WWE has reached an agreement to be purchased by Saudi Arabia’s $600 billion sovereign wealth fund. This is just a rumor, for now. But it’s the same entity that has recently invested hundreds of millions of dollars across LIV Golf, Formula 1, Newcastle United, boxing, and esports. So today’s newsletter will dive into the details, including how WWE became a $7 billion company, why sports business executives are obsessed with its intellectual property, and what the future might look like under Saudi control. Enjoy! The WWE Origin StoryTo really understand what makes the WWE so valuable today, it’s essential to understand its past — dating all the way back to the mid-1950s. You see, professional wrestling was the Wild West from the 1950s through the 1980s. The sport operated under a territory system, which assigned individual wrestling promotions to informal geographical boundaries across the United States. Each territory was typically run by a single promoter, and there were anywhere from 30 to 40 territories across North America. This system created little to no local competition, providing individual promoters with an advantage in marketing and publicity — and that resulted in talent spreading across the country.

But this is where the McMahon family comes into the equation. They ran an independent wrestling promoter in the Northeast during the early days of the territory system. It was first known as Capitol Wrestling Corporation (CWC) but later changed its name to the World Wide Wrestling Federation (WWWF). Then in 1982, Vincent K. McMahon purchased the wrestling promotion from his father, Vincent J. McMahon, and renamed it World Wrestling Federation (WWF). This ended up being the turning point for pro wrestling in the United States. Vince McMahon immediately made it clear that he would no longer follow the territory system. Instead, he felt that for the sport to grow and become profitable long-term, a single professional wrestling league was needed — and that it should be the WWF.

McMahon knew that cable television would be the key to nationwide domination. So in 1983, he signed a deal with USA Network that put WWF in homes across the country. In hindsight, this was a genius move, but it infuriated the other promoters.

The decision to place WWF on cable television created competition amongst promoters for the first time, and no one benefitted more than Vince McMahon. The independent promoters started to lose fans, and their business models began to fail. This pushed the biggest stars in wrestling toward WWF, including people like Hulk Hogan, “Rowdy” Roddy Piper, Ric Flair, and many others. The organization hosted its first pay-per-view event in 1985 — Hulk Hogan went on Saturday Night Live the night before the first WrestleMania at Madison Square Garden in New York City — and the rest is history. The World Wrestling Federation Starts To GrowThe decisions made by Vince McMahon in the mid-1980s kickstarted several decades of growth for professional wrestling, both in the United States and abroad. For example, in 1987, WrestleMania III broke an indoor attendance record with 93,173 fans at the Pontiac Silverdome near Detroit, Michigan. WWF then held its first international event (WrestleMania VI at the SkyDome in Toronto) just three years later. And in 2002, the organization officially changed its name from WWF to WWE following legal action from the World Wildlife Fund. World Wrestling Entertainment Key Dates & Timeline

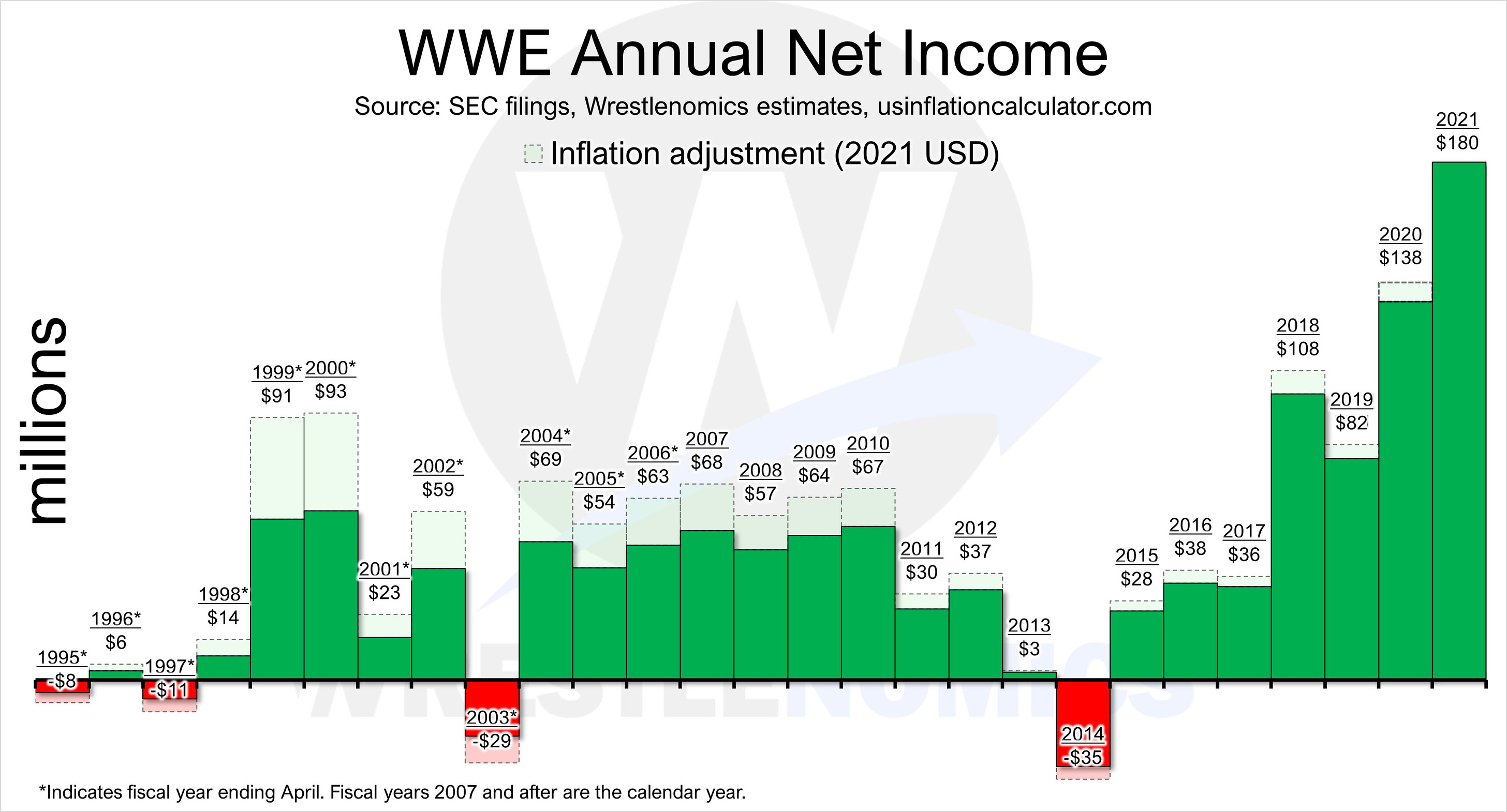

WWE ended up going public in 1999, and as you can see from the timeline above, they have continued to build an incredibly impressive business over the last two decades. WWE was one of the first major sports organizations to launch a 24/7 streaming service, which included all pay-per-view events, and they probably navigated COVID-19 better than anyone — they held shows in a bubble, and net income actually increased during the pandemic (from $82 million in 2019 to $180 million in 2021).

But this success hasn’t come without controversy. For example, in June, WWE founder and chairman Vince McMahon stepped down as CEO after a WSJ report revealed that he paid more than $12 million to four women over the past sixteen years to silence allegations of sexual misconduct and infidelity. The company immediately launched an internal investigation into the matter, but that investigation officially closed in November, and 77-year-old Vince McMahon announced last week that he was unretiring to resume his role as Executive Chairman. McMahon initially said he decided to return so the company can “fully capitalize” on its upcoming media rights negotiations — WWE’s rights deals with Fox and USA expire next year — but the business has reportedly retained J.P. Morgan for advisory services, and many people expect a sale to occur in the near future. How Much Is The WWE Actually Worth?WWE is a valuable asset for several reasons. The company is already producing $180 million in net income based on $1.1 billion of annual revenue. That’s a 33% increase over the last five years, and it’s something many analysts expect to keep growing. But more importantly, WWE has some of the most valuable intellectual property in sports. I’m talking about 50+ years of content, characters, and stories — and once you combine that with WWE’s TV assets, premium live events, merchandise business, and more, it’s easy to see why entertainment companies might pay a premium. For context, WWE has publicly said they want to be like Marvel, the failing comic book company that became a box-office behemoth through film, TV, and theme parks. But the real question is, how much is the WWE actually worth? Well, let’s do the math. WWE’s stock is currently trading around $88/share and has a market cap of $6.57 billion. So given most public companies end up selling at a 20% to 30% premium, that would put WWE’s sale price at $105/share to $115/share — or a market cap of $8 billion to $8.5 billion — and Vince McMahon’s 28.7 million shares would be worth $3 billion to $3.3 billion. Note: The stock was trading at ~$70/share before Vince McMahon’s return, so maybe we should be basing the acquisition premium off that — but you get the point. Now, several companies make sense from an acquisition standpoint. You have everyone from Comcast, who currently has a $160 billion market cap and is already investing billions in the WWE, to Amazon, a company with a $916 billion market cap and a growing appetite for live sports rights and premium IP. Potential WWE Buyers

But the Saudi Arabia rumors shouldn’t be all that shocking. The Gulf state has already announced its desire to transition away from a dependence on oil and is actively using its $600 billion sovereign wealth fund to invest in global sports assets like LIV Golf, Formula 1, and Newcastle United. So we’ll have to give it some time to see how this plays out, but the bottom line is clear: WWE has built an extremely impressive business over the last 70+ years, and someone is going to pay a premium to access its extensive IP portfolio. If you enjoyed this breakdown, please share it with your friends. My team and I work hard to create quality content, and every new subscriber helps. Thanks! I hope everyone has a great day. We’ll talk on Friday. Enjoy this content? Subscribe to my YouTube channel. Your feedback helps me improve Huddle Up. How did you like today’s post? Loved | Great | Good | Meh | Bad Extra Credit: Why Saudi Arabia Is Investing Billions In SportsSaudi Arabia’s $600 billion sovereign wealth fund has recently invested hundreds of millions across the sporting world, including LIV Golf, Formula 1, Newcastle United, WWE, major boxing competitions, and entire esports leagues. This video is a few months old, but I dive into the details, covering everything from why Saudi Arabia wants to own world sport to allegations of human rights abuses. Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. Subscribers include investors, professional athletes, team owners, and casual fans. So if you are not already a subscriber, sign up and join 79,000+ others who receive it directly in their inbox each week — it’s free.

Read Huddle Up in the app

Listen to posts, join subscriber chats, and never miss an update from Joseph Pompliano.

© 2023 |